Stocks took a significant hit, with the market plunging by 1.5% in response to the Federal Reserve’s reticence on a potential upcoming rate cut, leaving investors in suspense.

Fed Chair Powell has shown no urgency towards a rate cut, and given the economy’s robust 4% growth in the latter half of 2023, coupled with a sub-4% unemployment rate and an inflation rate that hasn’t yet reached its target, why should he?

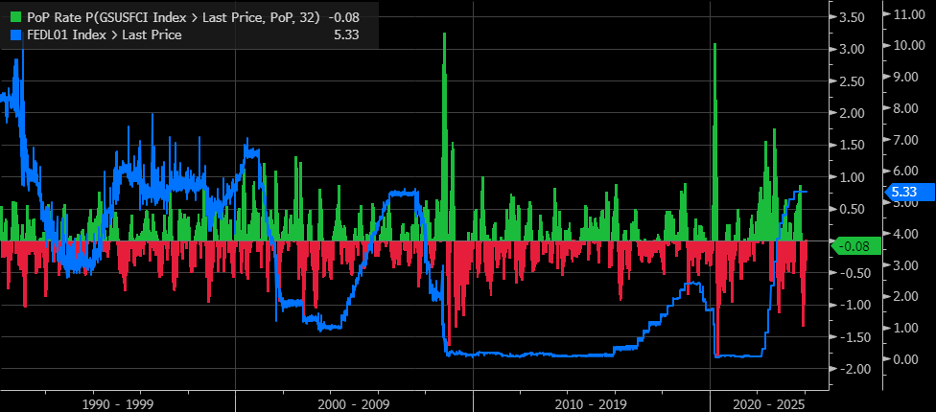

As Powell sees it, there’s no need to act hastily. He posits that the market, through one of the most aggressive easing of financial conditions since the financial crisis and pandemic, has essentially cut rates on his behalf. Thus, he questions the need for any immediate intervention.

So, why rock the boat when the market has paved the way? If the market wants Powell to cut rates, it needs to present a compelling case.

At the very least, it could start to tighten financial conditions, making the Fed fear the possibility of restrictive policies.

But, as long as the market is willing to bear the responsibility, Powell can enjoy a leisurely pace, unrushed by external pressures.

Perhaps the market needs to give Powell a reason to contemplate a rate cut if it seeks one.

Seemingly, it is the market’s move now to possibly influence a shift in momentum, symbolized by the bullish RSI-upside break in the CDX High Yield spread, hinting at wider spreads.

The 2:35 PM ET Vol crush took its predictable course with a notable surge in the SPX and a subsequent decline in the .

However, once the implied volatility reset took effect, selling reemerged, exacerbated by Powell’s remark on the unlikeliness of a March rate cut.

Moreover, there was an escalation in the implied correlation index for 1, 3, 9, and 12 months.

These indicators warrant vigilant observation in the upcoming days. Following today’s post-close release of the next set of Mag7 earnings, an uptick in the index is anticipated as the short-volatility dispersion trade faces further strain.

As discussed repeatedly, implied volatility levels undergo a sharp dip post-earnings release and as event risks dissipate. This pattern was mirrored following yesterday’s earnings, leading to a rise in the S&P 500’s IV.

Things appear to be playing out as per expectations at the moment. The focus now shifts to sustaining this pattern for an eventual return to significantly lower levels for the S&P 500 in the coming weeks.

Source: Adapted from the original post