Momentum in the artificial intelligence (AI) sector, spearheaded by industry giant Nvidia (NVDA), has been nothing short of meteoric over the past 15 months. Nvidia’s extraordinary growth and expanding profit margins continue to captivate analysts and investors alike; however, amidst the fervor, several AI-driven stocks are perched on precarious valuation peaks.

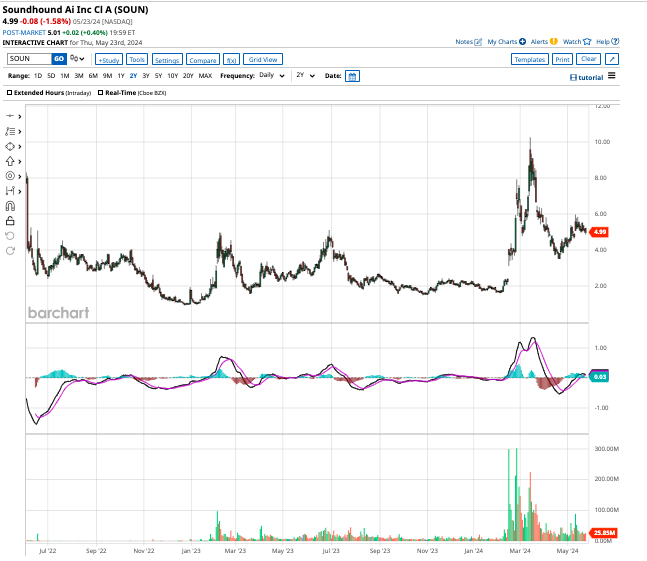

One such stock basking in the AI limelight is SoundHound AI (SOUN), which has soared 68% in the past year and a remarkable 136% in 2024 alone.

Now, let’s delve into why at least one Wall Street analyst perceives SoundHound AI as precariously overvalued at this juncture.

Dissecting Soundhound AI’s Realm

With a market capitalization of $1.64 billion, SoundHound AI operates in the realm of conversational intelligence, offering innovative voice AI solutions to businesses. Leveraging proprietary technology, its voice AI is proficient across multiple languages, catering to industry verticals such as automotive, TV, and the Internet of Things (IoT).

The company’s aspiration is to cater to consumer-facing sectors through AI-powered products like smart answering, smart ordering, and dynamic drive-thru—a novel multimodal food ordering solution.

Forecasting a Bumpy Road Ahead for SoundHound Stock

Despite its modest dimensions, SoundHound AI flaunts an illustrious client roster including big names like Netflix (NFLX) and Mastercard (MA). Moreover, the goliath Nvidia has also made a nominal investment in SoundHound; however, its ownership stake in the company stands at less than 1%.

On the flip side, SoundHound AI lacks significant competitive moats and faces the looming threat of losing market share to tech behemoths such as Apple (AAPL), Amazon (AMZN), Alphabet (GOOG), and Microsoft (MSFT), who are diligently crafting their voice recognition technologies.

In line with other burgeoning enterprises, SoundHound AI finds itself mired in unprofitability, wrapping up Q1 with $226 million in liquid assets. Although Q1 revenue surged by an impressive 73% to $11.59 million, its operating losses swelled to $28.52 million, marking a 13% increase from the prior-year shortfall of $25.2 million.

Analysts anticipate SoundHound AI to narrow its losses per share to $0.22 in 2025, a significant improvement from $0.40 per share in 2023. However, considering its current cash outflow rate, SoundHound AI has roughly six more quarters before it must seek fresh capital, potentially diluting shareholder value.

Consequently, it appears imminent that SoundHound AI will embark on an equity capital-raising spree within the next year. Having entered the public domain two years ago with 200 million outstanding shares, the figure has since ballooned to nearly 330 million.

KM Capital’s Pessimistic Outlook on SOUN Stock

One investment firm, KM Capital, staunchly expresses its bearish sentiment towards SOUN stock. Seemingly perched on a lofty valuation precipice, SoundHound AI currently trades at an astronomical forward price-to-sales multiple of 23x. KM Capital asserts that the stock’s fair value is $1.20, a staggering 76% plunge from Friday’s closing price.

In a candid investor brief, KM Capital articulates, “While I acknowledge SoundHound’s pioneering strides in a promising industry and its robust Q1 earnings, coupled with an optimistic outlook for 2024 and 2025, even my exuberantly optimistic discounted cash flow model denotes significant overvaluation of the stock.”

On the flip side, KM Capital cautions that an acquisition bid from a tech juggernaut could potentially trigger a near-term upsurge in SoundHound AI’s stock price.

Interestingly, this bearish stance deviates from the consensus prevailing on Wall Street for SOUN. Among the six analysts monitoring SOUN stock, four advocate a “strong buy” rating, while two recommend a “hold,” culminating in a “moderate buy” consensus rating.

The average target price designated for SoundHound AI stock stands at $7.17, hinting at a potential 41.6% rally from its current standing.