Unprecedented Rise in the Chip Market

A historical ascent has defined Nvidia‘s journey in the last decade, with its share price skyrocketing by over 25,000% since 2014. The company’s strategic positioning in selling graphics processing units (GPUs) directly to consumers kickstarted the consumer chip industry, shaping it into the powerhouse it is today.

Notching an 18% year-over-year growth in the gaming segment during the first quarter of fiscal 2025 positions Nvidia’s direct-to-consumer business as a lucrative stronghold. Its dominance in desktop GPUs has not only established its brand supremacy but has also fueled its expansion into diverse sectors like artificial intelligence (AI), cloud computing, healthcare, government, robotics, and self-driving vehicles.

Potential for a Market Cap Above $3 Trillion

Having flirted with a market cap above $3 trillion recently, Nvidia’s valuation currently hovers around $2.7 trillion following a minor correction. However, its colossal growth potential hints at an imminent resurgence past the $3 trillion benchmark, and this time, it might just settle there permanently.

The surge in AI applications underscores the pivotal role of chips in shaping the future tech landscape, providing developers with the firepower to create groundbreaking software. Industries beyond AI are craving high-powered chips, setting the stage for Nvidia’s sustained growth momentum across various sectors.

Data sourced from JPMorgan Chase reveals a projected surge in capital expenditures by tech titans Microsoft, Amazon, Alphabet, and Meta Platforms, totaling $201 billion by May 2025 – a 44% jump from 2023. A substantial chunk of this investment will be channeled towards bolstering their presence in AI through the deployment of GPUs.

Nvidia, commanding roughly 90% of the GPU market share, stands poised to reap monumental gains from the escalating AI expenditure. The company’s revenue catapulted by 262% year over year in Q1 2025, with an additional 18% sequential increase driven by a whopping 427% surge in the data center segment, underscoring the crescendo in AI chip sales.

While AI frontiers like OpenAI’s ChatGPT have showcased the efficacy of language generation, revelations by Meta Chief Scientist Yann LeCun allude to the untapped potential in AI technology. Nvidia’s robust AI prowess places it at the vanguard of steering the market’s evolution, with heightened AI investments projected to bolster earnings and propel the market cap beyond $3 trillion.

Undervalued Stock with Tremendous Growth Potential

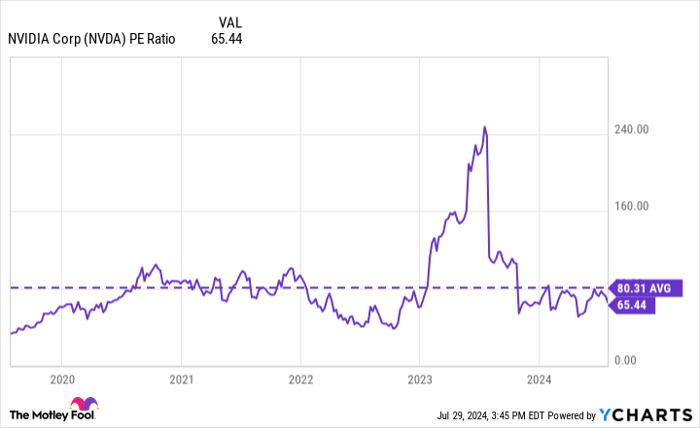

Despite trading at around 65 times its earnings, Nvidia’s valuation outperforms its chief rival Advanced Micro Devices, sporting a sky-high price-to-earnings (P/E) ratio of 206. Analyzing Nvidia’s P/E against its five-year average portrays its current valuation in a positive light, especially against the backdrop of a monumental 2,450% stock price surge over the said period. A lofty P/E doesn’t necessarily equate to stunted growth, signifying Nvidia’s potential as a valuable investment proposition.

Nvidia’s unrivaled positioning in AI and broader tech spheres, coupled with the surging demand for chips, cements its stock as an undeniable asset for long-term investors. The company is primed to capitalize on the escalating need for powerful hardware across a myriad of markets, ensuring sustained profitability in the years to come.

Riding the Nvidia Wave: A Lucrative Investment Opportunity

Evaluating the proposition of investing in Nvidia warrants thoughtful consideration amidst its astronomical growth trajectory. The company’s robust foothold in burgeoning tech domains and expanding chip demand make it a standout choice for investors seeking long-term wealth accumulation.

The Motley Fool Stock Advisor analyst team, renowned for identifying high-potential stocks, presents an array of top picks for investors. Although Nvidia didn’t make the exclusive list, the 10 highlighted stocks harbor the potential for monumental returns in the foreseeable future, a testament to the dynamic investment landscape beckoning investors.

Reflecting on Nvidia’s historical performance and future potential, investing in the company could reap substantial rewards down the road, constituent of a wealth-building strategy that transcends conventional market norms.

A lush garden of opportunity awaits, with Nvidia poised to lead the charge into a future brimming with tech marvels and lucrative investment prospects. As investors navigate the intricate labyrinth of market dynamics, Nvidia emerges as a beacon of innovation and growth, ready to usher them into a realm brimming with value and potential.