Q4 Insights and Q1 Projections

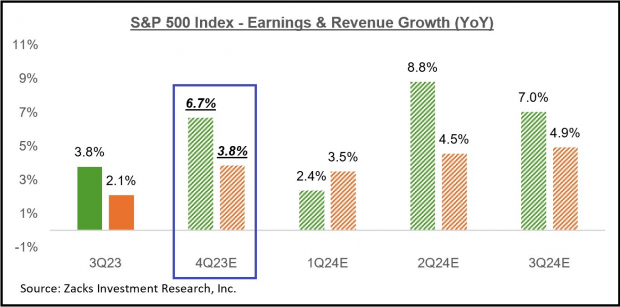

The Tech sector, akin to a steady hand leading a grand symphony, continues its momentum driving growth with projected earnings in Q1 2024 showing a promising increase of +2.4% from the same period last year. This echoes the positive trajectory seen in the previous quarter of 2023 with a commendable +6.7% uptick in earnings and +3.8% rise in revenues.

While the formal close of the 2023 Q4 earnings season awaits the results of 7 S&P 500 companies, the data from the 493 members that have reported so far paints a hopeful picture. Earnings surged by +6.9% compared to the previous year, with revenues also showing a healthy +3.8% uptick. Noteworthy is the percentage of companies surpassing EPS and revenue estimates, standing at 75.3% and 64.1% respectively.

With a focus on the ‘Magnificent 7’ stocks—Apple, Amazon, Alphabet, Microsoft, Meta, Nvidia & Tesla—projections for 2024 Q1 anticipate a remarkable increase of +33.2% in earnings and +13.4% in revenues. Excluding this elite group’s contribution, the remainder of the index may demonstrate a slight downturn of -3.3% in earnings, contrasting with the promising +2.4% growth overall.

Analysis and Optimism

As we gear up for the upcoming quarterly reports, a sense of steady progress permeates the atmosphere. The Q4 earnings season offered no major surprises, but revealed a modest acceleration in earnings and revenue growth rates. Management guidance remained positive, setting a reassuring tone for the impending results.

A poignant narrative unfolds as the Tech sector reclaims its stature as a growth driver, after grappling with challenges post-COVID. A resurgence in 2023 Q3 marked the end of a six-quarter slump, with the sector now a key contributor to overall earnings growth.

Noteworthy in this growth journey are the ‘Magnificent 7’ stocks, with stalwarts like Apple and Amazon leading the charge. These stocks continue to be pivotal players in driving growth, showcasing the resilience and innovation that propels the market forward.

Visualizing the Progress

Visual representations in the form of charts provide a snapshot of the S&P 500 index’s earnings and revenue trajectory. These illustrations capture the collective growth patterns, highlighting the significant contributions of key players like the ‘Magnificent 7’ and the Tech sector.

Looking at the larger picture on an annual basis, the overall earnings landscape for the S&P 500 index showcases a story of resilience and adaptability. Projections point towards a positive trajectory, underpinned by anticipated net margin expansion and favorable revenue growth expectations.

Future Outlook and Contemplation

A nuanced view of the market suggests a moderation in the U.S. economy’s growth trajectory, influenced by the Federal Reserve’s tightening policies. However, with a modest +4.9% revenue growth forecast, aligned with the previous year’s robust nominal GDP growth, the expectations remain pragmatic and in sync with prevailing economic conditions.

Emphasizing the crucial role of margin expansion, forecasts predict a rise in net margins to +12.4% from the previous year’s 11.7%, indicating a return to pre-inflation levels. This projection underscores a balanced and realistic outlook, acknowledging the evolving economic landscape.