- Small companies, often reliant on external financing, demonstrate heightened sensitivity to interest rate adjustments compared to their larger counterparts.

- Changes in Federal Reserve (Fed) policy tend to have a more pronounced impact on small caps, prompting discerning moves from investors.

- While beneficial under lower interest rates, small caps are disproportionately affected by economic slowdowns compared to larger firms.

- For small-cap investors, navigating the resulting dual influence requires a careful reassessment of portfolio strategies.

Redefining Small Caps Expectations in Light of Interest Rate Movements

Following the release of the latest Consumer Price Index (), a noticeable shift in sentiment emerged among investors, acknowledging a favorable trajectory towards rate cuts initiated by the Federal Reserve ().

Recent inflation data, particularly the increment in the Personal Consumption Expenditure Index (), indicates a gradual moderation of inflationary pressures, setting the stage for a potential resurgence in small-cap stocks.

As inflation continues to stabilize and near the Fed’s target, coupled with positive developments such as rising rent prices and moderated services costs, the conditions are ripe for a supportive environment for small-cap enterprises.

The potential rate cuts, expected in the upcoming months, are likely to be influenced by evolving economic indicators, with an emphasis on hiring trends and business activities, all of which have direct implications on small-cap performance.

Impacts of Divergent Forces on Small Caps Value

The resurgence of risk appetite following speculations of Federal Reserve rate cuts has led to a rally in small-cap stocks, reflecting investor optimism towards the market shift.

However, amidst the market enthusiasm lies the challenge of reconciling the intertwined consequences of interest rate alterations and economic deceleration as they translate into portfolio strategies across asset classes.

Historically, small caps have thrived under diminishing interest rates but are equally susceptible to downturns triggered by economic contractions, serving as a litmus test for investor resilience.

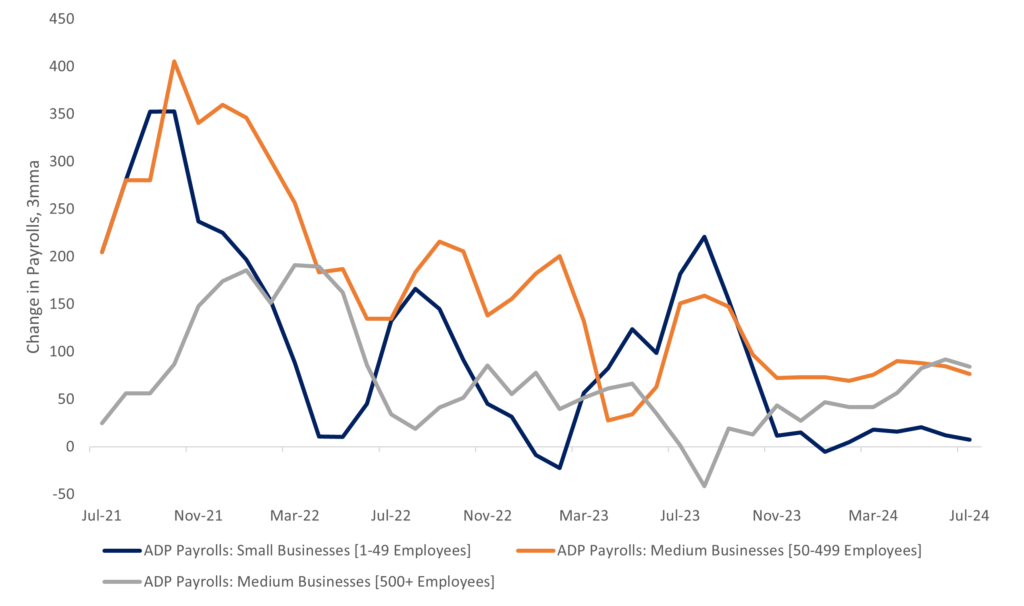

Monitoring Payroll Trends for Small Firms Amid Transitioning Economic Landscapes

Source: LPL Research, Automatic Data Processing (NASDAQ:), 07/31/24

Anticipating a series of rate cuts by the Fed later in the year, investors brace for the potential repercussions of an economic slowdown that could exacerbate existing challenges faced by small-cap enterprises.

The intimate correlation between the and the ISM Composite index serves as a barometer for market sentiment, guiding investors through the imminent market shifts orchestrated by economic dynamics.

Signaling Economic Uncertainties for Small Caps Amidst Slower Growth Projections

Source: LPL Research, Institute of Supply Management, WSJ, 07/31/24

Final Thoughts

Amidst the prevailing optimism surrounding a projected soft landing for the economy, investors are presented with a landscape characterized by evolving unemployment rates, wage increments, and controlled inflation, setting a stage for potential rate cuts by the Federal Reserve.

Nevertheless, the looming specter of political uncertainties and geopolitical risks warrants a cautious approach from investors, who must exercise prudence in navigating the unfolding market dynamics, where small-cap firms stand at the forefront of experiencing the brunt of challenges.

***

Asset Class Disclosures:

International investing, bond investments, municipal bonds, preferred stocks, alternative investments, mortgage-backed securities, and high yield/junk bonds present varying levels of risks for investors, necessitating informed decision-making. Precious metal investing and commodities trading entail significant volatility and potential losses.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value