Unveiling New Options Contracts

Investors circling Ford Motor Co. (Symbol: F) today were greeted by fresh options on the table, set to expire on April 12th. Delving into the world of possibilities, our financial calculations have scrutinized the F options sphere for these imminent April 12th contracts, spotlighting one lingering put and one upbeat call contract.

An Intriguing Put Opportunity

A tempting offer rests at the $12.00 strike price, where the put contract lures with a current bid of 24 cents. Opting to seize this opportunity involves a commitment to acquire the stock at $12.00, coupled with a premium collection—creating a shrewd cost basis of $11.76 per share (pre-broker fees). Comparing this offer to the current market value of $12.41/share presents a 3% discount, positioning the put contract enticingly out-of-the-money.

The scenario unfurls with the put contract facing a 99% possibility of expiring worthless, equating to a manageable 2.00% return on the cash invested, or a notable 16.99% annualized return—a concept termed by Stock Options Channel as the YieldBoost.

Visualizing the Past

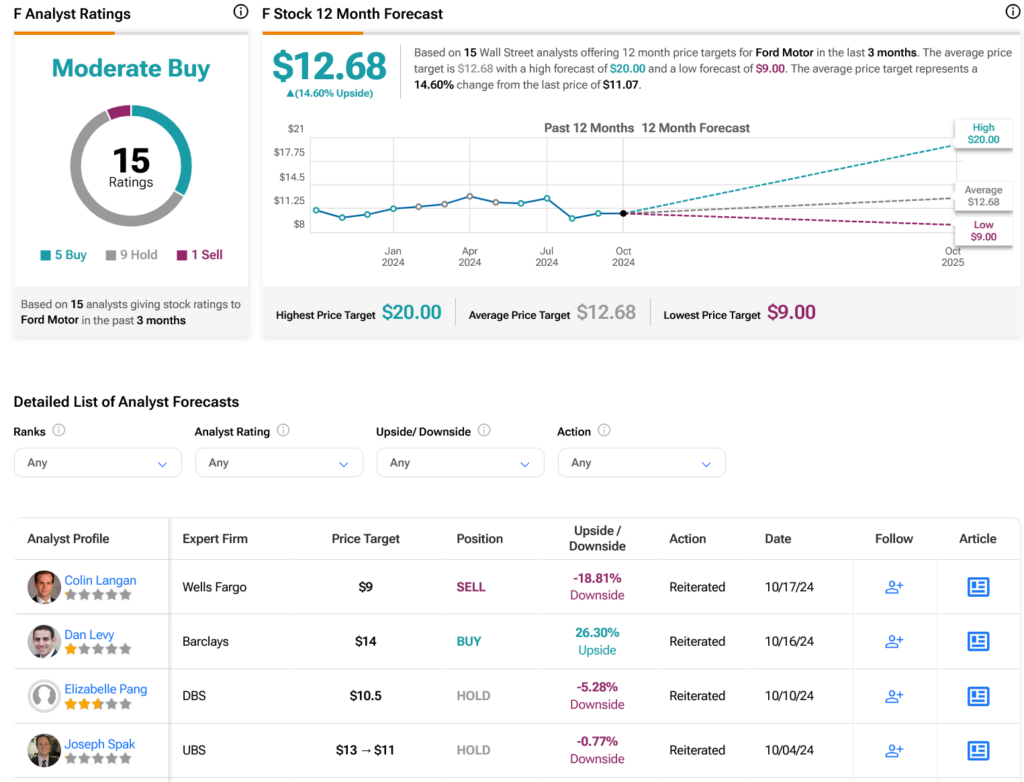

Looking back at Ford Motor Co.’s year-long trading narrative, the chart accentuates the $12.00 stake against historical movements, offering additional perspective to potential strategists.

A Tempting Call Possibility

Shifting focus to the calls spectrum, attention gravitates towards the $12.50 strike price. A ripe opportunity awaits with a current bid of 46 cents. Opting to engage involves acquiring F shares at the current price ($12.41/share) and venturing into a “covered call” scenario, obligating the sale of the stock at $12.50. This strategic move could yield a 4.43% total return (dividends aside) should the stock be called away upon April 12th’s closure (pre-commissions), presenting appealing prospects for investors.

While the call contract grapples with a modest 1% premium to the present market stock price, translating to an out-of-the-money setup, there lies a mirrored 99% likelihood of its expiry rendering zilch. In such a scenario, the investor retains both shares and the premium, with the latter contributing a 3.71% supplementary return, or an impressive 31.49% annualized boost—emphasized as the YieldBoost by Stock Options Channel.

Mapping the Journey Thus Far

Tracing back Ford Motor Co.’s previous twelve months in the trading realm, the chart spotlights the $12.50 strike in fiery red, guiding observers on the potential path ahead.

As the groundwork of deliberation intensifies, unveiling an actual trailing twelve month volatility rate of 34% adds depth to the intricate web of choices, enhancing the decision-making fabric for astute investors seeking to navigate the realm of put and call options landscapes.

For a deeper dive into the realm of put and call options, embark on a journey with Stock Options Channel.

Also see:

MNI Videos

Institutional Holders of EDGE

CRSA Historical Stock Prices