U.S. auto giant Ford is poised to re-enter the Indian market, motivated by a strategic shift towards boosting exports in the global automotive arena. This resurgence marks a pivotal moment for Ford, following its departure from India two years ago amidst financial struggles in a competitive landscape dominated by Asian car manufacturers. The company’s decision to revive operations from its manufacturing base in Tamil Nadu comes as part of the overarching “Ford+ Growth Plan” aimed at expanding its market presence worldwide. Tamil Nadu, already bustling with leading car manufacturers like Hyundai, Nissan, Renault, VinFast, and Tata Motors’ Jaguar Land Rover division, is set to witness a surge of electric vehicle production as well.

Ford’s re-entry into India, underpinned by renewed vigor and a strategic focus on exports, offers a fresh opportunity for the company to tap into its global business operations and potentially carve out a profitable niche in the dynamic Indian automotive market. With plans to generate up to 3,000 jobs over the next three years, Ford’s move reflects a bold step towards cementing its presence in a key market.

Driving Factors for Ford Stock

Ford is pinning its hopes on the growth trajectory of its commercial vehicle division, Ford Pro, which continues to witness robust demand. The successful rollout of new models like the Super Duty, coupled with a healthy order backlog, has prompted the firm to revise its 2024 EBIT forecast for the Ford Pro unit upwards. This division, spanning vehicles, software, and services, is pivotal for Ford’s future, with software revenue expected to soar and contribute significantly to the company’s bottom line in the coming years.

In the Ford Blue segment, iconic models such as the F-150, Maverick, Bronco, and Mustang offer substantial growth potential. With the introduction of new models and revamped versions of existing favorites, Ford anticipates a boost in revenue and profitability by the latter half of 2024.

While the short-term outlook for the Ford Model e division presents challenges, it stands poised for long-term growth by focusing on scaling production, enhancing digital manufacturing efficiency, and vertical integration. Ford’s popular electric vehicles, including the Mustang Mach-E and F-150 Lightning, are positioned to bolster shipments, with plans for new EV models on the horizon.

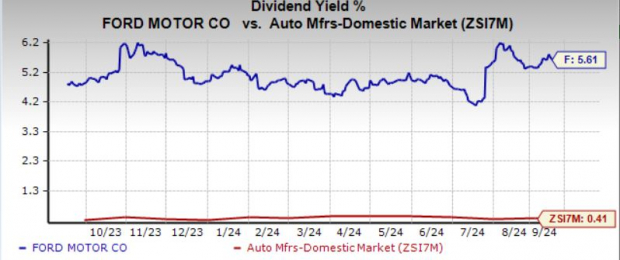

With a strong liquidity position boasting around $27 billion in cash reserves, Ford remains well-equipped to pursue its Ford+ strategy, while an attractive dividend yield exceeding 5% makes it an appealing choice for income-oriented investors. Notably, Ford has raised its adjusted free cash flow projection for the year, underscoring its dedication to enhancing shareholder value through consistent returns.

Short-Term Challenges for Ford

Despite promising long-term prospects in the electric vehicle segment, Ford anticipates a hit on its profits in the current year. The company projects a full-year loss from the Model e unit, wider than the previous year, amid ongoing pricing pressures and increased investments in next-generation EV technologies.

Moreover, Ford has grappled with escalating warranty and recall costs, reaching significant levels in recent quarters. These mounting costs, largely associated with older models, have necessitated Ford’s focus on enhancing the quality of newer models to mitigate warranty expenses. However, the impact of these efforts is expected to materialize over the next 12 to 18 months, indicating continued pressure on Ford’s financials in the interim.

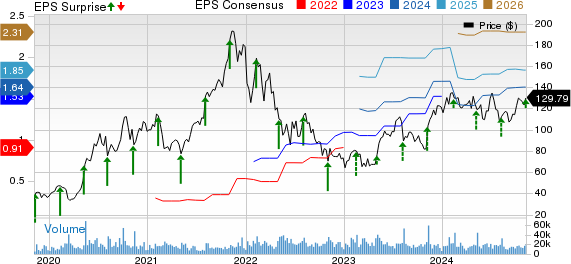

Market analysts project a decline in Ford’s 2024 earnings per share, reflecting the current challenges facing the company. Despite efforts to navigate these hurdles, Ford’s profitability in the near term remains a point of concern.

Ford Stock Evaluation

From a valuation perspective, Ford presents an attractive proposition at present. With a forward sales multiple below industry averages and its historical benchmarks, the stock appears undervalued in the market. Backed by a compelling Value Score, Ford’s stock showcases potential for growth in the eyes of discerning investors.

Analyst Perspectives on Ford

Brokerage views on Ford reflect a balanced outlook, with the stock garnering an average brokerage recommendation of 2.60 on a scale ranging from Strong Buy to Strong Sell. Among the 20 brokerage firms offering recommendations, a considerable portion have rated the stock as a Hold, indicating a cautious yet neutral stance on Ford’s investment prospects.

Is Investing in Ford Shares Prudent?

As Ford embarks on its resurgence in India and continues to bolster its global market presence, investors may find an appealing opportunity in the company’s stock. With a focus on strategic growth areas like Ford Pro, strong dividend yields, and ample liquidity, Ford is positioned for long-term success. Moreover, projections of potential consumer interest revival spurred by anticipated interest rate adjustments could work in Ford’s favor, underpinning its growth prospects.

However, caution is warranted given the near-term challenges faced by Ford, particularly concerning its Model e unit’s profitability and rising warranty costs. Monitoring Ford’s progress in navigating these obstacles will be critical for prospective investors looking to capitalize on the company’s long-term potential. Existing shareholders are advised to hold onto their positions, while potential buyers should conduct thorough research and consider the risk factors associated with investing in Ford.

Ford currently holds a Zacks Rank #3 (Hold), reflecting the mixed sentiments surrounding the stock among market analysts and researchers.