-

This week, the Dow Jones is facing minor losses, with the S&P 500 eyeing modest gains while Nasdaq builds momentum.

-

Among the standout performers are Constellation Energy Corp and Palo Alto Networks.

- Let’s dissect the reasons behind these stocks’ success this week and assess their future outlook.

The market is painting a picture of slight losses for Dow Jones, modest gains for the S&P 500, and a bullish outlook for Nasdaq.

The noteworthy market movers driving these indexes are:

- Constellation Energy (NASDAQ:) +25.72%

- Palo Alto Networks (NASDAQ:) +10.09%

- Saipem SpA ADR (OTC:) +22.94%

Driving Forces Behind Market Resilience

Constellation Energy’s surge can be linked to a significant institution owning 84% of the stake, influencing key strategic decisions ahead.

Despite falling short on earnings per share with a -$0.11 result for Q4, Constellation Energy’s $5.8 billion revenue surpassed estimates.

Palo Alto Networks soared after news broke of Nancy Pelosi’s notable investment in the cybersecurity firm.

Reported in a Congressional financial disclosure, Pelosi’s holdings range between $500,000 and $1 million, with additional call options valued at $100,000 to $250,000.

Moreover, Saipem’s standout full-year 2023 net profit of 179 million euros marks a remarkable turnaround from its 2022 loss of 209 million euros.

Constellation Energy: Insights from InvestingPro

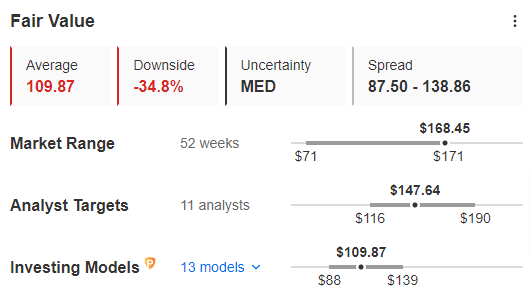

InvestingPro’s Fair Value, amalgamating 13 models, pegs Constellation Energy at $109.87, signaling a -34.8% disparity from the current price.

While the target price sits bearishly at $147.64, analysts and Fair Value foresee downside risks in agreement.

The stock, despite its robust financial standing with a 3 out of 5 score, displays signs of overvaluation compared to industry standards.

Palo Alto Networks: Analyzing with InvestingPro

InvestingPro’s Fair Value, synchronized from 12 models, marks Palo Alto Networks at $285, reflecting an -8.2% stance against the current price.

With a bullish target price of $335.92, the stock’s alignment with industry competitors hints at overvaluation.

Palo Alto Networks’ standout financial health with a rating of 4 out of 5 underscores its overrated status against industry metrics.

Saipem: A Glimpse through InvestingPro’s Lens

InvestingPro’s Fair Value, amalgamating 9 models, values Saipem at $0.34, indicating a +16.6% value uplift from the present price.

While potential for an upsurge is noted, Saipem’s risk profile stands moderately sound at 2 out of 5 in financial health.

Unlike its counterparts, Saipem reveals potential undervaluation when scrutinized against industry peers.

Conclusion: Reflections on Market Performances

Constellation Energy Corp and Palo Alto Networks exhibit robust financial foundations despite looming downside risks indicated by Fair Value.

Meanwhile, Saipem showcases strengths in analyst forecasts and average Fair Value, albeit with a need for enhancement in financial health.

The market’s continued fluctuation emphasizes the importance of strategic investment decisions.