Apple (NASDAQ: AAPL) made a remarkable product launch last week with the unveiling of the Apple Vision Pro, a virtual/augmented reality (VR/AR) headset, or “spatial computer” as described by Apple. This new product is powered by the same chip in the MacBook Air, enabling the Vision Pro to handle various computing tasks, from web browsing to video editing.

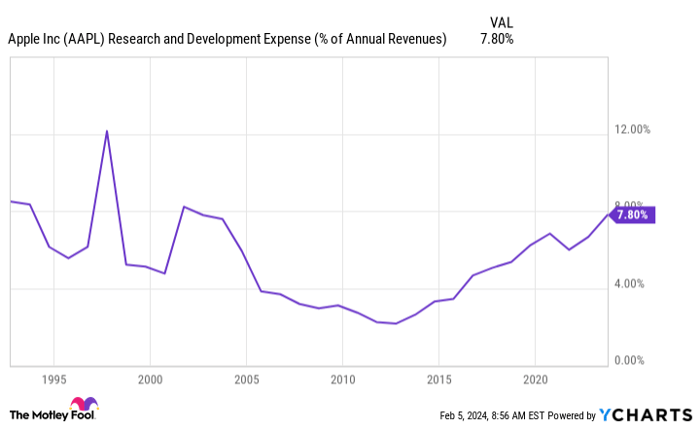

The latest data shows that Apple is currently allocating about 8% of its annual revenue to research and development, a figure not seen since the initial iPhone launch. This indicates that Apple is paving the way for potential breakthroughs in the coming decade.

Despite facing challenges over the past year, Apple’s substantial cash reserves and strong brand make a compelling case for its long-term success. Here’s why it might not be too late to consider investing in Apple stock.

Navigating Adverse Market Conditions

Apple has faced challenges in the past year, with macroeconomic headwinds leading to four consecutive quarters of revenue declines. However, the company managed to reverse this trend in its latest quarter, posting a 2% year-over-year increase in revenue to $120 billion in the first quarter of 2024, surpassing the Wall Street forecasts by over $1 billion.

Despite beating estimates, Apple’s stock has been down 3% year-to-date, reflecting investor concerns about its iPhone business. While smartphone sales increased by 6% in Q1 2024, they declined by 13% in China, Apple’s third-largest market, which accounts for about 17% of the company’s revenue. The increased restrictions in China pose a threat to Apple’s business in this region.

Despite the challenges in China, Apple has witnessed revenue growth in other markets. Sales in Europe, its second-largest market, grew by 10% year over year in Q1 2024, while sales in Japan soared by 15%. Additionally, Apple’s free cash flow climbed by 10% to about $107 billion in the last year, indicating that the company is capable of overcoming current headwinds and investing in high-growth areas of tech.

A Positive Outlook with a Need for Patience

Apple’s recent investment in research and development, just under $8 billion last quarter, underscores its commitment to future innovation. Although the specifics of Apple’s roadmap for the next decade are unclear, market trends and the release of its Vision Pro headset suggest a potential forays into artificial intelligence (AI), VR/AR, and digital services.

The AI market alone is projected to grow by 37% annually through 2030, surpassing $1 trillion. Similarly, the VR market is predicted to grow at a compound annual growth rate of 31% during the same period. With Apple’s brand loyalty and substantial cash reserves, the company is well-positioned to capitalize on growth in both industries.

Digital services are gradually becoming Apple’s best-performing business and could eventually overtake the iPhone. Services, including income from the App Store and subscription platforms like Apple TV+, Music, and iCloud, accounted for about 20% of the company’s revenue. Revenue from this segment saw an 11% year-over-year increase in Q1 2024, outperforming the iPhone’s growth of 6%.

While it may take time for Apple’s investments to yield results and reflect in its stock price, it could be an opportune moment for long-term investment. Apple’s stock offers more value compared to some of its competitors, indicating lower risk than other “Big Tech” stocks.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, and Microsoft. The Motley Fool has a disclosure policy.