To gain an edge, this is what you need to know today.

Exploring the World of Folding Apple iPhones

Apple Inc AAPL is rumored to be in the development stages of two folding iPhones

reminiscent of the popular Samsung Electronics Co Ltd SSNLF folding smartphones. The rise in interest for

folding phone technology has also contributed to significant buying of AAPL stock amidst an already extreme positive

market sentiment.

Extreme Sentiment and the Reign of AI King NVIDIA

The stock market is experiencing extreme positive sentiment, where NVIDIA Corp

NVDA holds a

prominent place as the ruler of artificial intelligence (AI) and one of the top-performing stocks. Notably, investors

should pay close attention to NVIDIA’s recent AI-related buying frenzy, marked by a dramatic surge in stock price

followed by a heavy sell-off, indicating a cautious early signal amid prevailing extreme market sentiment. The

sentiment also remains a vital factor to consider for investors, especially in guiding against relying solely on

emotional sentiment when making investment decisions.

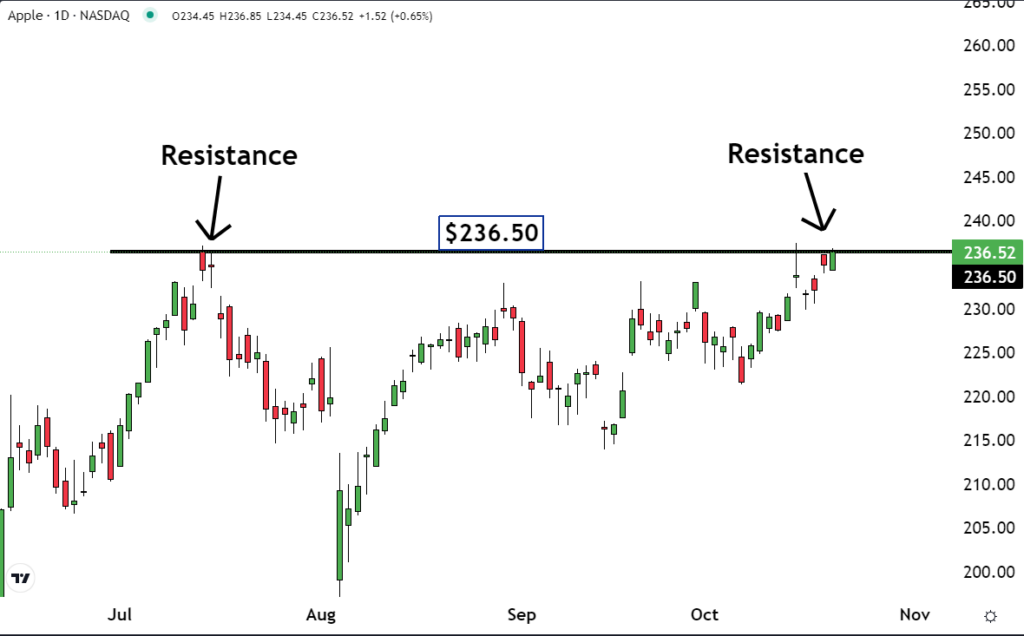

- The Morning Capsule offers a comprehensive overview of the broader market landscape, using the chart of NVDA stock as an insightful visual aid.

- The chart highlights NVDA’s status as the leading force in AI technology and stock performance, underscoring the significance of NVIDIA’s impact on market trends.

- Examining the recent AI buying frenzy in NVDA stock, the chart reveals a peak three days ago when the stock surpassed $700, followed by a subsequent decline, signaling a potential market top in the near future.

- With the subsequent drop in NVDA stock price, marked by a notable red candle on the chart amid high trading volume, market participants express concerns about the impending market top and the reliability of the recent bullish trend.

- In light of the recent cautionary signs, an analysis of money flows indicates a current equilibrium between bullish and bearish sentiments for NVDA stock, coupled with RSI divergence suggesting a loss of momentum in the short term.

- Overall, the recent market sentiment reflects extreme positivity, often serving as a contrarian indicator, signaling a potential sell-off, although precise timing remains unpredictable.

- Recent statements from the Federal Reserve (Fed) officials help provide a comprehensive understanding of economic and rate expectations, further contributing to the delicate balance of market forces.

- Considering these overarching factors, the protection band presents a prudent strategy for navigating the complex market dynamics, offering a balanced approach amid various crosscurrents.

Navigating Commercial Real Estate Challenges

In light of lingering commercial real estate loan concerns following the banking crisis of March 2023, recent downgrades, such as New York Community Bancorp, Inc. NYCB, underscore the necessity for prudent vigilance in addressing ongoing real estate market challenges. Moody’s downgrade of NYCB to junk status, despite its previous standing as a well-respected bank, further highlights the persisting volatility and uncertainty within the commercial real estate sector.

An Unexpected Shift in the Chinese Stock Market

China’s recent replacement of its top stock market regulator, appointing Wu Qing, a prominent banker, suggests a deliberate effort to drive a resurgence in the Chinese stock market. This surprising move, analyzed by The Arora Report, signifies President Xi’s proactive measures to stimulate market growth, underscoring the dynamic nature of global market forces and regulatory influences.

Monitoring Money Flows Across Key Market Players

Early market activities reveal positive money flows in AAPL, Alphabet Inc Class C GOOG,

Meta Platforms Inc META, Microsoft Corp MSFT, and Tesla Inc TSLA.

Additionally, market trends indicate neutral money flows for Amazon.com, Inc.

AMZN, while NVDA

experiences negative money flows. SPDR S&P 500 ETF Trust SPY and Invesco QQQ Trust Series 1 QQQ are subject to

mixed money flows.

Market Activity of Momo Crowd and Smart Money

The current market sees the momo crowd actively buying stocks, while smart money remains relatively inactive at this juncture.

Evaluating Gold and Silver Market Dynamics

Notably, there is a consistent trend of the momo crowd investing in gold, while smart money remains less active in this arena. For a more comprehensive outlook, it is advisable to consult gold and silver ratings for longer-term perspectives.

The most widely recognized ETF for gold, SPDR Gold

GLD, embodies the ongoing

market interest in precious metals.

Investor’s Insider: Navigating Evolving Market Trends

Silver’s Strength

Trust GLD. The most popular ETF for silver is SLV.

Oscillating Oil Market

API crude inventories came at a build of 0.674M barrels vs. a consensus of a build of 2.133M barrels. The momo crowd is buying oil in the early trade. Smart money is inactive in the early trade. For longer-term, please see oil ratings. The most popular ETF for oil is USO.

The Cryptic Bitcoin

Bitcoin BTC/USD is range bound. Sentiment in bitcoin continues to be bullish as the belief is steadfast that it is only a matter of time before bitcoin whales run up bitcoin above $50,000. Bitcoin bulls are hoping that bitcoin whales will take advantage of the low liquidity over the coming weekend to run up bitcoin.

Protection Band And Strategic Moves

It is important for investors to look ahead and not in the rearview mirror. Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time. You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges. It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

A Fresh Approach to Portfolio Building

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time. Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of seven year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.