The Business of ChargePoint

Before assessing ChargePoint’s financial trajectory, it’s crucial to understand the core of its operations. The majority of the company’s revenue is derived from the sale of chargers, supplemented by income from Networked Charging Systems, Cloud Services, and related warranties. Notably, the sale of networked charging systems contributed a substantial $73.9 million out of a total $110.3 million in revenue during the third quarter of 2023, while subscriptions accounted for just $30.6 million.

A Jolt in the Charging Industry

ChargePoint is currently grappling with a significant challenge stemming from the shift in U.S. charging infrastructure to the North American Charging Standard developed by Tesla (NASDAQ: TSLA). This transition not only positions Tesla’s superchargers as a formidable competition but also dilutes ChargePoint’s market standing, essentially transforming its offering into a commoditized asset.

Thus, with charging networks being confronted by the standardization of connectors and the provision of a commonplace product, the forthcoming subdued differentiation will likely curtail profit margins from charger sales as well as the potential revenue from subscription-based EV charging services.

The Profit Predicament

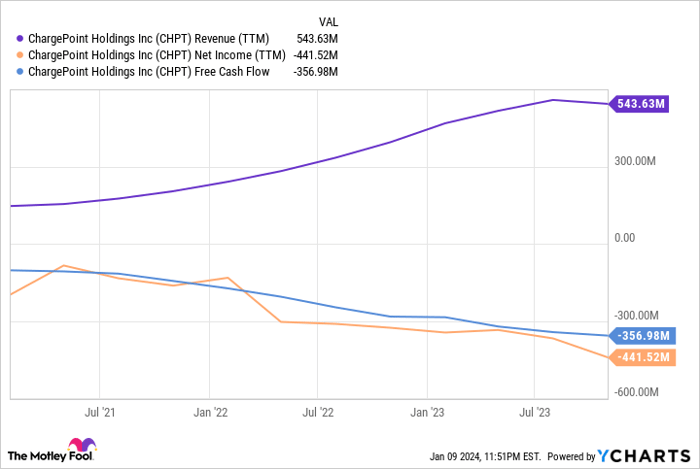

ChargePoint’s predicament is further compounded by its financial woes. The company has been unable to turn a profit from its primary business of selling chargers and related services within the existing network. Consequently, the question arises: how will the company navigate when faced with further commoditization in the market?

Investor Outlook

In a market where the demand for EV charging is anticipated to surge, the prospect for charging infrastructure appears promising. However, the current landscape does not imply that profitability is an inevitable outcome. Chargers inherently provide a standardized commodity, i.e., electricity, through an interchangeable interface, leaving little room for network exclusivity or substantial cost advantages. With ChargePoint sustaining ongoing losses, any discernible improvement in its financial outlook remains dubious.

Though the market for EV charging continues to expand, the lack of profitability in the industry warrants caution. It’s pivotal for investors to acknowledge that robust market growth doesn’t automatically signify favorable prospects for the individual companies operating within it, and this is precisely why ChargePoint is not a viable investment at present.

Final Verdict

Given the prevailing circumstances, it’s evident that ChargePoint’s future hangs in the balance. While the potential for widespread EV adoption paints a promising picture for the charging industry, the company’s current financial state, coupled with the challenges it confronts, portrays a bleak investment outlook. As such, prudent investors should exercise caution when considering ChargePoint as an addition to their portfolios.