The Tale of Two Retail Giants

When it comes to the retail universe, Walmart’s colossal presence is undeniable, with its $650 billion retail empire casting an imposing shadow. However, it’s Walmart’s staggering $100 billion e-commerce platform that has left jaws dropped in the business world. Yes, you read that right – Walmart is a behemoth in the digital space.

Now, when Walmart talks about e-commerce sales, it’s not just about what you order online and get delivered to your doorstep. It includes the innovative concept of shoppers purchasing items digitally and picking them up at Walmart stores, a unique hybrid model, to say the least.

Unveiling Amazon-esque Revenue Streams

But hold your horses, the digital saga doesn’t end there. Walmart’s digital sales soar over $100 billion, ushering in a new era of opportunity – digital advertising. With a massive online audience flocking to its website and app, Walmart has become a prime ad space for consumer brands willing to shell out big bucks to reach this vast clientele.

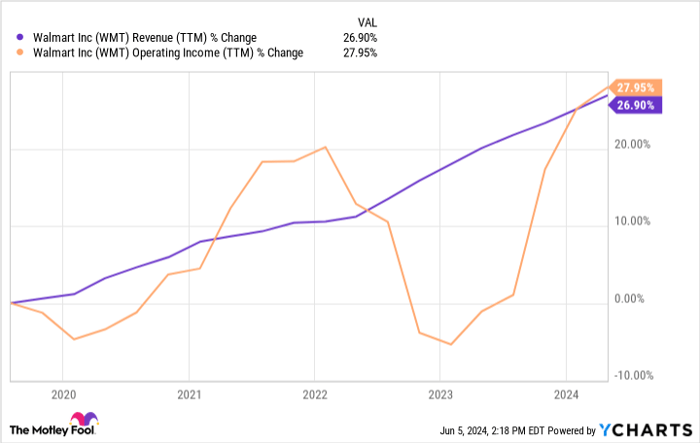

The beauty of digital ads lies in their profitability for Walmart. With low incremental costs, these ads have become a key revenue source for the retail giant. In fact, by the end of fiscal 2024, advertising had already burgeoned into a $3.4 billion business for Walmart, maintaining a robust 24% growth in the Q1 of fiscal 2025.

Cosmic Possibilities for Costco

Now, let’s shift the spotlight to another titan in the retail realm – Costco Wholesale. While Costco’s sprawling stores and extensive product offerings steal the limelight, its e-commerce domain is quietly simmering with promise. Amidst its nearly 900 warehouses and a less than 7% uptick in same-store sales, Costco’s e-commerce segment witnessed a whopping 21% surge in the Q3 of its fiscal 2024.

On its Q3 earnings call, Costco hinted at a potential foray into retail media, a move that could transform its digital presence. Emulating Amazon’s retail media strategy, Costco aims to monetize its digital channels by offering ad space to brands looking to target its 73 million paid members.

From Walmart’s Blueprint to Costco’s Canvas

While Walmart’s e-commerce stronghold dwarfs Costco’s digital footprint, the latter’s accelerating e-commerce growth hints at a lucrative avenue for revenue diversification. Speculations suggest that retail media could burgeon into a billion-dollar enterprise for Costco, echoing Walmart’s trajectory in monetizing its digital landscape.

While the road to retail media dominance may be a long and winding one, tapping into this digital goldmine could significantly bolster Costco’s financial prowess. With an operating income projected at around $8.5 billion for the year, adding another billion-dollar asset through retail media could mark a game-changing moment for the wholesale giant.

Costco shareholders, take note – as the company charts its course towards digital innovation, the virtuous cycle of profitability could fuel a surge in stock price, aligning with investors’ long-term ambitions.

A Glimpse into the Crystal Ball

So, should you bet $1,000 on Costco Wholesale at this juncture? While the Buy-Hold-Sell debate rages on, ponder this: unparalleled market insights often illuminate hidden gems beyond the obvious choices.

Steering clear of cookie-cutter recommendations, the Motley Fool Stock Advisor team has unearthed a treasure trove of 10 stock marvels poised to unlock monstrous returns in the near future – Costco Wholesale, unfortunately, not making the cut this time around.

Recall the Nvidia fairytale back in 2005 – a mere $1,000 investment then would now blossom into an eye-popping $740,688*, a testament to the transformative power of smart investment decisions.

In the realm of investment wisdom, the Stock Advisor service shines as a guiding light, offering a roadmap to success sprinkled with timely updates, expert analysis, and two fresh stock picks each month. Its meteoric returns have outpaced the S&P 500 by a fourfold margin since 2002*, ensuring an enriching journey for investors who dare to dream big.

Dive into the Stock Market Odyssey Now »

*Stock Advisor returns as of June 3, 2024