Apple’s latest financial report has once again demonstrated its growth potential, catching the attention of seasoned investors like Warren Buffett. Diving into the Berkshire Hathaway portfolio’s massive stake in Apple sheds light on the compelling logic driving Buffett’s investment decisions.

Unveiled by Todd Combs, a key member of Berkshire’s management team, Apple’s value proposition captured Buffett’s interest. Challenged by Buffett to pinpoint investments with significant potential, Combs navigated the complexities of the market, eventually identifying Apple as a prime candidate for Berkshire’s portfolio.

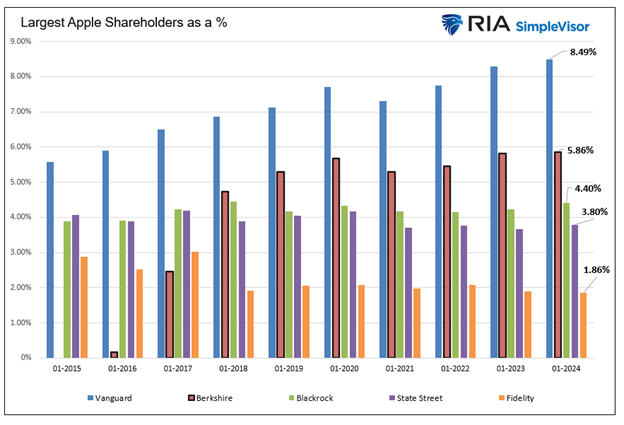

Through the lens of historical context, it becomes apparent that Berkshire Hathaway’s journey with Apple symbolizes a strategic evolution. The rise in Berkshire’s percentage ownership of Apple, showcased in visual data, serves as a testament to the astute investment decisions driving the conglomerate’s success.

Apple’s Evolution as Part of Berkshire’s Portfolio

Reflecting on Berkshire’s substantial investment in Apple, it’s imperative to grasp the significant transformation in Berkshire’s stake in Apple over time. From a negligible position in 2015 to currently holding over 5% of the tech giant, Berkshire’s journey exemplifies strategic portfolio management.

Comparing Berkshire’s stake in Apple with other major mutual funds and ETFs unveils the remarkable growth trajectory, underlining the strategic foresight driving Berkshire’s investment decisions.

The escalating number of Apple shares owned by Berkshire, in conjunction with the increasing value of these shares, paints a vivid picture of Berkshire’s profound confidence in Apple’s long-term growth prospects.

Buffett’s Stance on the Tech Industry

Warren Buffett’s initial skepticism towards tech stocks serves as a compelling backdrop to Berkshire’s foray into Apple. Despite his reluctance to invest in sectors he didn’t fully comprehend, Buffett’s eventual recognition of Apple as a consumer goods powerhouse illustrates his adaptive investment approach.

Buffett’s perception of Apple as a consumer-goods company, resonating with consumers on a profound level, showcases his ability to identify unconventional value propositions within the technology sector.

The Legacy of Todd Combs

Todd Combs, a pivotal figure behind Berkshire Hathaway’s successful investments, exemplifies the blend of strategic acumen and meticulous analysis defining Berkshire’s investment philosophy. Combs’ instrumental role in identifying Apple as a lucrative investment underscores his astute investment prowess.

The partnership between Buffett’s visionary leadership and Combs’ analytical expertise has not only propelled Berkshire’s financial success but also hints at the potential for identifying future market gems using a similar investment framework.

Buffett’s Foresight: The Investment Criteria

Delving into the investment criteria outlined by Buffett, which guided Berkshire’s acquisition of Apple, unveils a strategic roadmap for identifying potential investment gems in the market. Emphasizing factors such as reasonable valuation, earnings growth projections, and the company’s market impact, Buffett’s criteria provide a template for informed investment decisions.

By incorporating additional screening parameters like sales growth and sector exclusions, investors can enhance their ability to unearth the next burgeoning market standout, akin to Apple’s meteoric rise in Berkshire’s portfolio.

Unveiling the Next Apple: The Investment Pursuit

Building on Buffett’s investment framework, investors can embark on a quest to unearth the next Apple by applying rigorous analytical criteria and strategic foresight. Leveraging market insights and historical performance data, investors can navigate the investment landscape with a keen eye for potential market disruptors.

Through a nuanced analysis of market trends and company fundamentals, investors can identify companies poised for substantial growth, echoing Apple’s trajectory in Berkshire’s portfolio.

Embracing Buffett’s Legacy: Navigating the Investment Terrain

Warren Buffett’s investment legacy, epitomized by Berkshire Hathaway’s strategic investments in companies like Apple, serves as a guiding beacon for investors navigating the dynamic financial landscape. By embracing Buffett’s investment philosophy and leveraging insightful market analysis, investors can chart a course towards discovering the next market titan.