Investments in the retail sector have had the potential to yield substantial returns over the years, with innovative concepts and expansions leading to notable successes such as Home Depot and Walmart. However, for every soaring success story, there exists a cautionary tale like Bed Bath & Beyond or JCPenney, leaving many investors wary of individual stock picks. This dilemma has prompted some to turn towards exchange-traded funds (ETFs) as a savvy strategy to mitigate risk in the volatile retail landscape.

Among the plethora of ETF options available for investors interested in consumer discretionary stocks, the VanEck Retail ETF (NASDAQ: RTH) stands out as a prime selection. Let’s delve into why this ETF is a standout choice.

The Essence of VanEck Retail ETF

The VanEck Retail ETF mirrors the performance of the U.S. consumer discretionary sector, offering a focused approach that sets it apart from broader index-replicating funds. Unlike competitors with a wide array of holdings, such as the Vanguard Consumer Discretionary ETF, VanEck Retail ETF boasts just 26 holdings.

Unsurprisingly, Amazon reigns as the largest holding, commanding a substantial 21% of the fund. This allocation dwarfs that of other major funds, like the Vanguard S&P 500 ETF, where Microsoft holds only 7%.

Furthermore, no single stock accounts for more than 10% of the fund, ensuring a diversified portfolio. Notable holdings include Costco, Home Depot, Walmart, Lowe’s, TJX, and McKesson.

Performance in the Arena of Retail ETFs

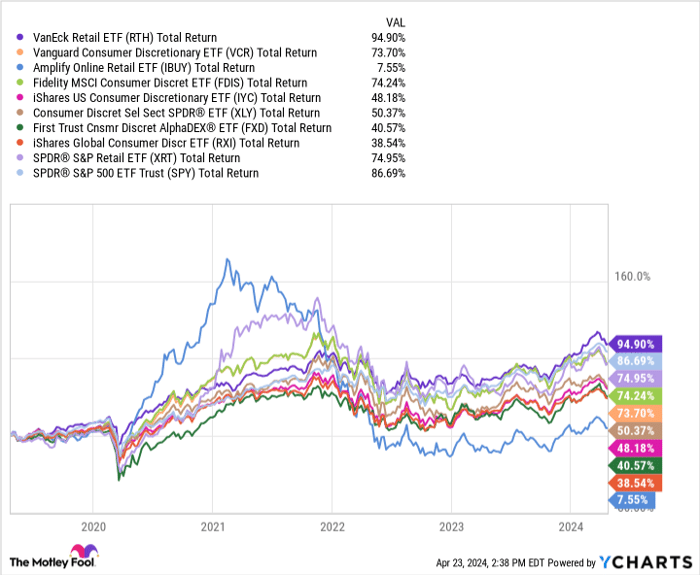

The VanEck Retail ETF has not just held its ground – it has outperformed its competitors significantly over the past five years, even surpassing the well-regarded SPDR S&P 500 ETF. Despite its slightly higher expense ratio of 0.35%, compared to some funds charging 0.10% or less, Morningstar reports that it remains below the industry average of 0.37%.

Impressively, the VanEck Retail ETF has delivered returns over 20 percentage points higher than the Fidelity MSCI Consumer Discretionary ETF and nearly 8 percentage points above the SPDR S&P 500 index. These results substantiate the value proposition of the VanEck Retail ETF, justifying its marginally higher costs.

RTH Total Return Level data by YCharts

The Appeal of VanEck Retail ETF

VanEck Retail ETF emerges as a top choice for retail investors seeking a balanced strategy to navigate the market’s nuances. Its proven track record of outperforming the S&P 500 over a five-year horizon makes it an enticing proposition for those striving to beat market benchmarks.

While the expense ratio may be marginally higher, the consistent market-beating performance showcases that the VanEck Retail ETF offers robust value for investors. As long as this trend persists, passive investors could benefit from considering this ETF over traditional funds or individual retail stocks.

Before jumping in, it’s worth pondering the potential returns. While VanEck Retail ETF has shown promise, exploring various investment avenues can be valuable. The Motley Fool Stock Advisor has identified 10 stocks with significant growth potential, suggesting a diversified approach for a well-rounded investment strategy.

*Stock Advisor returns as of April 22, 2024