Analyst Downgrade Signals Shift in Microsoft’s AI Dominance

DA Davidson analyst Gil Luria recently downgraded the rating on Microsoft Corp (NASDAQ: MSFT) to Neutral from Buy, citing a leveling playing field in the realm of artificial intelligence (AI), punctuated by rising competition from industry giants like Amazon and Google.

Microsoft’s Fall from AI Grace

Luria acknowledged that the AI landscape has transformed, eroding Microsoft’s leading position and undermining the rationale for its premium valuation. Once a frontrunner amongst the “Magnificent Six,” Microsoft has slipped to fourth place under this new paradigm.

Shifting Dynamics in the Cloud and Code Generation Sectors

Microsoft’s earlier prowess in accelerating growth and bolstering margins through generative AI initiatives, such as its partnership with OpenAI and strategic deployment within Azure and GitHub, has faltered. Amazon Web Service and Google Cloud, its major competitors, have narrowed the gap considerably, leading to a more level playing field.

The Semiconductor Race and Implications for Microsoft

Luria’s analysis indicates that Amazon Web Service and Google Cloud Platform have taken a lead in deploying their own semiconductors in data centers, granting them a strategic edge over Azure, Microsoft’s cloud offering. Microsoft’s launch of Maia chips places it at a significant disadvantage vis-à-vis its competitors, potentially compromising its future position.

Financial Forecasts and Market Response

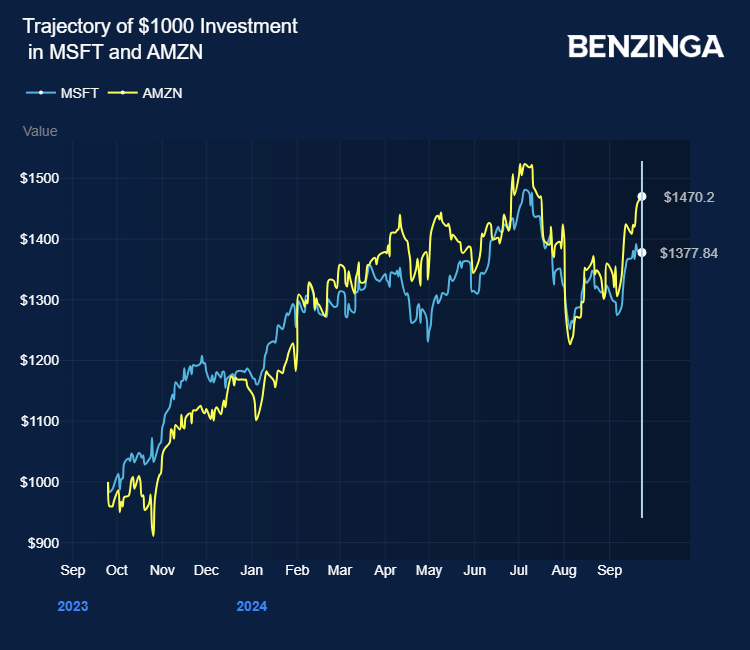

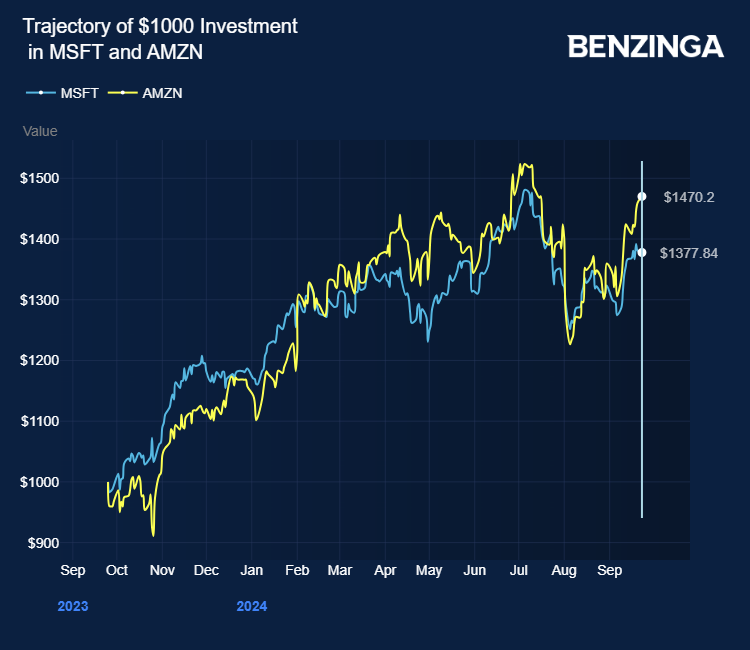

Luria’s projections for Microsoft’s fiscal first-quarter 2025 revenue stand at $64.2 billion, with an EPS of $2.96. The market has reacted to these developments, with MSFT stock declining by 0.50% to $433.10 as of the latest update.

Despite these challenges, Microsoft’s ability to navigate this new competitive landscape remains to be seen. The winds of change are blowing, and the tech giant may need to recalibrate its strategies to maintain its foothold in the fast-evolving AI sector.