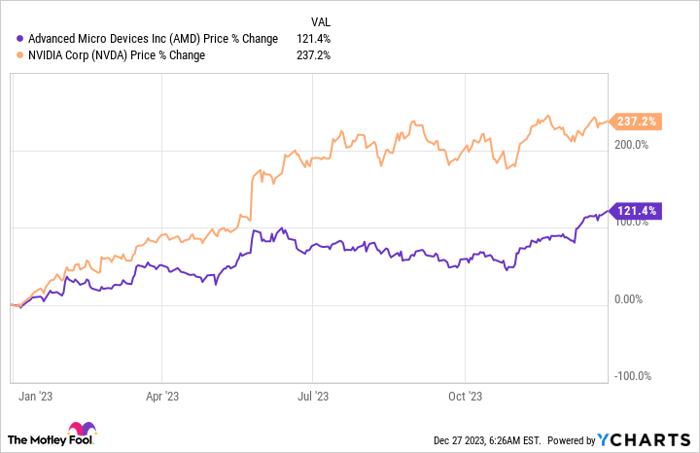

As 2023 comes to a close, semiconductor stocks have emerged as the darlings of the market, outperforming the broader S&P 500 index by a significant margin. The PHLX Semiconductor Sector index surged 66% compared to the S&P 500’s 24% gain. Driving this impressive growth were the soaring demand for artificial intelligence (AI) chips, catapulting industry giants like Nvidia and Advanced Micro Devices (AMD) to deliver promising gains to their shareholders.

The outlook for 2024 mirrors investors’ bullish sentiments as a new catalyst prepares to propel these semiconductor juggernauts to greater heights.

The Potential Rebound of the PC Market

After suffering consecutive declines since 2022, the PC market could finally witness a much-needed resurgence in 2024. Due to a confluence of factors such as the emergence of AI-enabled PCs, the impending obsolescence of Windows 10, and an aging installed base of computers, market research firms IDC and Canalys are forecasting a 3.4% and 8% increase in PC shipments, respectively. Additionally, IDC projects a compound annual growth rate of 3.1% through 2027.

For Nvidia and AMD, both of which are key suppliers of PC chips, a rebound in PC sales would be a windfall.

Impending Gains for Nvidia and AMD

Nvidia, known for its dominance in discrete graphics cards, observes an upward trend in sales as manufacturers anticipate a rebound in PC demand. Its gaming revenue increased by 22% in the second quarter and by a staggering 81% in the subsequent quarter of fiscal 2024, hinting at a robust momentum that is expected to complement the growth of their data center business in 2024.

Meanwhile, AMD experienced a noteworthy upturn in its PC-focused business, with a 42% year-over-year revenue increase in the third quarter. This segment accounted for 26% of its top line, and CEO Lisa Su highlighted the launch of over 50 new notebook designs powered by the Ryzen AI processors. AMD’s revenue is anticipated to rise by 17% in 2024, but its expanding presence in the AI data center chip space and the recovery of the PC market could facilitate an even more substantial increase.

Analysts foresee a potential leap in AMD’s revenue, hinting at a favorable trajectory for its stock.

Should you invest $1,000 in Nvidia right now?

Before you make a move, consider this: The Motley Fool Stock Advisor analyst team curated a list of what they believe are the 10 best stocks for investors to buy now. While Nvidia did not make the cut, the identified stocks could offer remarkable returns in the coming years.

Stock Advisor provides investors a guide for success, including portfolio building advice, regular updates from analysts, and two new stock picks each month, significantly outperforming the S&P 500 since 2002*

See the 10 stocks

*Stock Advisor returns as of December 18, 2023

This article was written by Harsh Chauhan. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.