Retail, a beacon of stability in tumultuous markets, stands tall as a bastion for long-term investors. From the aisles of grocers to the digital realms of e-commerce, this industry boasts an expansive landscape where investors can ride the crest of multiple waves. The global retail market, a behemoth that eclipsed a staggering $27 trillion valuation in 2022, is poised to surge to greater heights, projected to scale the $30 trillion summit this year.

Apple has carved its path to success within this industry, boasting commendable market shares across various consumer tech segments ranging from smartphones to tablets, smartwatches, and headphones. Despite a more focused product range compared to its competitors, Apple has snatched the bronze medal in the U.S. e-commerce arena.

But in a world where Amazon looms large, it’s hard to advocate for Apple’s stock. Seated as the world’s second-largest retailer behind only Walmart, Amazon reigns supreme as the monarch of e-commerce. Moreover, its diversified business model has propelled it to the pinnacle of the tech world, commanding a whopping 31% share of the $626 billion cloud market.

Amazon’s Astounding Rebound

The orchestration of an economic doomsday in 2022 precipitated a market cascade, resulting in the Nasdaq Composite plummeting by 33%. Retail entities bore the brunt of this turmoil as inflation spikes coerced consumers to slash discretionary spending. Amazon, too, felt the weight of this crisis as its shares nosedived by 50% in 2022, accompanied by plummeting profits in its e-commerce domains.

However, in a tale akin to a phoenix rising from the ashes, Amazon executed a remarkable resurgence, showcasing its mettle and resilience. The fiscal year 2023 illuminated Amazon’s prowess with a 12% year-over-year revenue surge to $575 billion and a staggering threefold surge in operating income to $37 billion.

Through a medley of cost-cutting maneuvers and the easing of inflationary pressures, Amazon resuscitated its e-commerce arm, witnessing a stratospheric 904% surge in free cash flow to $32 billion over the prior 12 months.

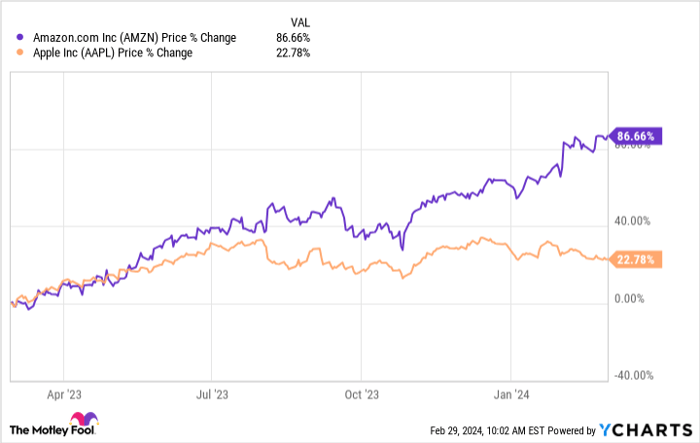

Data by YCharts

Amazon’s Potential Upswing

In a multitude of nations, Amazon stands as the unchallenged titan of e-commerce, a realm primed to soar to a colossal $3.6 trillion valuation by 2024, exhibiting a steady compound annual growth rate (CAGR) of 10% through 2028. The tech colossus appears destined to bask in the perpetual tailwinds of this sector for years to come.

However, the crowning jewel amidst Amazon’s assortment of growth catalysts remains its cloud platform, Amazon Web Services (AWS). In the concluding quarter of 2023, AWS witnessed a 13% year-over-year revenue ascension to a princely $24 billion. Noteworthy is that AWS, although accounting for the lowest revenue allocation among the three segments, commanded a lion’s share of 54% of the company’s operating income.

Furthermore, AWS positions Amazon as a formidable force in the lucrative domain of AI, a realm prophesied to burgeon at a CAGR of 37% through 2030. In its dominion as the grandest cloud service provider globally, AWS flaunts the potential to harness its colossal cloud data repositories to chart the course of the generative AI sector.

Embarking on this vista, Amazon has infused a plethora of AI tools into AWS, unveiling a new AI shopping assistant christened Rufus on its e-commerce platform.

Amazon’s trajectory is laden with promise, reflected in earnings per share (EPS) estimates that portray the company with far more growth potential than Apple.

Data by YCharts

These projections, when juxtaposed with their present standings, augur a 68% uptick in Amazon’s share price and a 20% ascent in Apple’s by fiscal 2026. Coupled with a sturdy business model and entrenched positions in e-commerce and AI, Amazon emerges as an unequivocal growth stock choice over Apple.

Should you invest $1,000 in Amazon right now?

Before diving into Amazon stock, pause to ponder this:

The Motley Fool Stock Advisor analyst ensemble has pinpointed what they deem the 10 best stocks for investors to acquire now… and Amazon didn’t make the list. These chosen ones are poised to yield gargantuan returns in the impending years.

Stock Advisor furnishes investors with a lucid roadmap to prosperity, encompassing counsel on fortifying a portfolio, routine missives from analysts, and a bimonthly duo of fresh stock selections. Since 2002, the Stock Advisor service has outperformed the S&P 500 return by a tripling factor.*

*Stock Advisor returns as of February 26, 2024