As I delve into the market’s currents, I consistently find myself in the camp that views the glass as significantly more than half full when peering into the long-term panorama. The rationale behind my perpetual optimism is plain. Simply put, stocks have a historical penchant for mounting upwards trajectories over time. Admittedly, this trend, pervasive since the dawn of financial trading, is not immune to interruption. A substantial shift in the fabric of U.S. democracy or the fundamental structure of our capitalist economy might necessitate a recalibration of my perspective. Yet, drawing on over four decades of navigating the tumultuous waters of Ms. Market’s domain, one lesson rings clear – granting the benefit of the doubt to the bulls tends to yield rewards, with remarkable consistency.

Of course, bear markets rear their ominous heads from time to time. Crises ravage the economic landscape, causing earnings to stumble. Wall Street, renowned for embracing excess in myriad forms, occasionally steers the ship toward a painful reconfiguration.

Enduring these tumultuous phases is far from enjoyable. Still, they exhibit a transitory nature, particularly when scrutinized through a wide-angle lens of historical perspective.

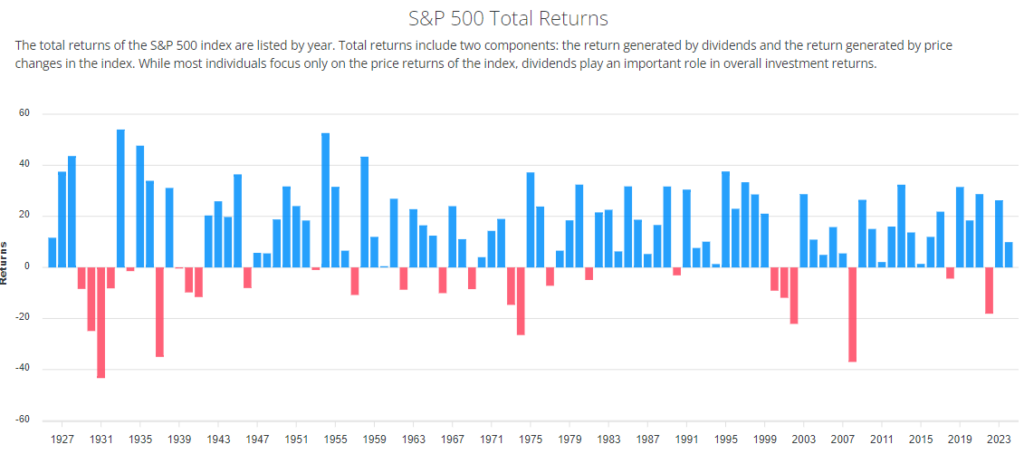

My elucidation finds tangible support in the chart depicted below – one that delineates the calendar year returns for the sought-after S&P 500 index since its inception. The blue bars signify gains, while the inevitable red bars denote declines in various calendar years.

Source: Slickcharts.com

A cursory glance at this graphical representation immediately unveils a salient observation – the vast majority of bars adorn themselves in a lustrous shade of blue, symbolizing upward movement in most years. Notably, only sporadic instances of consecutive red bar sequences emerge. The most protracted stretch of pessimism dates back to the Great Depression era, whereas the modern epoch bore witness to a three-year losing streak subsequent to the tech bubble implosion.

Intermittent red years punctuate the timeline. Nevertheless, embarking on a panoramic observation, one must internalize that most years culminate with stock market upswings.

Transitioning our focus now to a pivotal reason to remain steadfast onboard the bullish locomotive from a more near-sighted standpoint.

History Favors the Bulls Right Now

The bears, undoubtedly burdened by a litany of concerns, find themselves brooding over several pressing issues. Stubborn inflation, geopolitical turmoil, political unrest, towering valuations, exuberant sentiment, and regulatory nudges from the Fed collectively cast a pervasive shadow.

A recent bone of contention for the bears revolves around the substantial mileage covered by the market since the quelling of last fall’s correction. The ensuing rally has notched up four consecutive months of gains, ushering in overbought conditions. With market sentiment teetering on the edge of exuberance, our furry skeptics contend that a retracement looms on the horizon.

Granting due credence to this conjecture, I concur with the notion of pullbacks, corrections, or what I humorously dub “sloppy periods” – recurring visitors in contemporary market landscapes. These phenomena often materialize devoid of specific triggers or during ephemeral turbulent spells.

Yet, considering that market fluctuations within the 3-5% range occur for a sundry of reasons at any given juncture, historical analyses of prevailing rallies lean decisively in favor of brushing aside short-term apprehensions and embracing a bullish outlook.

The Data is Convincing

Here’s the dime drop. Insights from the number-crunching wizards at Ned Davis Research reveal a striking pattern. When the S&P 500 index stages a rally spanning November through February, the subsequent three months witness the index surging past its February closing benchmark 87.5% of the time, boasting a mean gain of 4.9%, doubling the 2% average typical of all periods.

Zooming out to the six-month horizon, the numbers exhibit similar bullish tendencies, with the S&P 500 charting an ascent 93.8% of the time, with an average gain of 6.4%. Remarkably, the subsequent ten and twelve-month periods after a Nov-Feb rally manifest an unbroken trajectory skyward – a phenomenon witnessed every single time.

The average market upswing for the remainder of a calendar year following this rally stands at a formidable 15.5%, dwarfing the humbler 6.8% average for all March-December spells. Akin sentiments resonate for the twelve-month aftermath, where the average ascension weighs in at 18.1%, eclipsing the 8.2% average characterizing all March-February periods. The numbers, indeed, paint a compelling portrait.

Therefore, notwithstanding the highly plausible emergence of sporadic setbacks, corrections, or sloppy spells in the ensuing months, one may find solace in the substantiated probability of stocks trending favorably in the near-term landscape, spanning 3, 6, and 12-month scopes.

Such insights strike a resonant chord with me.

Thought for the Day:

Let him that would move the world first move himself. – Socrates