Welcome to the forefront of the AI revolution, a realm where the ordinary transforms into the extraordinary as seamlessly as day shifts into night. In the fast-changing world of artificial intelligence, three sharp-eyed Motley Fool contributors have come together to light a path for investors looking to delve into the AI investment landscape this spring.

The Rise of UiPath in the AI Arena

Anders Bylund (UiPath): At the helm of business automation, UiPath occupies a rarefied air—a space where the banal is ushered aside to make room for the innovative and the value-driven. By automating mundane tasks, UiPath’s AI-driven bots unlock a company’s potential, allowing employees to redirect their efforts towards more meaningful and impactful endeavors.

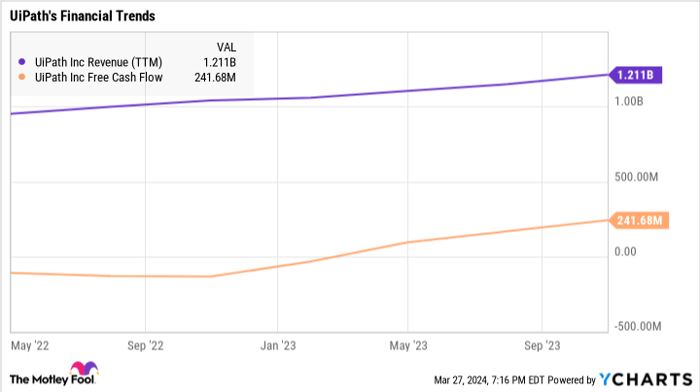

With UiPath’s intervention, clients witness cost savings and streamlining in their daily operations. The company’s recent financial performance speaks volumes: a 31% year-over-year sales surge in the last reported quarter, with free cash flow soaring from zero to $309 million in just a year.

UiPath, riding on the coattails of the AI wave, is poised for a sustained growth trajectory. Trading at bargain multiples relative to its industry peers, this software virtuoso offers investors an enticing proposition—a chance to partake in its explosive sales growth story.

Despite its compelling narrative, Wall Street remains reticent in acknowledging UiPath’s potential, trading at modest valuations that belie its vigorous growth. For investors seeking a reasonably priced AI stock with a high-octane sales engine, UiPath warrants a closer inspection. With legendary investor Cathie Wood ramping up her holdings, following her lead could prove to be a savvy move.

Broadcom’s Evolution Beyond Semiconductor Supplier

Billy Duberstein (Broadcom): Broadcom, a stalwart in the technology industry, stands as an underappreciated force in the AI domain, notwithstanding its formidable run in recent times.

While trading at 28 times this year’s earnings estimates, Broadcom’s track record of consistently outperforming analyst expectations positions it as a compelling bet for further accolades. Propelled by two burgeoning AI chip segments, the company is primed for a period of ascendant growth.

Within Broadcom’s portfolio lies a suite of merchant-networking chips that reign supreme in the realm of ethernet communications, enabling rapid data transmission. Coupled with its custom ASIC chips, utilized by tech titans like Alphabet and Meta Platforms for specialized AI accelerators, Broadcom has carved a niche for itself in the AI ecosystem.

Anticipating robust growth in its AI chip division, Broadcom recently upped its projections, forecasting a surge in AI revenue to represent 35% of its semiconductor revenue in 2024. This increased allocation underscores the burgeoning importance of AI applications in driving the company’s top-line growth.

Moreover, Broadcom’s foray into software, buoyed by the acquisition of VMware, marks a strategic pivot towards diversification. With software revenue comprising nearly half of its total revenue, Broadcom’s latest move appears aptly timed, reflecting a shift towards software-led growth.

Their recent announcement of accelerated growth for VMware following the acquisition signifies a lucrative opportunity for investors. As corporate clients navigate the complex interplay between on-premise data centers and public clouds in an AI-centric world, Broadcom’s diversified portfolio stands poised to capitalize on this paradigm shift.

Unveiling the Underrated Giants of the Tech World

The Rise of VMware: Glue that Binds the Tech Landscape

Companies are increasingly drawn to cloud-based AI tools, yet they remain cautious about sharing data beyond their in-house data centers. In this dynamic tech realm, VMware emerges as the indispensable connective tissue intertwining various computing environments.

Broadcom: Transforming into a Hybrid Powerhouse

Broadcom has evolved beyond mere chip manufacturing. With a unique balance of chips and software at its core, the company now stands at a vantage point to explore possibilities in both hardware and software domains for future expansions. The recent VMware acquisition significantly enhances Broadcom’s growth potential, possibly eluding the radar of investors who tend to undervalue its stock despite a remarkable 116% surge over the past year.

Is Nvidia’s Apex Closer than Perceived?

Nvidia, a tech juggernaut synonymous with igniting the AI revolution, faces questions about its pinnacle status in the industry. Acknowledged for its pivotal role in pioneering the AI landscape, Nvidia’s GPUs now underpin cutting-edge generative-AI training and inference capabilities, cementing its dominance in the sector.

CEO Jensen Huang’s vision places Nvidia at the forefront of upgrading global data center infrastructures to adopt accelerated computing hardware. Simultaneously, the burgeoning generative-AI market, aimed at revolutionary AI training applications, presents Nvidia with a lucrative frontier to conquer. With this market poised to burgeon into a multibillion-dollar industry, Nvidia holds a commanding position as a trailblazer in generative AI.

The market projection reinforces Nvidia’s colossal potential, reflected in its staggering $2.3 trillion market capitalization. Despite being one of the world’s most valuable companies, Nvidia’s revenue and profits are yet to match those of industry giants. However, investors remain bullish on Nvidia’s perpetual high-growth trajectory, underpinned by robust revenue expansion predictions and sustained profit margins.

While Nvidia’s business cycle entails inherent cyclicality, driven by the ebb and flow of AI-infrastructure demand, indications do not point towards an imminent peak in Nvidia’s sales trajectory. As Nvidia continues to chart new territories in the tech sphere, a cautious approach may be prudent for prospective investors eyeing the tech titan.

Before diving into Nvidia’s stock, prudent investors may derive valuable insights from the tenets shared by the Motley Fool Stock Advisor analyst team, who recently uncovered the 10 most promising stocks for future investment opportunities. The omission of Nvidia from this elite list underscores the myriad options available for investors to explore and potentially reap substantial returns in the ensuing years.

The tech realm’s landscape is ever-evolving, where giants like VMware, Broadcom, and Nvidia wield considerable influence. As these tech powerhouses navigate through uncharted territories, investors keen on the tech sector’s growth trajectory must navigate prudently amid the turbulent yet exciting tech ecosystem.

*Stock Advisor returns as of March 25, 2024