Just as the sun rises in the east, it has become evident that the AI industry is soaring high. And amidst this technological renaissance, many companies are vying to capitalize on the momentum. One such company that quickly comes to mind is the resilient Advanced Micro Devices (NASDAQ: AMD), whose shares have surged by more than 130% over the past year owing to the AI boom. The titan of graphics processing units (GPUs) is set to launch a cutting-edge AI chip this year, further solidifying its position at the forefront of innovation.

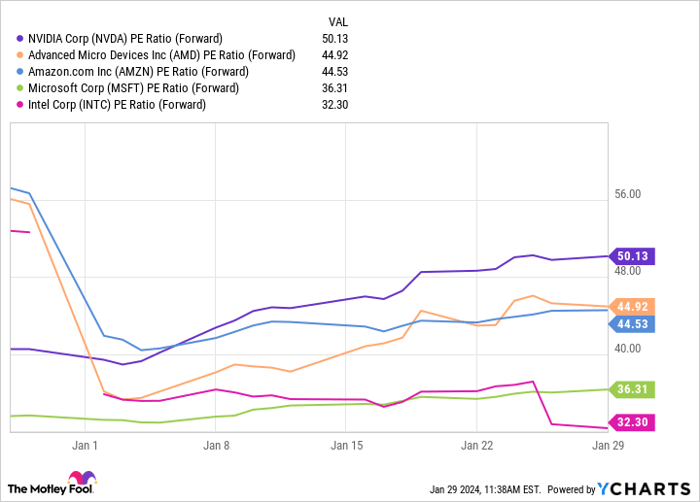

However, even as AMD basks in the glow of its AI potential, its financial figures portray a different picture. The company’s forward price-to-earnings ratio (P/E) has ballooned by 58% to 45, while its free cash flow has plummeted by a staggering 47% to a paltry $1 billion over the same period. As a result, investing in AMD may be akin to walking a tightrope. It might lead to wondrous vistas, but the risks are skyscraping. Hence, the question arises – should we turn our gaze elsewhere for better prospects? Indeed, it may be a wise move to explore the greener pastures of other AI stocks.

Microsoft: The Champion of AI

With a cape as azure as its ambition, Microsoft rose in 2023 as a formidable force in the AI realm. The enigmatic behemoth undertook substantial investments in OpenAI, propelling it into the vanguard of AI supremacy. Harnessing OpenAI’s advanced AI models, Microsoft seamlessly integrated AI features across its product spectrum, introducing a potpourri of cutting-edge tools.

Not content with mere strides, Microsoft ventured forth, enhancing its cloud platform Azure with fresh AI tools, infusing its search engine Bing with elements of ChatGPT, and augmenting the productivity of its Office suite through the wizardry of AI. The pièce de résistance, however, was the unveiling of Copilot, Microsoft’s AI assistant, which now dances enchantingly as an iridescent add-on to the 365 membership.

Microsoft’s stock has ascended by a colossal 64% over the past year, with 8% of that ascent occurring in the early days of 2024. Surpassing Apple in market cap, Microsoft is undoubtedly a company on the rise. With a robust free cash flow of over $62 billion in 2023 and a forward P/E that dwarfs that of AMD, Microsoft seems to beckon investors like the Pied Piper. The path to AI glory might well lead through the hallowed halls of Microsoft.

Intel: The Phoenix of AI

Amidst the crescendo of technological advancements, Intel stands as a captivating enigma. The company’s shares have dipped by nearly 13% following its fourth-quarter earnings report that, despite boasting a 10% year-over-year revenue growth, unveiled disconcerting guidance. Intel’s projected earnings and revenue for Q1 2024 fell short of Wall Street’s expectations, shrouding the company in a pall.

The tide has turned in the chip market, buoyed by an explosion in AI. GPUs for servers are now the cynosure while CPUs have taken a back seat. Intel, traditionally the mastodon of CPU production, has been caught off guard by this seismic shift, evident in its bleak guidance.

Nevertheless, Intel remains undeterred, steadfastly investing in the generative technology that holds the key to its resurgence. Unveiling an enticing array of AI chips, along with new processors that flaunt neural processing units for efficient AI operations, Intel seems poised for a resurgent odyssey. Its tantalizing forward P/E of 32 makes it an alluring choice, especially when compared to the likes of AMD, Nvidia, and Amazon. In a 2024 fraught with possibilities, Intel shines as a beacon of promise.

As the curtains rise on this epoch of AI innovation, AMD, for all its grandeur, might not be the wisest investment. Its pricey valuation and dwindling free cash flow paint a cautionary tableau. In contrast, Microsoft and Intel emerge as two celestial bodies navigating the constellations of AI, gleaming with robust potential and captivating allure. The journey ahead is abundant with opportunities; the key lies in choosing the right vessel to navigate through the celestial sea.