The rise in artificial intelligence (AI) stocks has been nothing short of extraordinary, heralding a seismic shift with far-reaching implications across myriad industries. One forecast suggests that the AI market is poised to soar to a staggering $2.74 trillion by 2032, boasting a jaw-dropping CAGR of 20.4% from 2024 to 2032 – a tantalizing prospect coveted by investors and analysts alike.

Amid this AI revolution stands Nvidia (NVDA), the Santa Clara-based juggernaut renowned for designing and selling specialized GPUs. With an astounding surge of 2,848% over the last five years and a robust YTD increase of 138.5%, Nvidia embodies the essence of the AI euphoria, creating waves that ripple throughout the market. Moreover, a modest dividend yield of 0.02% sweetens the pot for investors eyeing long-term gains.

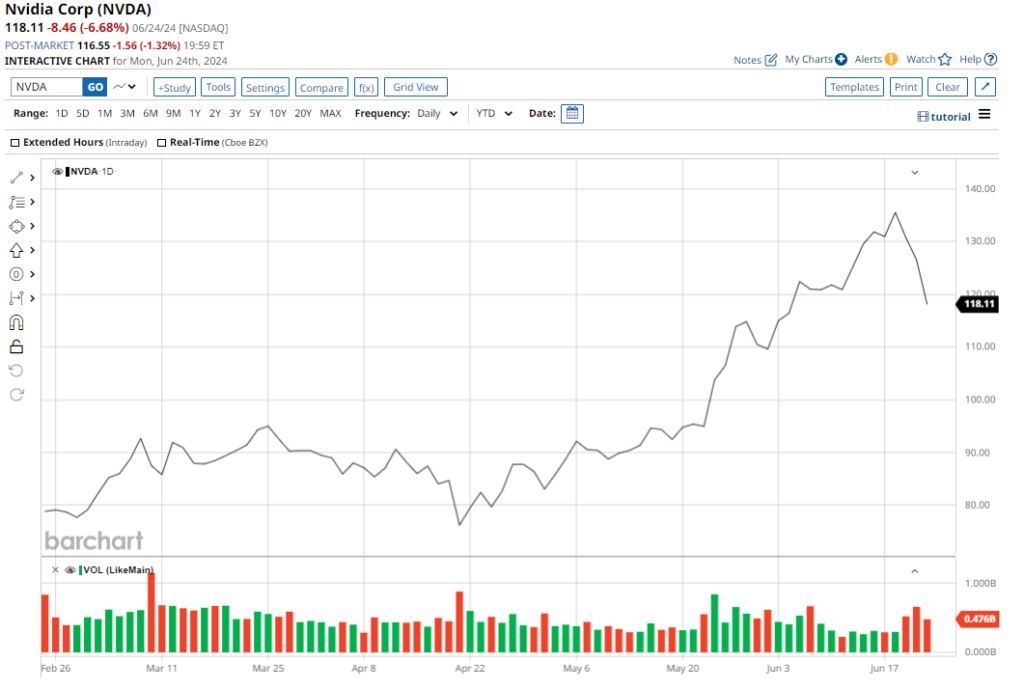

Recent Stock Performance

However, Nvidia’s ascent to briefly claim the title of the world’s most valuable company was followed by a precipitous decline, with shares shedding 16% from their peak amidst the recent market turmoil, marking its steepest pullback in months.

The trigger for this downturn likely includes profit-taking following an overextended rally and concerns regarding substantial insider selling. As Nvidia insiders offloaded shares in significant volumes, questions arose about the implications of their actions on the stock’s trajectory.

Interpreting Insider Selling

Executives, including CEO Jensen Huang, undertook substantial selling of Nvidia shares, raising eyebrows in market circles. While these transactions may initially seem alarming, they often form part of pre-established stock compensation plans rather than indicating a lack of confidence in the company’s prospects.

Mark Lehmann, CEO of Citizens JMP Securities, echoed a sentiment that while the level of insider selling at Nvidia is noteworthy, it should not be construed as an ominous sign for the stock’s future.

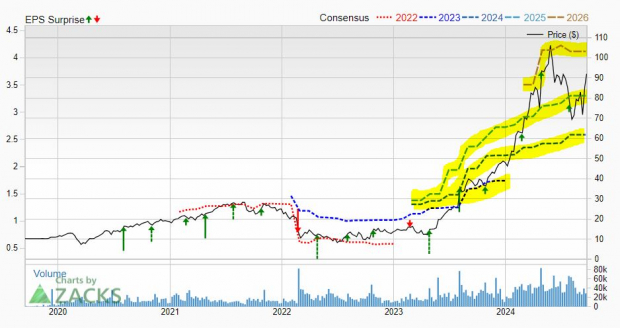

Financial Fortitude

Driving home a message of financial robustness, Nvidia delivered stellar results in the first quarter, surpassing revenue and earnings estimates with remarkable ease. The company’s record quarterly revenues of $26 billion, a substantial YoY increase, underscored its dominance in the data center realm, with core revenues skyrocketing by 427%.

With a staggering 261.5% surge in adjusted EPS, robust operating cash flows, and a healthy cash reserve exceeding debt levels, Nvidia emerged as a beacon of stability amidst the recent market upheavals.

Innovative Ventures

Nvidia’s foray into revolutionary chip technologies, epitomized by the Blackwell platform, signals a significant leap in computational efficiency, promising cost reductions and energy savings of monumental proportions. This technological leap not only consolidates Nvidia’s market dominance but also sets the stage for transformative progress in the AI realm.

With a relentless focus on innovation, exemplified by the forthcoming Rubin platform and the game-changing Nvidia Inference Microservices, the company is primed to lead the charge in the realm of accelerated computing and generative AI applications.

Analyst Sentiment

Despite the recent tumult, analysts maintain a bullish outlook on Nvidia, with a consensus “Strong Buy” rating and an average target price pointing to a considerable upside potential. The overwhelming analyst sentiment underscores the long-term growth prospects and resilience of Nvidia in weathering market fluctuations.