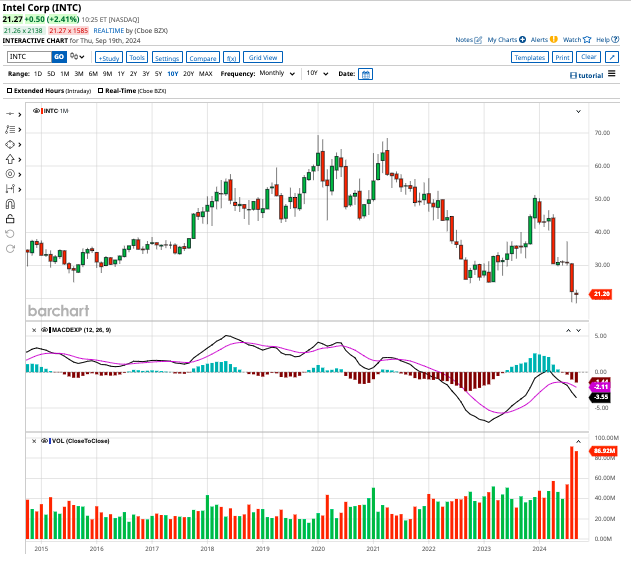

While the broader Dow Jones Industrial Average is reaching new heights, semiconductor giant Intel (INTC) is grappling with a significant downturn. The tech company’s stock has plummeted by 70% from its peak, marking a steep decline of nearly 58% in 2024.

With a market capitalization of $88.4 billion, it is now crucial to evaluate whether the underperforming Intel stock presents a viable investment opportunity following the announcement of its foundry spin-off plans.

A Bold Strategic Move by Intel

Intel experienced a notable surge in its stock price on Monday, September 16, triggered by the revelation of its decision to spin off its foundry business into an independent entity with its own board of directors. This strategic maneuver is expected to provide the spin-off business with the autonomy to seek external funding sources and operate with a streamlined corporate framework.

Similar to Taiwan Semiconductor (TSM), Intel’s foundry division will oversee the production of chips for other firms. In a bid to bolster this segment, the chip manufacturer has pledged a hefty $100 billion investment to enhance its manufacturing facilities across four U.S. states. Notably, Intel’s capital expenditures in this domain surged to $43.4 billion in 2024, rising from $36.7 billion in 2022.

In a candid assertion, Intel CEO Pat Gelsinger outlined projections that anticipate losses for the chip-manufacturing unit to hit a peak this year and achieve breakeven status by 2027. Furthermore, Gelsinger forecasted the business to culminate in 2030 with a gross margin of 40%, lagging behind Taiwan Semiconductor’s robust 53% margin.

Despite these ambitious plans, Intel’s conventional chip business continues to grapple with challenges. Rivaled by Nvidia (NVDA) in the wake of the AI boom, where Nvidia boasts dominance by capitalizing on a fabless model that powers AI workloads, Intel is compelled to restructure its operations. In response to dwindling demand, Intel has initiated a 15% reduction in its workforce as part of a cost-saving initiative amounting to $10 billion.

Exploring Future Trajectories for Intel Stock

Despite recent strategic strides, Intel faces the imperative task of demonstrating financial resilience in the upcoming quarters. Disappointingly, its Q2 2024 financials indicated a decline in sales to $12.83 billion, down by 1% compared to the previous year and falling short of estimates pegged at $12.94 billion. Furthermore, its adjusted earnings stood at $0.02 per share, significantly undershooting the consensus projection of $0.10 per share.

The company’s GAAP loss of $1.61 billion was primarily attributed to the strategic shift in chip production to cater to AI workloads. With the AI PC sector anticipated to witness substantial growth from under 10% in 2024 to over 50% in 2026, Intel projects shipments of AI-powered PC chips to reach 40 million units in the current year. Nevertheless, Intel’s data center and AI segment reported a decline in revenue to $3.05 billion, marking a 3% drop from the previous year.

Of the aggregate 36 analysts tracking Intel stock, the consensus stands at a “hold” rating, with two advocating a “strong buy,” one suggesting a “moderate buy,” 30 recommending a “hold,” one indicating a “moderate sell,” and two advising a “strong sell.”

The average target price for INTC stock currently stands at $29.26, reflecting a prospective upside of approximately 38.3% from its present valuation.

Access more Stock Market News from Barchart