If you’ve been following the tech scene, you must have noticed the buzz surrounding artificial intelligence (AI). It’s as ubiquitous as a catchy summer tune. The enigmatic allure of AI has drawn a horde of investors looking to ride the wave of this burgeoning industry.

This surge in interest has propelled the stocks of various companies involved in AI to stratospheric heights, with notable mentions like Nvidia, Microsoft, and CrowdStrike hogging the limelight. However, amidst the glamour, one tech titan stands in the shadows, quietly commanding attention: Taiwan Semiconductor Manufacturing (NYSE: TSM).

The Backbone of the AI Pipeline

TSMC reigns supreme as the top dog in the semiconductor foundry realm, boasting a hefty 61% slice of the global semiconductor foundry market as of 2023’s curtain call. Operating on a foundry model, TSMC tailors semiconductors (chips) to meet the bespoke needs of its clientele, rather than churning out generic offerings.

To grasp TSMC’s pivotal role in the AI supply chain, let’s conduct a brief reverse-engineering exercise. Massive AI models, essential for natural language processing applications (think OpenAI’s ChatGPT, Netflix’s recommendations, and Amazon’s Alexa), demand a copious influx of data to perform effectively. This data deluge necessitates robust data centers, reliant on high-performance AI chips and graphic processing units (GPUs) for optimal functioning.

Anticipating a Revenue Surge for TSMC

The bulk of TSMC’s revenue stems from two primary sources: smartphones (accounting for 38% in Q1) and high-power computing (representing 46% of revenue).

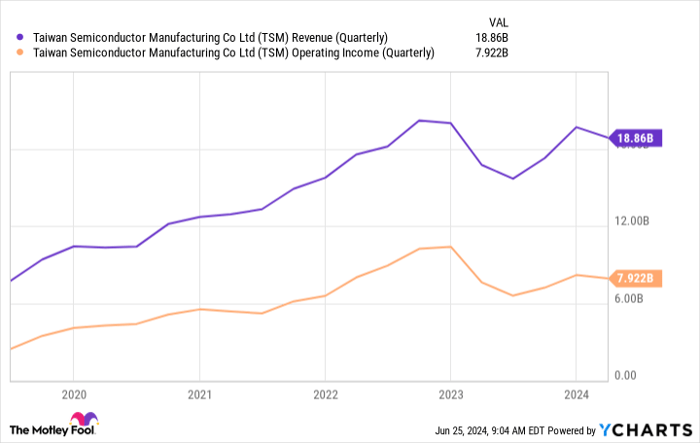

A recent downturn in the global smartphone arena dealt a blow to TSMC’s revenue stream, precipitating a decline in the first half of 2023. Although a late-year recovery salvaged the situation, TSMC is yet to recapture its former vigor entirely.

However, a silver lining is in sight. In a recent earnings call, TSMC’s CEO hinted at a doubling of AI-related revenue this year, constituting a “low-teens percentage” of its 2024 revenue. Even more promising is the forecast of AI-related revenue expanding at a 50% compound annual growth rate (CAGR) over the next half-decade, eventually comprising around 20% of total revenue.

While smartphones will remain a cornerstone for TSMC (Apple alone contributing significantly to revenue), AI chips could offer a double whammy for the chip manufacturer. With demand soaring, TSMC can wield its market dominance to exercise pricing power. Augmented pricing without accompanying cost hikes could uplift margins and bolster free cash flow.

Analysing TSMC’s Valuation

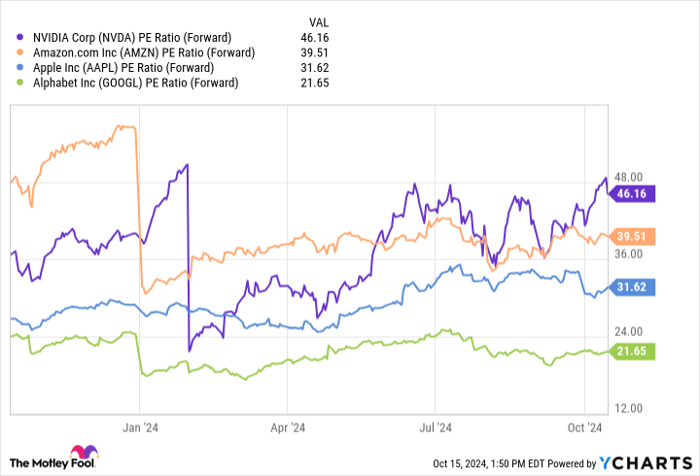

Despite my conviction in TSMC’s prowess, its stock veers toward the pricey side by conventional metrics. Its price-to-earnings (P/E) ratio loiters around 32, notably eclipsing its five-year average.

Nevertheless, TSMC’s lofty valuation finds validation in its growth potential. It’s not solely about AI and its pivotal role in the burgeoning tech landscape. An anticipated resurgence in the smartphone and PC markets is poised to furnish TSMC with a financial shot in the arm. Coupled with its above-average dividend yield, investors have ample rationale to retain the stock for the long haul.

Is Taiwan Semiconductor Manufacturing Worth a $1,000 Investment Now?

Ponder this before delving into Taiwan Semiconductor Manufacturing stock:

The Motley Fool Stock Advisor analyst squadron has pinpointed what they deem as the standout options for a $1,000 investment. Should TSMC make the cut?

The Unseen Winners: Stock Advisor’s Top Stock Picks That Can Reshape Your Portfolio

Missing the Mark: A Glance at the 10 Best Stock Picks

As the investment world buzzes with excitement about the 10 best stocks for investors to buy, Taiwan Semiconductor Manufacturing finds itself excluded from this coveted list. However, this is not about who didn’t make the cut. The focus is on the 10 chosen stocks that have the potential to yield significant returns in the forthcoming years.

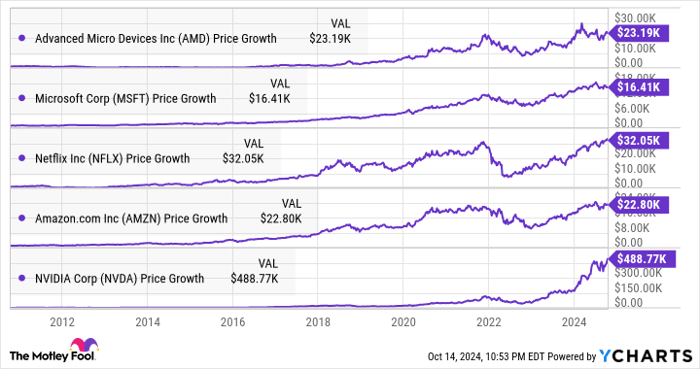

A Glimpse into the Past: Nvidia’s Monumental Rise

Consider Nvidia’s inclusion in a similar list back on April 15, 2005. If an individual had invested $1,000 at the time of the recommendation, they would now be sitting on an eye-watering $774,526. This anecdote from the past underscores the transformative power hidden in the selection of these top stocks.

The Stock Advisor Advantage: A Blueprint for Investment Success

Stock Advisor offers investors a straightforward roadmap to success in the unpredictable world of stock markets. With insightful guidance on portfolio construction, regular analyst updates, and two fresh stock recommendations monthly, the Stock Advisor service has proven its mettle by outperforming the S&P 500 index by a staggering margin since its inception in 2002.

Discover the Gems: Explore the Top 10 Stocks

To unearth these hidden gems and potentially reshape your investment portfolio, delve into the list of the top 10 recommended stocks. Each of these picks holds the promise of delivering exceptional returns and could be the key to unlocking your financial success in the years to come.