The Impressive Quarter of Meta Platforms

Meta Platforms delivered an outstanding quarterly performance, resulting in one of the largest single-day market cap gains in its history. The stock surged by over 20%, marking an unprecedented $204.5 billion increase in market value. With a fresh dividend, AI tailwinds, and the potential of its Reality Labs business, Meta has garnered significant attention from Wall Street analysts. Many believe that the stock has room for further growth as it enters its dividend-paying era. Despite maturing as a company, Meta remains a standout member of the Magnificent Seven, with a forward price-to-earnings ratio of 23.7, making it an attractive investment compared to its peers.

Price Target for META Stock

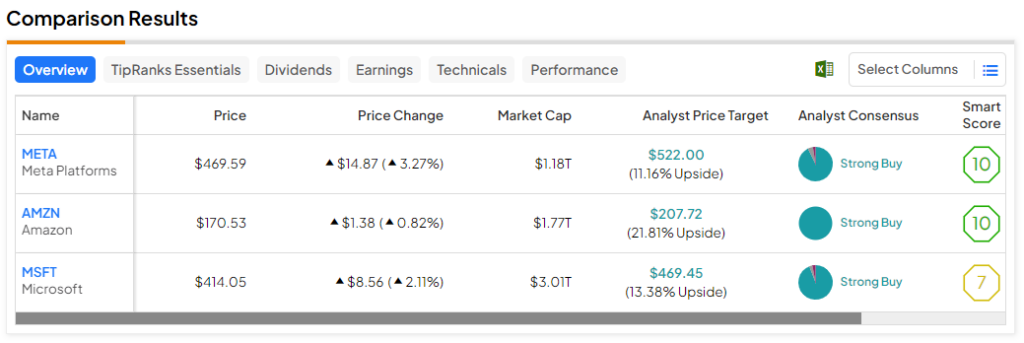

Analysts have labeled Meta stock as a Strong Buy, with an average price target of $522.00, indicating an 11.2% upside potential.

The Surge in Amazon’s Performance

Amazon also experienced a remarkable surge in its stock price following stellar quarterly earnings. The company’s numbers surpassed expectations and propelled its shares by over 7% in a single trading session. With the introduction of new AI tools and a successful holiday season, analysts remain bullish on Amazon’s future prospects in the market. Furthermore, Amazon’s push into the advertising space, including the launch of new privacy tools and the incorporation of ads within its Prime Video service, positions the company for continued growth.

Price Target for AMZN Stock

Analysts unanimously rate Amazon stock as a Strong Buy, with an average price target of $207.72, implying a 21.8% upside potential.

The Strength of Microsoft’s Earnings

Microsoft stood out with its robust earnings report, showcasing its prowess in the AI sector. Despite reaching new highs in share price and a trailing price-to-earnings multiple exceeding 35 times, Microsoft continues to be a favorite among analysts. The company’s strategic moves, such as promoting its AI software CoPilot and expanding its Xbox gaming ecosystem, have further bolstered investor confidence. By extending its gaming titles to rival platforms, Microsoft is enhancing its market potential and fostering growth in software, much to the market’s approval.

Price Target for MSFT Stock

Microsoft stock is deemed a Strong Buy by analysts, with an average price target of $469.45, signaling a 13.4% upside potential.

The Takeaway

These Magnificent Seven stocks are poised for further growth if they continue to deliver exceptional earnings. The integration of AI capabilities serves as a driving force for their future success. Among the three, analysts project the highest potential upside, at 21.8%, for AMZN stock.