Just when investors thought shares of Apple (NASDAQ: AAPL) might have run out of steam, the company’s developer conference unveiled an array of upcoming products and features powered by artificial intelligence (AI), propelling the stock to new highs.

The Game-Changing Potential of AI for Apple

AI holds immense promise for Apple. Recent announcements showcased various AI features embedded within its software, promising to enhance the user experience on iOS devices. Of particular interest is the integration of ChatGPT into Siri and Apple’s proprietary AI tech, Apple Intelligence.

After years of limited functionality, the prospect of a revamped Siri is eagerly anticipated. This improvement could solidify Apple’s ecosystem, making it even more attractive to users.

Addressing Apple’s Growth Challenges with AI

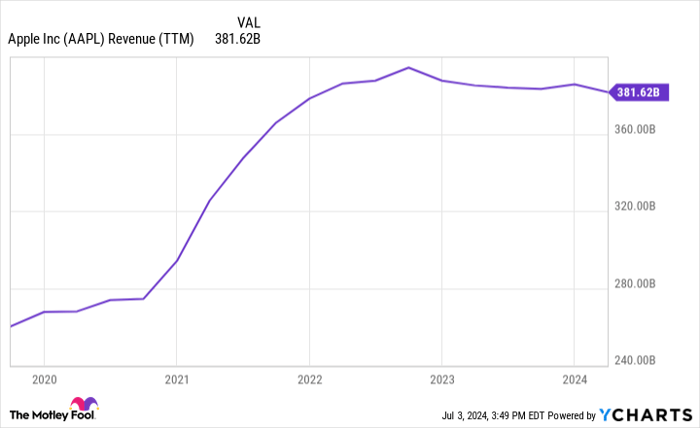

Apple’s revenue growth hinges on the successful integration of AI. The company has seen a plateau in revenue, driven by the maturity of its flagship product, the iPhone. With incremental updates failing to entice users into frequent upgrades, the challenge lies in leveraging AI to drive renewed interest in its devices.

The adoption of AI features has the potential to reinvigorate revenue growth, particularly with the launch of the iPhone 15 series. However, the success of this endeavor remains uncertain, as it depends on consumer enthusiasm for the new technology.

Evaluating Apple’s Investment Potential

Despite the optimism surrounding AI’s impact, Apple’s stock is trading at historically high valuations, with a forward P/E ratio exceeding 33. This premium valuation demands exceptional performance to justify further appreciation.

Analysts project modest earnings growth, raising concerns about whether the current price reflects future prospects adequately. The exuberance surrounding AI has possibly inflated Apple’s stock, leaving minimal room for significant upside.

Investing in Apple at this juncture requires careful consideration, as the company needs to surpass elevated expectations to sustain its valuation. While AI holds promise for Apple’s future, investors should exercise caution until the stock price aligns more closely with underlying fundamentals.

Final Thoughts on Apple’s Investment Potential

Before committing funds to Apple, investors should weigh the risks associated with the stock’s lofty valuation and the uncertainties surrounding AI implementation. While the technology offers exciting prospects, its transformative impact on Apple’s business remains unproven.

The current market conditions warrant a cautious approach, with the focus on long-term value creation and sustainable growth drivers within the tech giant’s portfolio.