Last week, Alphabet (GOOG), Meta Platforms (META), Apple (AAPL), and Amazon (AMZN) all released their quarterly results to wrap up the earnings season for FAANG companies. It was a mixed earnings season for the group; while Alphabet and Apple closed lower, the other three Big Tech names rose after their respective earnings releases.

There were a few particularly notable performances in the quarter, and Netflix yet again shattered estimates, adding a record number of subscribers. Meta also set a new record, after the stock’s post-earnings rally fueled a $196 billion rise in its market cap – a record for any U.S. company.

Alphabet shares, meanwhile, plunged 7.5% after the company released its Q4 earnings, and its price action was the worst among its FAANG peers. Previously, the stock’s price action after its Q3 earnings release was also the worst among the widely followed group, as it fell by almost double digits to mark its worst day since Mar. 16, 2020 – which, investors will recall, was around the same time broader markets crashed amid the initial COVID-19 scare.

Here’s a comparative analysis of FAANG companies’ performance in the December quarter, and why Meta Platforms and Alphabet – the two stalwarts of digital advertising – experienced such divergent price action after their earnings reports.

FAANG Earnings Begin with a Bang: Netflix Shatters Estimates

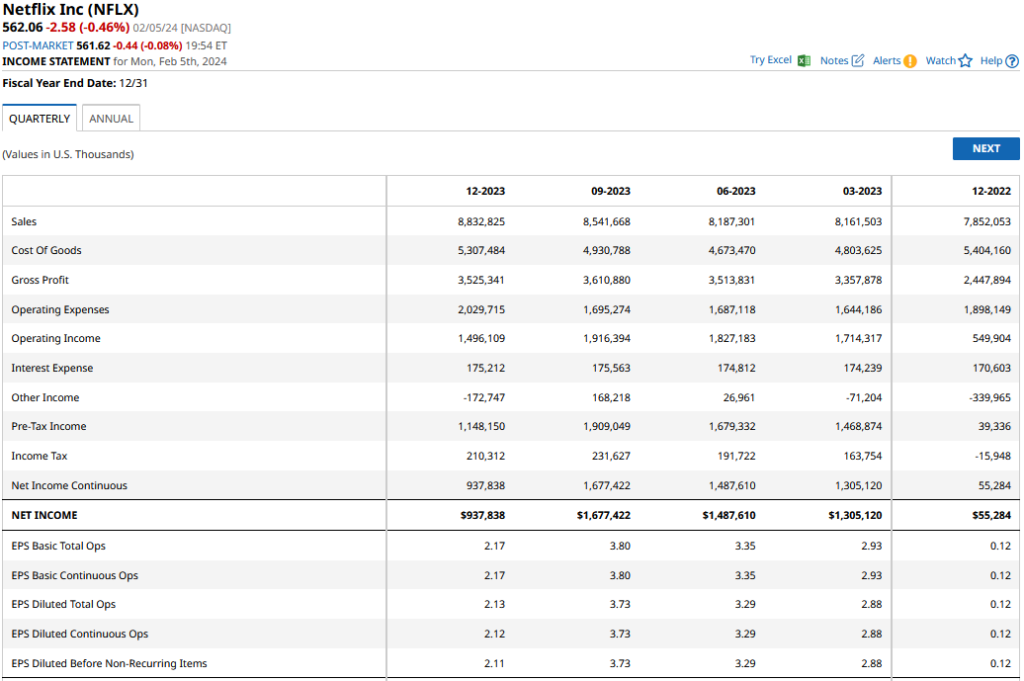

The earnings season for FAANG began with a bang when Netflix reported. The streaming giant added 13.1 million net subscribers in Q4, which was a new fourth-quarter record and almost 5 million higher than what analysts expected. It was the second consecutive quarter when Netflix’s subscriber numbers blew past estimates, as the company’s ad-supported tier and password-sharing crackdown has fueled its growth.

Netflix’s guidance was also impressive, and the projected earnings per share (EPS) of $4.49 easily surpassed the $4.10 that analysts expected. The company also raised its full-year operating margin guidance to 24%, which was higher than the previous guidance of 22%-23%.

Alphabet’s Advertising Revenues Trailed Estimates

While Alphabet’s overall revenues rose 13% in Q4 – which was ahead of estimates, and the strongest growth since early 2022 – its ad revenues trailed estimates.

Cloud was one bright spot in the company’s Q4 earnings report. Not only did that business report an acceleration in growth, but also generated an operating profit of $864 million, as compared to an operating loss of $186 million in the corresponding quarter last year.

Meta Stock Rose to Record Highs After Q4 Earnings

Meta Platforms, the best-performing FAANG stock of 2023, reported an impressive set of numbers for Q4. The company’s revenues rose 25%, which was the highest rate of growth since mid-2021. Its net income also more than tripled – thanks to the “year of efficiency” and aggressive belt-tightening. The cherry on top was the company’s Q1 revenue guidance of $34.5 billion to $37 billion, well ahead of the $33.8 billion that analysts expected.

Amid strong earnings, investors overlooked the record $4.65 billion loss in Meta’s Reality Labs segment, which is building the metaverse. The segment’s full-year operating loss ballooned to a new record high of $16.1 billion, and Meta forecasted that losses would “increase meaningfully” in 2024.

META vs. GOOG

Around a year ago, both Meta and Alphabet were battling similar issues – the slowing digital ad market, competition from the likes of TikTok, a bloated headcount, and too much flab, of the same kind that most tech companies accumulated between 2020 and 2021 on the assumption that the growth rates of those years would sustain over the long term.

Cut to 2024, and it looks like Meta has addressed these issues much more effectively, even as Alphabet hasn’t been able to counter the narrative that it is playing catch-up in the artificial intelligence (AI) space.

Meta, on the other hand, has not only been able to accelerate its top-line growth after reporting its first YoY fall in revenues last year, but its cost cuts helped fuel a steep rise in profits and cash flows – which it used to announce a $50 billion share buyback, while also initiating a dividend.

Amazon Reported Better-Than-Expected Earnings

Looking at other FAANG constituents, Amazon also reported stellar earnings, as both its top-line and bottom-line were better than expected.

Amazon posted a record net profit of $10.6 billion in Q4, blowing away the previous record of $9.9 billion set in the previous quarter. The company’s Q4 operating income surged to $13.2 billion in Q4, which was up almost five times from the corresponding quarter last year, and over $2.2 billion higher than the upper end of its guidance.

Amazon expects to post revenues between $138 billion and $143.5 billion in Q1, which implies YoY growth between 8%-13%. The company guided for operating income between $8 billion to $12 billion – which, even at the lower end, is significantly higher than the $4.8 billion that it reported in Q1 2023.

Apple Disappointed Markets Yet Again

Apple’s earnings, finally, disappointed markets yet again, even as the iPhone maker’s sales rose 2% to beat estimates after having fallen in the previous four quarters. Its EPS also hit a record high of $2.18 and topped analysts’ estimates.

However, China’s slowdown continues to take a toll on Apple’s earnings, and its sales in Greater China fell 13% YoY in the December quarter. The management’s commentary on revenue guidance for the current quarter failed to instill confidence, either, as it forecasted revenues “similar” to the corresponding quarter last year. Apple faced a flurry of downgrades – three, to be precise – in the month heading up to its earnings, and it seems analysts weren’t skeptical of the Cupertino-based company without reason.

That said, Apple CEO Tim Cook talked about AI (finally!), and teased more details on that space “later” in the year. Apple shares closed marginally lower after the earnings release, and the tech giant has yet to reclaim its $3 trillion market cap or the crown of the world’s largest company, which it lost to Microsoft (MSFT).

Apple was the worst-performing FAANG stock of 2023, and it’s also at the bottom of the pack based on YTD price action in 2024. To make things worse, it is the only FAANG constituent that is in the red this year, even as its peers seem to have resumed their rally right from where they left off in 2023.