As an investor, your 2023 was likely a success if you had exposure to the “Magnificent Seven” stocks. This group of mega-cap tech stocks, including Nvidia, Amazon, Tesla, Apple, Microsoft, Meta Platforms, and Alphabet, showed outstanding performance, outpacing the Nasdaq Composite’s 45% surge last year.

However, the success of 2023 doesn’t guarantee a repeat performance in 2024. Some of these “magnificent” stocks could be at risk of running out of steam. In this investing preview, we identify the four stocks worth buying in 2024 and the three to avoid from the “Magnificent Seven” group.

Nvidia: A Focal Point of Artificial Intelligence

Nvidia is riding high on the artificial intelligence (AI) wave with its specialized chips for demanding, high-compute applications. The company’s dominance in the market, controlling up to 90% of AI chips, has propelled its revenue growth to a staggering 200% year over year to $18 billion in the latest quarter.

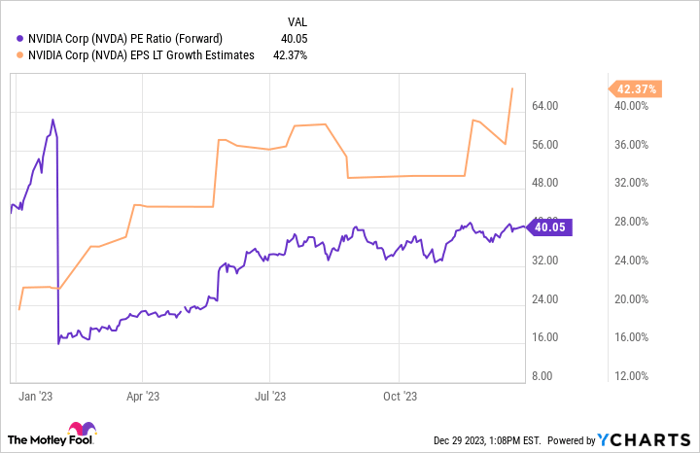

NVDA PE Ratio (Forward) data by YCharts

With AI demand showing no signs of slowing down, Nvidia is projected to achieve an annual earnings growth rate of 42% in the coming years, justifying its valuation at 40 times 2023 profits. Despites its massive 250% climb in 2023, the stock remains attractive with a PEG ratio of just 1.

Apple: Struggling to Keep Up

Apple’s revenue has declined over the past year, and its net income saw a mere 1% increase. The company’s business, known for cyclical swings tied to key iPhone releases, has complicated the correlation between share prices and operating results.

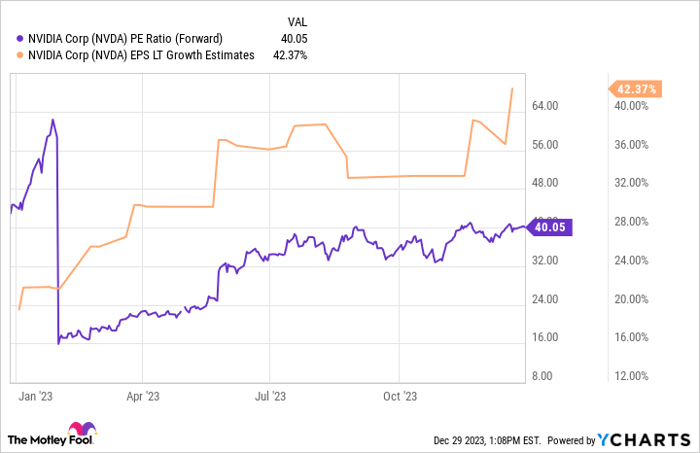

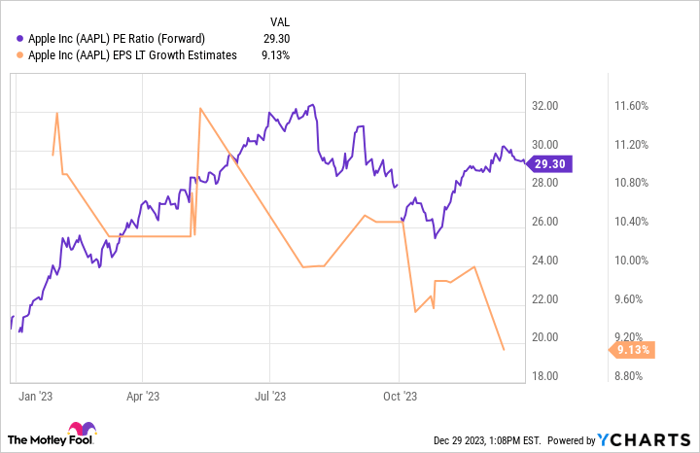

AAPL PE Ratio (Forward) data by YCharts

Analysts have tempered their growth expectations for Apple, and with a PEG ratio over 3, buying Apple at over 29 times its 2023 earnings is a tough call. The wiser choice for investors may be to wait for a more reasonable valuation.

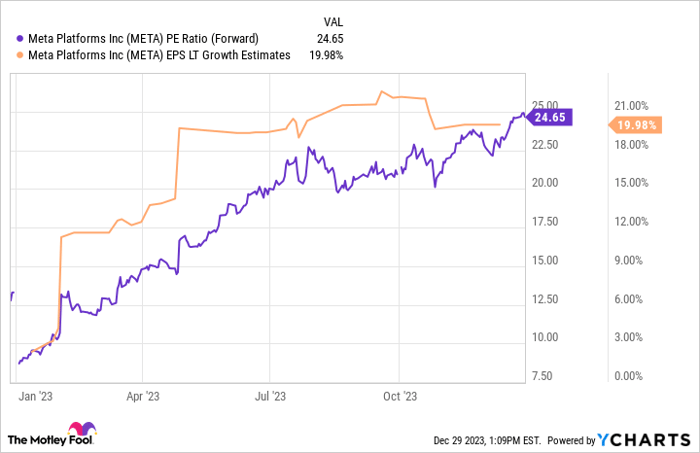

Meta Platforms: A Turnaround Story

After a challenging 2022, Meta Platforms, formerly Facebook, made a comeback under the leadership of CEO Mark Zuckerberg. Facing obstacles such as a slowing advertising business and costly metaverse projects, the company managed to regroup, cut costs, and rekindle revenue growth and profits.

META PE Ratio (Forward) data by YCharts

Despite the stock’s rally in 2023, Meta Platforms remains attractively valued at just 25 times 2023 earnings, with an expected annual growth rate of 20%. The market overlooked the business’s potential, leaving significant room for growth in 2024 and beyond.

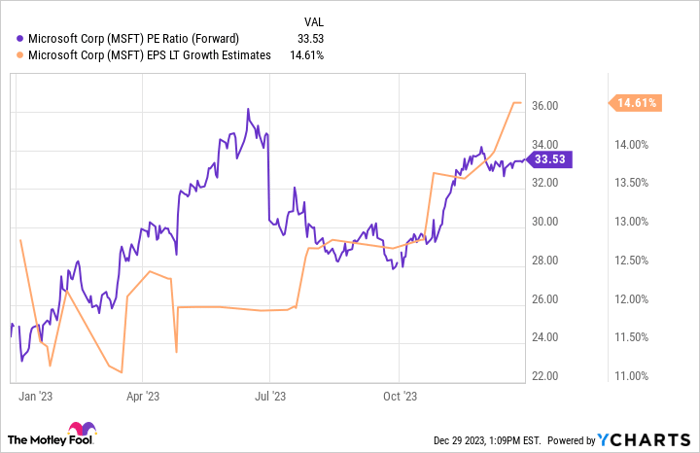

Microsoft: Struggling to Sustain Growth

Microsoft’s foray into the viral sensation ChatGPT and its multibillion-dollar investment in OpenAI indicate the company’s diversification across enterprise software, cloud computing, and gaming. Despite boosting analyst expectations for earnings growth, the stock’s steep valuation and its shift away from being a growth stock warrant caution.

MSFT PE Ratio (Forward) data by YCharts

While mid-teens growth is commendable, Microsoft’s colossal $2.8 trillion valuation challenges its status as a growth stock. Caution is warranted.

Highs and Lows in the Stock Market: A Detailed Analysis

Stock Evaluation: Amazon, Tesla, and Alphabet

As we navigate the bumpy terrain of the stock market, it’s crucial to scrutinize the surges and slumps of various companies, weighing the allure of solid investments against caution. In this balancing act, Amazon has emerged as a compelling buy, driven by its e-commerce and cloud leadership, especially when compared to Microsoft. The e-commerce giant’s profound re-investment strategy might understate its true profit potential, rendering it an intriguing prospect. On the flip side, Tesla has veered into concerning territory, with its stock soaring despite a disconnect from its fundamentals. A brave gambit to slash prices to amplify unit sales has battered Tesla’s operating results. Meanwhile, Alphabet’s unwavering dominance in the tech realm, underpinned by a steady flow of user data, places it firmly in the category of compelling buys, especially for long-term investors.

Amazon: Stock to Consider

It’s intriguing that Amazon trades at a similar PEG ratio to Microsoft — just over 2. But beyond the numbers, what sets Amazon apart is its penchant for plowing profits back into the business, potentially masking its actual profit potential. Although the stock is trading at 57 times its bottom-line earnings, it’s just 22 times its operating profits, hinting at a wealth of untapped potential. With grand developments such as artificial intelligence and the expansive e-commerce landscape, Amazon remains a promising prospect for discerning investors.

AMZN PE Ratio (Forward) data by YCharts

Tesla: A Stock to Approach with Caution

The recent strategy of price cuts by Tesla to invigorate unit sales has led to near-term repercussions, evident in a 22% decline in gross profit margin over the past year. The ensuing pessimism among analysts has resulted in a PEG ratio exceeding 4, marking a significant departure from its historical performance. The stock’s exuberant 130% surge last year lends weight to the argument for a prudent wait-and-watch approach, until clearer indicators corroborate Tesla’s price-cutting strategy.

TSLA PE Ratio (Forward) data by YCharts

Alphabet: A Stock with Value

Amidst Alphabet’s commanding presence facilitated by Google and YouTube, lies its latent potential in the realm of artificial intelligence, an area that often takes a backseat to its public-facing offerings. Augmenting this is the company’s robust financials, evident in its consistent share buybacks, underscoring its potential for rewarding investors. This balanced equation of growth and buybacks has analysts anticipating an annual earnings growth in excess of 17%. Despite the stock’s 57% uptick in 2023, it still holds solid promise for long-term investors, mirrored in a PEG ratio of 1.4.

GOOGL PE Ratio (Forward) data by YCharts

Informed Stock Investment

To navigate the riptides of the stock market requires informed decision-making and a keen eye for lurking opportunities. It’s not just about the numbers; it’s about sensing the soul of a company and its future prospects. As we decipher the stock market’s labyrinth, the stories of Amazon’s resilience, Tesla’s unpredictability, and Alphabet’s quiet strength serve as allegories for investors to decipher.

Should you invest $1,000 in Nvidia right now?

In a realm where stock investments demand a calculated approach, the intricate dance of evaluating stock worthiness is often riddled with complexities. It’s not merely about the here and now; it’s about the trajectory and resilience of stocks. As the stock market pulsates with ever-changing dynamics, precision and patience are the twin mandates for investors. Let us navigate these waters with tenacity and acumen, discerning the tales that numbers weave.