Software giant Oracle (NYSE: ORCL), renowned for its database and enterprise applications, has been a latecomer in the cloud infrastructure realm, trailing behind industry leaders such as Amazon Web Services, Microsoft Azure, and Alphabet’s Google Cloud.

Although Oracle’s current standing in the market is modest, the tides could turn due to the escalating demand for computing power dedicated to artificial intelligence operations. Oracle’s cloud infrastructure wing is experiencing a robust 49% year-over-year revenue surge, partially driven by the insatiable appetite for AI capabilities.

Oracle Leans into AI

While Oracle faces stiff competition in the cloud infrastructure sector, the scarcity of high-powered Nvidia GPUs and other AI accelerators presents a common challenge for both startups and corporations.

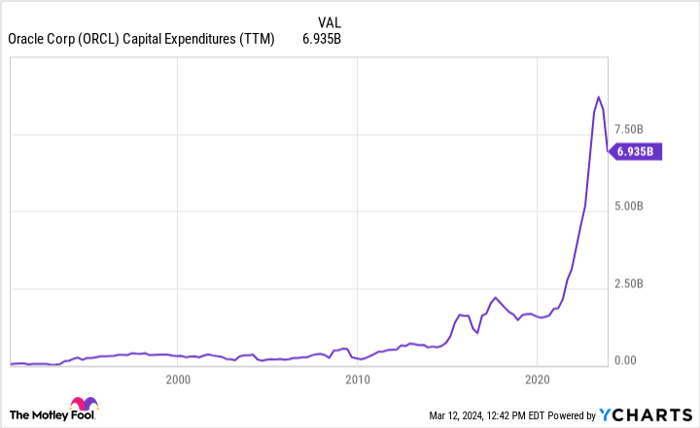

Oracle is heavily investing in expanding its cloud computing capacity, predominantly focused on bolstering its AI offerings. To meet the escalating demand, Oracle is earmarking up to $7.5 billion for capital expenditures in the current fiscal year, a substantial spike compared to its previous annual spending.

ORCL Capital Expenditures (TTM) data by YCharts

During an earnings call, Oracle’s CEO Safra Catz hinted at the company’s AI prowess by revealing, “We’ve got at least 40 new AI bookings that are over a billion that haven’t come online yet.” This underscores Oracle’s significant traction in the AI market.

Evaluating Oracle’s Stock Potential

While Oracle is capitalizing on the AI wave, its cloud infrastructure business remains a small fraction of its revenue. The company’s overall revenue climbed 7% year over year to $13.3 billion, with cloud infrastructure contributing less than 14% to the total.

While cloud application revenue surged by 14%, the segment covering both cloud licenses and on-premise licenses faced a 3% decline. Aside from cloud infrastructure and select cloud applications, Oracle’s traditional business segments are displaying lackluster performances.

As cloud infrastructure revenue grows relative to the total revenue, Oracle’s growth trajectory is poised to intensify. Nevertheless, the long-term profitability of cloud infrastructure compared to software license sales might present challenges if AI demand diminishes unexpectedly or if the industry’s capacity surpasses demand levels.

With a market cap of around $350 billion, Oracle’s stock trades at about 25 times the average analyst estimate for full-year adjusted earnings. Projections indicate a slight decline in adjusted EPS for fiscal 2024, with modest growth anticipated in fiscal 2025.

While Oracle’s stock may not be a steal at current valuations, the company’s success in securing business for its AI infrastructure bodes well for potential future returns. Sustaining its rapid growth in the cloud sector could position Oracle for promising outcomes in the years ahead.

Before diving into Oracle stock, investors should consider that the Motley Fool Stock Advisor analysts have highlighted what they believe are the 10 best stocks for investment opportunities, with Oracle missing the cut. The recommended stocks hold the potential for substantial returns in the forthcoming years.

Stock Advisor offers investors guidance on portfolio construction, regular analyst updates, and two new stock picks monthly. Since 2002, the service has surpassed the S&P 500 returns threefold*.