Nvidia (NASDAQ: NVDA) soared into the $1 trillion club in May 2023, fueled by the burgeoning demand for artificial intelligence. Since then, the chipmaker has skyrocketed in value, solidifying its position as the second most valuable company globally, trailing only Apple.

Among the elite members of the $1 trillion club are Nvidia’s major clients, the “hyperscalers” constructing massive data centers for powering and training generative AI models. However, the latest entrant into this exclusive club plays a crucial role in Nvidia’s supply chain. This semiconductor company is deeply interconnected with nearly every tech giant in the $1 trillion club, and now, it stands proudly as a member itself.

Stepping into the limelight is Taiwan Semiconductor Manufacturing Company (NYSE: TSM), the newest player in the AI chip sector among the trillion-dollar giants. This milestone may just mark the beginning of an upward trajectory for this stock, propelling it even further into the realm of mega-cap companies.

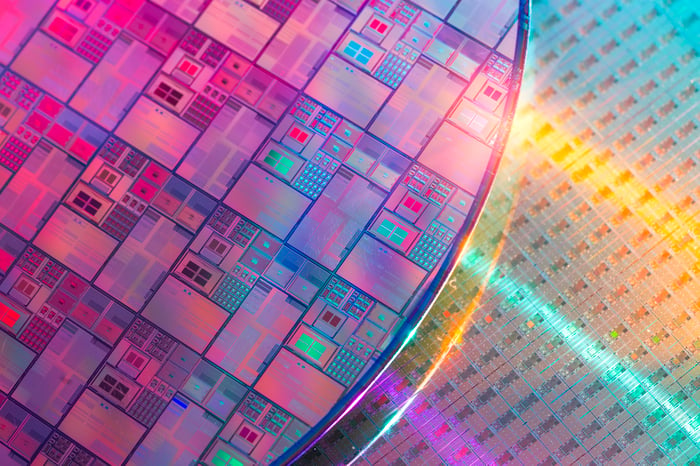

![]()

Image source: Getty Images.

The Unrivaled Champion

Taiwan Semiconductor, known as TSMC, stands as a leading chip manufacturer, renowned as a foundry or fab. With over 60% of the industry’s spending gravitating towards TSMC, it’s evident why many chip designers choose this powerhouse. TSMC’s technological prowess outshines that of its competitors by a significant margin.

Nvidia CEO Jensen Huang expressed at an investor conference that they choose TSMC because it is unparalleled in the world of chip manufacturing, not by a small margin, but by an extraordinary distance.

This superiority is mirrored in TSMC’s recent financial performance for the third quarter. The company reported a remarkable 39% year-over-year revenue growth. Its gross margin expanded from 54.3% to 57.8% over the previous year, leading to a 54.2% surge in net income. This impressive growth is fueled by TSMC’s technological edge, making it the go-to partner for manufacturing cutting-edge chips for AI applications like Nvidia’s GPUs or smartphones like Apple’s iPhone.

“Our third-quarter performance was bolstered by robust demand for our industry-leading 3nm and 5nm technologies in the smartphone and AI sectors,” stated CFO Wendell Huang in the earnings report.

Diving Deeper into AI

Management anticipates a more than threefold increase in revenue from AI chips by 2024. However, this segment is projected to constitute only a mid-teen percentage of TSMC’s total revenue for the year. The future looks promising for TSMC in the realm of AI, prompting strategic investments to capitalize on emerging opportunities.

While Nvidia relies on TSMC for chip fabrication, numerous other AI chip manufacturers are leveraging TSMC’s cutting-edge technology. Giants like Microsoft, Alphabet, Meta, Broadcom, and Advanced Micro Devices have contracts in place with TSMC to develop AI accelerator chips. Apple has partnered with TSMC for years to produce chips for its devices, including the iPhone, iPad, and more recently, the Mac.

In essence, irrespective of how the landscape of AI data centers, large language model training, and AI inference unfolds, TSMC is positioned to emerge as a dominant victor.

Management has revised its estimates for capital expenditure in 2024 to surpass $30 billion, with even more substantial investments planned for 2025. Additionally, the company is ramping up research and development efforts, reflecting an 11.4% increase year-over-year in the last quarter.

These strategic moves serve as linchpins for TSMC’s sustained prosperity. As the unrivaled leader in the foundry sector, TSMC holds a distinct advantage, enabling it to outspend competitors on equipment and technology advancements. This fortifies its technological dominance, fostering enduring partnerships with global industry giants. This virtuous cycle bolsters TSMC’s impregnable competitive edge that proves challenging to rival.

Beyond $1 Trillion

Although TSMC’s stock surged over 100% in 2024, there remains ample room for further growth.

At the current share price, TSMC trades slightly above 25 times analysts’ 2025 earnings estimates, an assessment that precludes the most recent financial outcomes and management guidance. Over the upcoming five years, TSMC could sustain a bottom-line growth rate in the vicinity of 20%. The persistent vigor in AI spending, coupled with TSMC’s ability to uphold robust gross margins by maximizing its technology, lends credence to the justification of its current valuation.

The allure of TSMC lies in its safeguard against future industry transformations. Irrespective of the designer dictating the chip requirements for data centers and smartphones, TSMC is primed to capture the lion’s share of that market, thanks to its impregnable virtuous cycle. Backed by the exceptional stewardship of management during the AI boom, the future appears luminous for the newest entrant into the $1 trillion club.

Is Taiwan Semiconductor Manufacturing a $1,000 Investment Opportunity?

Before deciding to invest in Taiwan Semiconductor Manufacturing, weigh the following factors:

The Motley Fool Stock Advisor analyst team recently pinpointed what they perceive to be the

The Unheard Narratives of Wall Street Giants

10 best stock picks for investors to buy now… and Taiwan Semiconductor Manufacturing missed the boat. The chosen 10 stocks have the potential to yield colossal returns in the approaching years.

The Power of Timing and Insight

Nvidia was once on this prestigious list back on April 15, 2005. If you had decided to invest $1,000 upon our suggestion, a mind-boggling $845,679 would now sit pretty in your account!

Stock Advisor grants investors a straightforward roadmap to triumph, featuring pointers on portfolio construction, routine insights from analysts, and a duo of fresh stock recommendations every month. The Stock Advisor facility has quadrupled the gains of the S&P 500 since 2002.

Unlocking Opportunities

*Stock Advisor results accurate as of October 14, 2024