Investors chasing artificial intelligence (AI) opportunities have a field day with accelerated computing and high-performance semiconductor chips, shaking up a vast array of products and services. Among the beneficiaries in the AI realm is the steady rise of data center investments. While Nvidia typically grabs the limelight in this space, shrewd investors see a plethora of businesses challenging the chip giant.

Contrary to the conventional infrastructure and storage plays, one of Nvidia’s notable “Magnificent Seven” peers is stepping into the data center arena. Despite its reputation for e-commerce and cloud computing, Amazon recently unveiled plans for a whopping $11 billion investment to construct data centers in Indiana, hinting at a thrilling endeavor with potentially lucrative returns.

The Roots of a $4 Billion Partnership

In a bold move last September, Amazon entered a $4 billion partnership with Anthropic, a burgeoning AI startup. Initial $1.25 billion funding jumpstarted this collaboration, with an additional $2.75 billion injected by late March. The heart of this investment was Amazon Web Services (AWS), the tech titan’s cloud computing platform.

Challenging economic landscapes in recent years, marked by surging inflation and rising borrowing costs, took a toll on both consumers and businesses, including enterprise software providers. Anthropic’s commitment to training future generative AI models on AWS, complemented by Amazon’s innovative semiconductor chips, Inferentia and Trainium, planted the seeds for a game-changing venture.

Image source: Getty Images.

Amazon Doubles Down on Data Centers

With AWS now boasting a $100 billion revenue run rate, Amazon’s relentless focus on cloud infrastructure investment shines through a decade-long surge in capital expenditure. Notably, plans for an $11 billion data center investment in Indiana highlight Amazon’s commitment to solidifying its standing in the AI landscape.

In a strategic move to reduce dependence on Nvidia’s GPUs, Amazon’s foray into custom chip development mirrors its historical perfection of warehouse efficiencies and shipping logistics through substantial fulfillment operation investments. This strategic shift anticipates manifold benefits, including expanded AI capabilities for AWS and eventual cost savings through proprietary data centers and in-house chips.

Ample Cash Reserves, No Cause for Concern

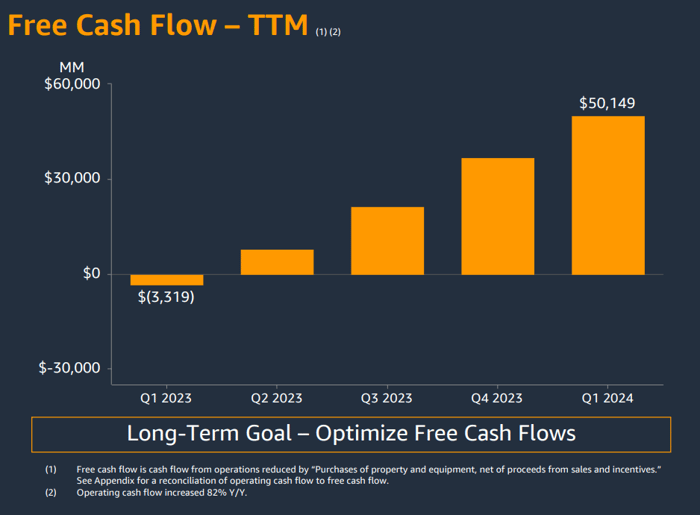

Eyebrows may raise at the staggering costs of Amazon’s ambitious AI pursuits. However, any concern dissipates as Amazon parades its overflowing coffers. Notably, the tech giant generated a hefty $50 billion in free cash flow for the trailing 12 months, with a comfortable $84 billion cash and equivalents cushion on its balance sheet by the end of the first quarter.

Image source: Amazon Investor Relations.

Assurances from Amazon’s CEO Andy Jassy during the first-quarter earnings call underscore the company’s unwavering commitment to infrastructure investments. Jassy’s remarks point to a clear-eyed optimism toward the monetization of capital expenses, propelled by burgeoning AWS demand, as Amazon boldly charts its course in the AI domain.

Unleashing the Potential: Amazon’s Strategic Investments in AI

As Amazon embarks on a journey toward further expansion in the cloud and artificial intelligence (AI) landscape, the horizon seems promising. With a legacy of 18 years as the CEO of Amazon Web Services (AWS), Andy Jassy’s ascension to the top spot brings a dose of optimism for stakeholders and investors alike.

Strategic Initiatives Fuel Growth

The decision to bolster investments in Anthropic, chips, and data centers underscores Amazon’s calculated approach towards shaping the future of AI. These strategic moves are akin to seeds planted in fertile ground, poised to sprout into a new era of growth for AWS.

Currently, Amazon boasts a commendable 3.2 price-to-sales (P/S) ratio, holding steady compared to its 10-year average. For investors eyeing the long-term horizon, this could be a golden opportunity to seize Amazon shares while the AI journey is still in its nascent stages.

Long-Term Investment Value

When contemplating an investment in Amazon, considerations beyond the present moment are crucial. The Motley Fool Stock Advisor provides insights into the 10 best stocks for future growth, with Amazon missing the current cut. This echoes back to historical instances like Nvidia’s inclusion in the list back in 2005, highlighting the immense potential for growth in the long run.

The Stock Advisor service has significantly outpaced the S&P 500 since 2002, making it a beacon for investors seeking substantial returns. The power of cumulative growth over time underscores the essence of long-term investment strategies.

*Stock Advisor returns as of May 6, 2024