Jim Cramer recently reiterated his positive outlook on Shopify Inc. SHOP, coinciding with a significant technical milestone. The company has experienced what is known as a Golden Cross, a key indicator signaling bullish momentum for the e-commerce behemoth.

For the uninitiated, a Golden Cross materializes when a stock’s short-term moving average surpasses its long-term moving average—a traditional harbinger of an impending upsurge.

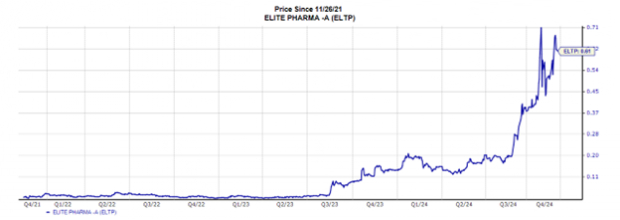

Chart created using Benzinga Pro

During a recent segment on CNBC’s Mad Money, Cramer expressed his bullish sentiment, emphasizing, “I think Shopify is at a great level to buy. Harvey Finkelstein is doing a terrific job, and the stock should be perfect,” he stated.

Shopify’s robust performance is evident, with a remarkable 20.56% surge in the last month, an 11.26% increase year-to-date, and a staggering 53.50% growth over the past year.

Ebullient Reactions to Shopify’s Golden Cross

The trading community and analysts are abuzz with excitement over Shopify’s current stock trajectory.

Chart created using Benzinga Pro

With Shopify’s stock price at $80.86, comfortably above its 50-day simple moving average of $72.34 and its 200-day moving average of $71.82, along with bullish signals from its eight-day and 20-day averages, the momentum appears firmly in Shopify’s favor.

Even the Wall Street elite are singing praises for Shopify. Goldman Sachs recently elevated Shopify to a Buy rating, while JPMorgan and BofA have also thrown their support behind the stock, citing its wide product range, user-friendliness, and expansive scale as pivotal advantages.

Shopify’s Q2 Triumph

To grasp why analysts and investors are exuberant, one needs to look no further than Shopify’s remarkable Q2 results. Free cash flow catapulted by 240% to $333 million, with revenue surging by 21% year-over-year. Despite a slight deceleration in GMV growth, Shopify still amassed a significant $67.2 billion in gross merchandise volume.

With third-quarter revenue anticipated to escalate within the low-to-mid 20% bracket, Shopify’s designation as a “best of breed” stock makes sense. While the forward P/E ratio hovers around 60, the anticipated 43% EPS growth validates the lofty valuation.

Cramer + Golden Cross = A Winning Formula For Shopify Stock

Coupling Cramer’s optimistic endorsement with Shopify’s Golden Cross and strong fundamental underpinnings may culminate in a significant success story.

The confluence of the stock’s technical setup and the resounding vote of confidence from Wall Street elevates Shopify as a standout contender heading into 2025.

For investors seeking the next significant leap, the grounds look promising here. Shopify isn’t just crossing averages—it’s blazing a trail into uncharted territory.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs