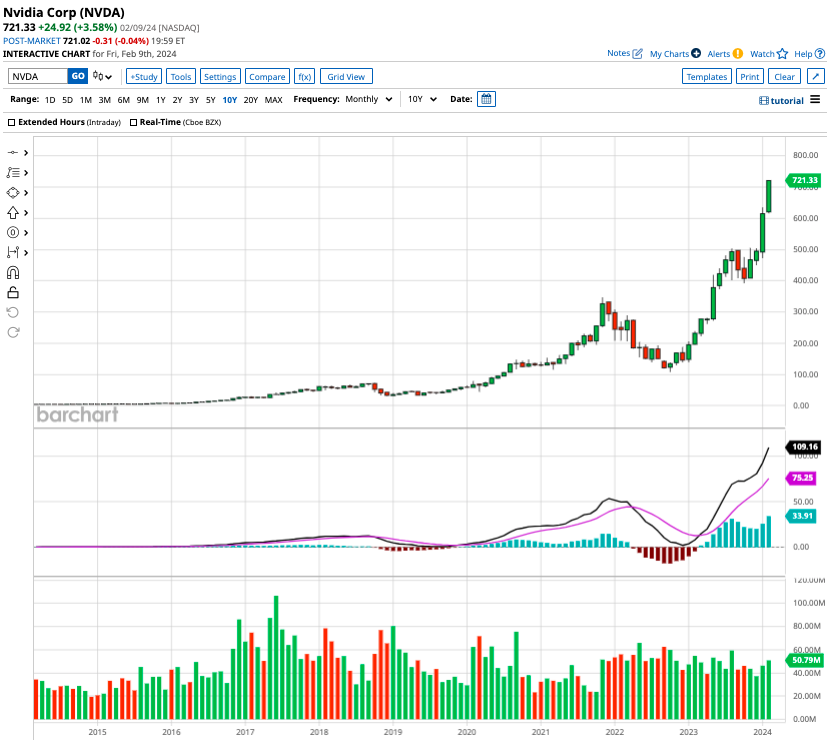

Nvidia (NVDA) has been a juggernaut in the tech stock world, propelling shareholders to dizzying wealth. Over the past year, the mega-cap semiconductor designer has seen shares surge by an astonishing 241.5%, with an eye-watering 15,738% hike over the last decade.

As a market behemoth, valued at $1.78 trillion, NVDA is facing the million-dollar question: How high can its stock rise in the next 12 months?

An Overview of Nvidia

Nvidia is a provider of graphics computing and networking solutions across the U.S. and international markets. Its products are utilized in a wide array of verticals, ranging from gaming and professional visualization to data centers and automotive applications.

Nvidia’s First Mover Advantage in AI

The future holds immense promise for artificial intelligence (AI) as a driving megatrend. Statista’s report forecasts the total addressable market for AI-powered products and solutions to balloon from $241 billion in 2023 to a jaw-dropping $738 billion by 2030, signifying annual growth rates of over 15%.

Nvidia’s strategic position in designing and supplying AI chips places it at the forefront of this burgeoning industry. With a surge in demand for AI chips, as evidenced by the doubling energy consumption by data centers projected by the International Energy Agency, Nvidia stands as a prime investment option in this rapidly evolving landscape.

Strong Revenue Growth

Over the last 12 months, Nvidia has seen a substantial upswing in sales to $45 billion, up from $26 billion in fiscal 2023. Wall Street analysts are anticipating the tech giant to report sales of $59.16 billion in fiscal 2024 and a whopping $94.46 billion in fiscal 2025. As investors eagerly wait for the impending Q4 results, Nvidia’s asset-light model has catapulted its free cash flow to $17 billion over the last four quarters, a stark contrast to its rival Advanced Micro Devices’ free cash flow of $1 billion.

What Is the Target Price for NVDA Stock?

Anticipation is rife ahead of the upcoming earnings report, with leading investment banks such as Morgan Stanley and Goldman Sachs raising their price targets on NVDA stock. Morgan Stanley has upped its target by $147, foreseeing NVDA to reach $750, while Goldman Sachs envisages NVDA stock hitting $800, representing a 10% premium from current levels.

Out of the 38 analysts covering Nvidia stock, 33 recommend “strong buy,” two recommend “moderate buy,” and three recommend “hold.” NVDA is currently trading above its mean target price of $675.52. The Street-high price target of $1,100 bodes an expected upside of 51%.