Earnings season continues to wind down, with the bulk of S&P 500 companies already revealing quarterly results. Recently, home improvement retailer Home Depot HD posted results that spurred bullish activity among investors.

With peer Lowe’s LOW set to disclose its quarterly results on August 20th, let’s delve into what investors can anticipate.

Home Depot’s Encouraging Performance

HD exceeded the Zacks Consensus EPS estimate by 2.9% and reported sales 1.4% above the consensus. While earnings dipped slightly from the year-ago period, sales saw a modest 0.6% increase.

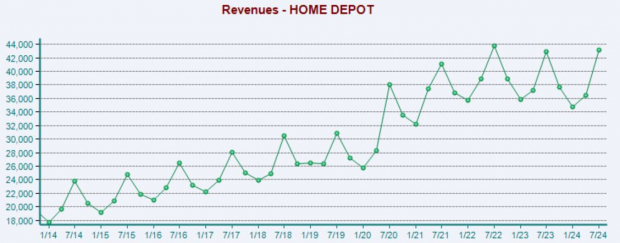

The company’s sales growth has plateaued since the pandemic, with the surge in demand for home improvement projects slowing down post-COVID. Consumers who initially embarked on various home upgrades have significantly reduced such activities, causing a sharp deceleration in the trend.

CEO Ted Decker acknowledged the trend but expressed optimism, emphasizing, ‘The underlying long-term fundamentals supporting home improvement demand are strong.’

Decker added, ‘During the quarter, higher interest rates and greater macro-economic uncertainty dampened consumer demand more broadly, resulting in reduced spending across home improvement projects.’

Although margin pressures have impacted profitability negatively, recent periods have seen a shift in the tide, as illustrated in the trailing twelve-month chart below.

Anticipated Cooling of Lowe’s Growth

Earnings projections for LOW have slightly decreased in recent months but remained steady following HD’s quarterly results. The company is expected to experience a growth slowdown, with earnings projected to decline by 13% on 4% lower sales.

Lowe’s has also faced a demand slowdown, with comparable store sales dropping 4% year-over-year in its latest period due to reduced spending on big-ticket discretionary items. Given HD’s performance, it is likely that LOW continued to witness a decline in big-ticket item sales during the period.

Furthermore, LOW currently holds a Zacks Rank #4 (Sell), with earnings expectations decreasing across the board in recent months. Investors are advised to remain cautious until positive earnings revisions occur, potentially prompted by favorable guidance and better-than-expected quarterly results.

Summarizing the Situation

Home improvement giant Home Depot HD recently revealed its quarterly results, leading to mildly positive market reaction. While there were no major surprises in the release, the slowdown in big-ticket discretionary purchases continues to pose a challenge for the company.

A similar trend is expected from Lowe’s LOW in its upcoming release on August 20th, as the company grapples with reduced spending on high-value items. Projections for Lowe’s indicate a decline in both earnings and revenue compared to the previous year.