Nvidia (NASDAQ: NVDA) stood as the perfect stock to ride the wave of artificial intelligence (AI) computing in 2023, with its revenue skyrocketing by an impressive 206% year over year in the fiscal third quarter. As a result, the GPU leader saw a remarkable surge of 238% in its stock value during 2023.

The exceptional growth experienced by a company of Nvidia’s magnitude is a rare occurrence. The colossal demand for AI chips certainly played a pivotal role in propelling Nvidia’s growth. However, as investors ponder the stock’s potential for the remainder of 2024, they are understandably concerned about the company’s anticipated slowdown in growth.

Factors That Could Impact Nvidia’s Performance in 2024

After a substantial ascent in the first half of the year, Nvidia shares have recently displayed a more modest climb, rising by a mere 16% since the end of June, pointing towards several foreseeable factors that could influence the stock’s trajectory in 2024.

One such factor is the uncertainty derived from the U.S. government’s imposition of chip export restrictions to China, with subsequent expansions to other countries, including Vietnam. These countries have historically contributed up to a quarter of Nvidia’s data center business revenue. Nonetheless, Nvidia’s management is confident that robust growth in other regions will outweigh this short-term setback.

Additionally, the limited supply of AI chips and the endeavors of competing tech companies to design their own processors pose another risk. Despite entities like Alphabet, Microsoft, and Intel introducing their own chips that boast a superior price-performance ratio compared to Nvidia’s pricier H100 and H200 GPUs, none have managed to surpass the horsepower provided by Nvidia’s data center chips, which have evolved into the standard for all major cloud service providers.

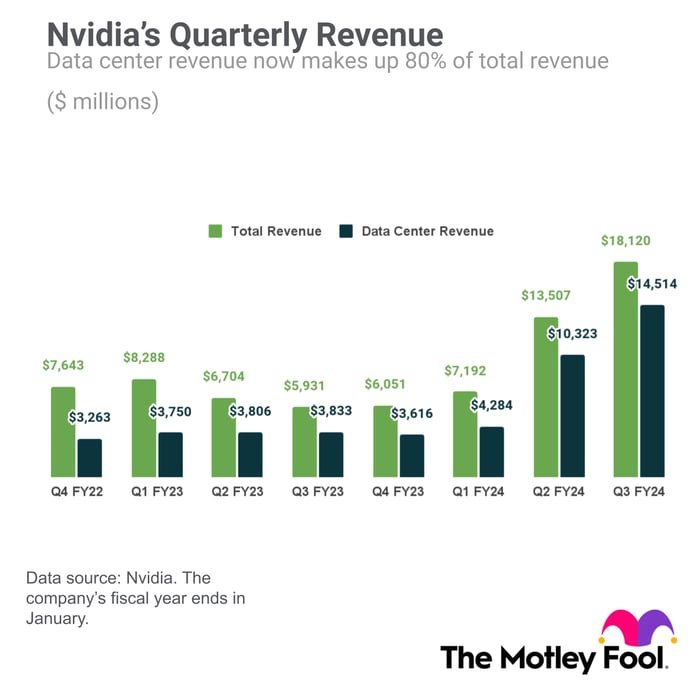

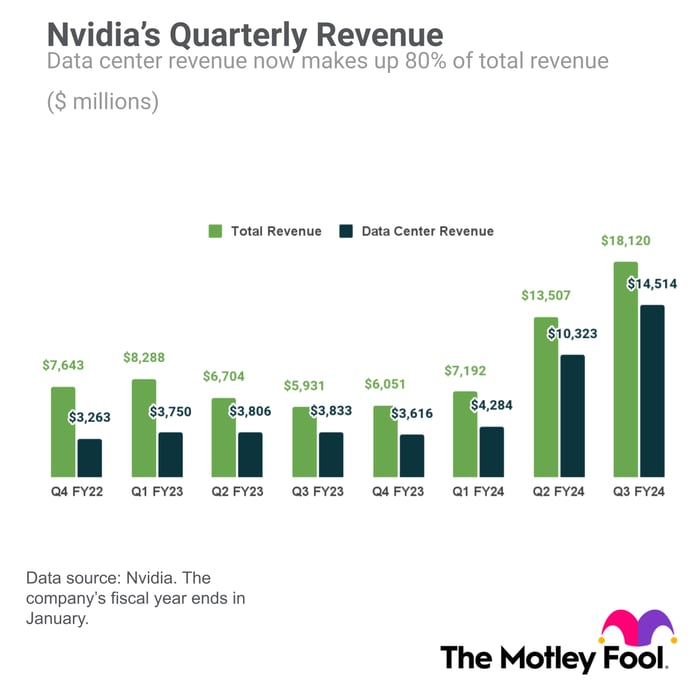

Furthermore, the recent introduction of new data center GPUs designed for AI workloads by Advanced Micro Devices (AMD) may present a near-term challenge. However, AMD’s projected revenue of $2 billion in 2024 for these GPUs pales in comparison to Nvidia’s data center revenue, which reached over $14 billion in the fiscal third quarter alone, equating to an annualized rate of $56 billion.

Nvidia anticipates total revenue of around $20 billion in fiscal Q4, a significant leap from $6 billion in the year-ago quarter. This substantial surge in revenue underscores a formidable boon to the company’s profits, a key consideration that could validate further stock gains in 2024.

Assessment of Growth and Valuation

While Nvidia’s guidance paints a picture of a diminished growth rate compared to the preceding quarter, the stock, in actuality, appears undervalued when one considers the company’s profit growth trajectory.

The advanced AI chips yield higher margins than other chip sales, leading to a profit surge for Nvidia, wherein earnings per share witnessed a staggering year-over-year leap of 1,274% in the last quarter.

At a mere 25 times the forward earnings estimates, the stock’s valuation appears quite attractive. This is especially notable for a company serving a rapidly expanding AI market, one of the most significant growth opportunities in recent decades, now an integral component of the products and services used by consumers every day. Like a blue chip in a gambling casino, Nvidia is a significant AI stock to consider including in an investment portfolio.

Should you invest $1,000 in Nvidia right now?

Before you invest in Nvidia stock, it’s essential to contemplate this:

The Motley Fool Stock Advisor analyst team recently highlighted what they believe are the 10 best stocks for investors to buy now, with Nvidia not making the list. The 10 stocks identified are poised to yield substantial returns in the future.

Stock Advisor furnishes investors with a straightforward formula for success, encompassing guidance on constructing a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, the Stock Advisor service has outperformed the S&P 500 returns more than threefold*

*Stock Advisor returns as of December 18, 2023

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Ballard has positions in Advanced Micro Devices and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.