The current quarter’s earnings reports are in full swing, with the upcoming week’s schedule filled with prominent names. The performance thus far has been positive, with the financial results from major banks failing to unsettle investors.

Looking ahead to the forthcoming week, a lineup of significant companies from the Mag 7 group, such as Meta Platforms (META), Amazon (AMZN), and Apple (AAPL), will be revealing their earnings. These three stocks have displayed remarkable success in 2024, leaving many pondering whether their growth trajectory will persist.

Let’s delve into a detailed examination of their standing as they approach their earnings announcements.

Apple’s Focus on China Sales Performance

Apple’s stock faced scrutiny due to a slow start in 2024 but has since gained momentum, boasting a 14% year-to-date increase. Concerns about performance in China and lagging in AI innovation previously weighed on the stock, although these worries have somewhat subsided.

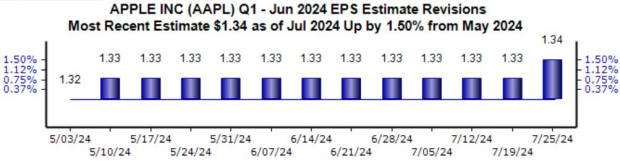

The stock holds a Zacks Rank #2 (Buy), with earnings projections for the upcoming period steadily rising over the past months. Expected earnings of $1.34 indicate a 6% rise from the previous year, while sales are anticipated to grow by 2.7% year-over-year.

The company encountered challenges in China during the recent period, yet managed to align sales closer to expectations compared to previous periods. Despite setbacks, recent positive announcements on iPhone shipments in China have alleviated concerns. Investors will be closely watching the company’s Services segment, which has proven to be a robust growth driver, aiding in reducing reliance on iPhone sales.

Amazon’s AWS Performance Spotlighted

Amazon excelled in its recent period, with operating income surging 220% year-over-year to $15.3 billion. Particularly noteworthy was the remarkable performance of Amazon Web Services (AWS), with net sales of $25 billion reflecting a 17% yearly increase and breaking a streak of disappointing figures in that domain.

Fears of a slowdown in cloud services loomed for a while; however, the recent results point towards a positive trend in the upcoming release.

Meta Platforms – Focus on Capital Expenditure

Improved operational efficiencies at META have significantly enhanced its profitability, resulting in substantial EPS growth over recent quarters.

Investors will be eager for insights on Capital Expenditure trends related to AI, a focal point also highlighted during Alphabet’s earnings release. Earnings forecasts for the period have shown an upward trend in recent months, with an expected EPS of $4.69 indicating a 45% year-over-year growth.

When it comes to crucial metrics, the Zacks Consensus Estimate is pegged at $37.5 billion for Advertising revenue, marking a 20% surge from the previous year. Of significant note is Alphabet’s strong Advertising business performance, with sales growing by 12% year-over-year.

Summing Up

The second quarter of 2024 earnings season marches on with a robust lineup of companies set to report their financial results this week. An overall positive outlook is anticipated, driven by another impressive showing from the Tech sector.

Several key members of the Mag 7 are lined up for this week, including Meta Platforms (META), Amazon (AMZN), and Apple (AAPL). Given their stellar performance in 2024, the scrutiny on their results is bound to be intense, marking a pivotal moment in the Q2 earnings cycle.