The Current Stock Performance

Alibaba (BABA) has captured the spotlight on Zacks.com with its recent surge in search volume. The past month has seen a 4.6% gain in Alibaba’s shares, outshining the Zacks S&P 500 composite’s 3.8% change. The Internet – Commerce industry, where Alibaba resides, has marked a 5.3% increase. The pivotal question now remains: What lies ahead for the stock?

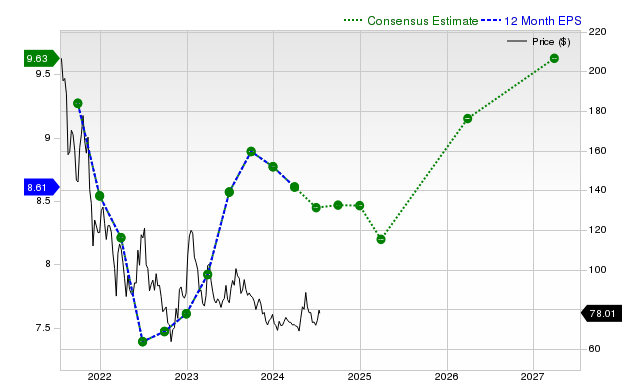

Diving into Earnings

Shunning the traditional hullabaloo, Zacks focuses on analyzing a company’s earnings forecast. The rationale behind this lies in the belief that a stock’s true worth hinges on the projection of its future earnings stream. A noteworthy surge in earnings estimates typically leads to an uptick in a stock’s intrinsic value, aligning market price with fair value. It’s no secret the upsurge in earnings estimates closely mirrors short-term stock price movements.

Insight into Revenue Growth

While earnings may take center stage, revenue growth remains the bedrock of a company’s financial vitality. A business cannot sustain earnings growth without a simultaneous uptick in revenues. Thus, gauging a company’s revenue potential is a crucial aspect. Alibaba’s sales forecasts include an 8.2% surge for the current quarter and +6.2% and +7.4% for the current and upcoming fiscal years, respectively.

Peering into Valuation

In the investment realm, valuation is king. Aligning a stock’s current market price with its intrinsic business worth and growth prospects is quintessential. Comparing a company’s valuation multiples with its historical data and peers provides a barometer for its stock price. The Zacks Value Style Score, grading stocks from A to F, offers a judicious perspective on a stock’s valuation. Alibaba’s A rating signifies it’s trading at a discount compared to its peers.

Final Analysis

Alibaba’s surge in interest beckons caution amidst the market buzz. While the stock’s potential merits further exploration, a Zacks Rank #4 (Sell) signals a nuanced outlook, suggesting possible underperformance compared to the broader market.