The tech industry is caught in a tempestuous storm of Q2 earnings, with giants like Microsoft, Apple, Amazon, and Meta Platforms set to unveil their quarterly reports. However, the winds of fortune have not favored this sector, as Tesla, Netflix, and Alphabet witnessed a downturn post their Q2 releases.

Alphabet’s descent, despite exceeding earnings expectations, hints at a broader market sentiment soured by lofty valuations. Amid this turbulent climate, Meta Platforms finds itself in a correction zone, having plummeted 13% from its peak. A marked departure from its companions, Meta’s Q1 earnings triggered a $132 billion market cap loss in a single day.

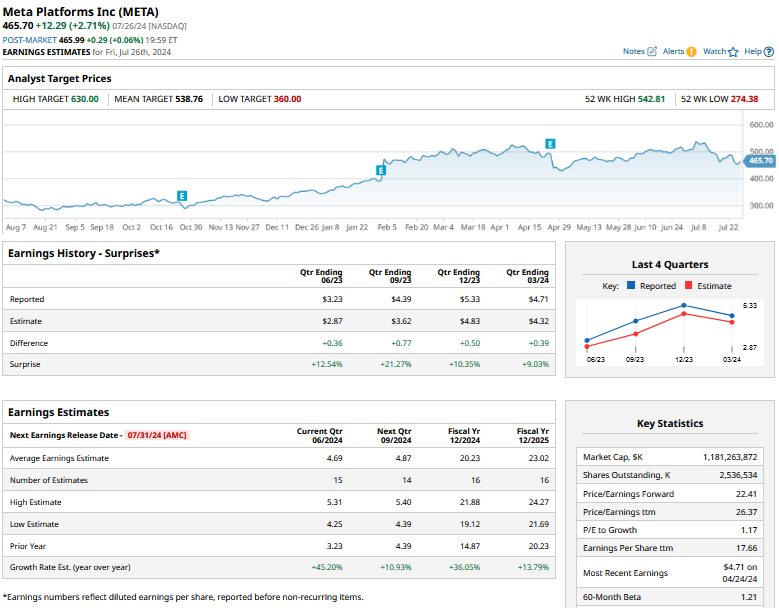

With all eyes fixed on Meta’s Q2 earnings, analysts anticipate a revenue surge of 19.6%, projecting a value of $38.3 billion. Although falling short of the initial $37.75 billion midpoint forecast, Meta’s trajectory indicates a robust bottom line expansion, with a predicted 45% year-over-year rise in earnings per share (EPS).

Key Metrics for Meta’s Q2 Earnings

As the market eagerly awaits Meta’s earnings unveiling, pivotal signals beckon our attention:

- Q3 Guidance: Following a tepid forecast last quarter that spooked investors, Meta’s Q3 guidance remains a critical pivot. At stake are predictions of a 14.7% revenue upsurge for Q3, with a tapering growth projection of 12.6% in the year’s final quarter.

- Chinese Advertisers: Meta’s revenue trajectory faces a crucial juncture shaped by Chinese advertisers’ spending habits. Against the backdrop of escalating trade tensions, Mark Zuckerberg’s narrative on ad spend dynamics assumes heightened significance.

- AI Innovation: Meta’s recent foray into open-source AI models underscores a strategic paradigm shift. With the release of Llama 3.1 405B, Meta’s monetization strategy comes under scrutiny, promising a nuanced discourse during the earnings call.

Meta Stock Prognosis: Analysts Chart Bullish Trajectory Pre-Q2 Earnings

Market analysts echo a harmonious chorus, designating Meta with a “Strong Buy” rating. The reaffirmed mean target price of $538.76 marks a 15.7% incline, hinting at an optimistic rhapsody ahead of the earnings disclosure. Noteworthy is the soaring Street-high target price of $630, signaling a remarkable 35.3% elevation from preceding levels.

Underpinning this upbeat sentiment, maestros of the financial realm advocate for a strategic embrace of the Meta dip. Oppenheimer and Bernstein’s fervor, coupled with Morgan Stanley’s counsel to ‘buy the dip,’ further embolden investors amidst an era of unpredictability.

Deciphering the Meta Conundrum: To Buy or Not to Buy?

Yet, as the Meta saga unfolds, shadows of uncertainty linger on the horizon. The specter of a resurgent Donald Trump, shadowed by VP hopeful JD Vance, casts an ominous cloud over tech behemoths. Meta’s Chinese revenue stream stands imperiled, with a potential crackdown under a Trump administration looming large.

Amidst this turbulence, Meta’s dalliance with AI innovation emerges as a beacon of hope. Leveraging AI to propel revenue growth and its strategic investments in the metaverse augur well for long-term trajectory, albeit against a backdrop of substantial quarterly losses.

From a valuation perspective, Meta’s P/E ratio of 22.3x hints at a moderate stance, neither exorbitant nor irresistible. While prudence advocates for a measured plunge into Meta shares, cautionary winds whisper of impending headwinds in the company’s 2024 journey.