Semiconductor titan Nvidia (NVDA) has firmly secured its throne as the paramount player in the artificial intelligence (AI) realm, grabbing the attention of both eager investors and discerning analysts. With a staggering surge of 131.9% this year, Nvidia’s stock has outshone the S&P 500 Index’s paltry 10.4% gain.

As Nvidia continues its relentless ascent, some may lament missing the boat on this AI darling. But fret not, for the AI saga is far from its final chapter. There exist other compelling contenders in this domain that promise handsome returns. Here, we delve into two AI stocks that could potentially soar in the current year.

Fortinet: Safeguarding the Cyber Realm

Embraced in the cybersecurity arena, Fortinet (FTNT) stands tall as a stalwart defender against digital malevolence. With an escalating global threat landscape, entities like Fortinet emerge as linchpins, rendering their stock all the more attractive to investors with a long view.

Indulge us as we shift our gaze to Soundhound AI, a pure-bred AI enterprise carving its niche in the voice AI technology domain. Noteworthy is Nvidia’s $3.7 million bet on Soundhound AI, fanning the flames beneath this stock’s meteoric rise.

The Fortinet Fortitude

Fortinet (FTNT) unfurls a tapestry of vigorous network security solutions, encompassing a plethora of products targeting diverse cybersecurity facets. Its flagship offering, FortiGate, packs a punch with advanced security features such as intrusion prevention, firewalling, antivirus, VPN, and web filtering.

Branded at $45.4 billion, FTNT stock has inched up by 2% year-to-date relative to broader market metrics.

Further fortifying its arsenal are products catering to cloud, endpoint, application, email, web, and industrial control system security. Fortinet’s diverse lineup and commitment to innovation have cemented its position as a trusted guardian for organizations safeguarding their digital assets.

In its latest financial report for the first quarter of 2024, total revenue exhibited a 7% year-over-year uptick to $1.35 billion, propelled by a 24% surge in services revenue from the preceding year. However, product revenue witnessed an 18.3% decline.

Total billings for the quarter experienced a 6.4% slump to $1.41 billion. Billings, representing outstanding invoices yet to be recognized as revenue, netted a 26% boost in the first quarter.

Anticipating Fortinet’s Future Fortunes

Analysts foresee a 9.3% year-over-year revenue uptick to $5.8 billion for Fortinet, accompanied by an 8.7% earnings surge in 2024. Looking ahead to 2025, revenue and earnings are projected to ascend by 13.1% and 10.8%, respectively.

Collating analyst sentiments, FTNT stock bears a “moderate buy” recommendation, reflecting an average target price of $70.25. This suggests a 17.6% upside over the ensuing 12 months. Of the 36 analysts tracking the stock, 11 advocate a “strong buy,” while two opt for a “moderate buy,” and 23 hold a “hold” position. Moreover, the lofty target estimate of $87 hints at a prospective gain of 45.6% from present levels.

While Fortinet stock may currently sport a lofty valuation at 31 times forward projected earnings for 2025, the cybersecurity domain is slated to expand at a 9.4% compound annual growth rate, potentially reaching a gargantuan $298.5 billion by 2027. Given Fortinet’s reputable standing in the cybersecurity realm, intrepid investors primed to navigate industry vicissitudes may discern Fortinet as a compelling elongated investment.

Soundhound AI: Harmonizing the AI Symphony

Enshrined at $1.6 billion, Soundhound AI has orchestrated a robust ensemble of voice AI technologies adopted across various sectors ranging from automotive to telecommunications. Thus far this year, SOUN stock has crescendoed by a remarkable 121%, pacing alongside Nvidia’s stellar returns.

The realm of voice AI assistants brims with cutthroat competition, spearheaded by tech behemoths like Google, Amazon, and Apple who presently reign supreme. Armed to the teeth with resources and well-entrenched ecosystems, these giants pose a daunting challenge to Soundhound.

Notwithstanding these hurdles, the company has exhibited promising financial prowess. The revenue uptick rides on the coattails of a burgeoning adoption of the Houndify platform and an expanding clientele base.

SoundHound AI Grows Revenue: A Deep Dive into Q1 Performance

The Resounding Surge in Revenue

SoundHound AI witnessed a remarkable 73% increase in revenue in the first quarter of the year, soaring to $11.6 million compared to the previous year. This meteoric rise reflects the company’s strategic positioning in the dynamic tech landscape.

Financial Strength and Backlog Boost

A noteworthy achievement for SoundHound was the growth in its cumulative subscription and booking backlog, which saw an impressive 80% surge to $682 million during the quarter. This bolstered financial standing is a testament to the company’s robust growth trajectory.

Market Expansion and Revenue Outlook

With an eye on growth and market domination, SoundHound AI remains laser-focused on expanding its presence. Analysts predict a considerable revenue increase of 42% to 68% in the fiscal year 2024, underlining the company’s commitment to sustained growth in the competitive tech industry.

Strategic Positioning and Market Potential

SoundHound AI’s strategic partnerships and diversified portfolio have positioned it as a key player in the surging voice AI market. With global voice recognition market projections reaching a staggering $84.9 billion by 2032, the company stands at the cusp of immense market opportunity and growth potential.

Investment Prospects and Analyst Sentiment

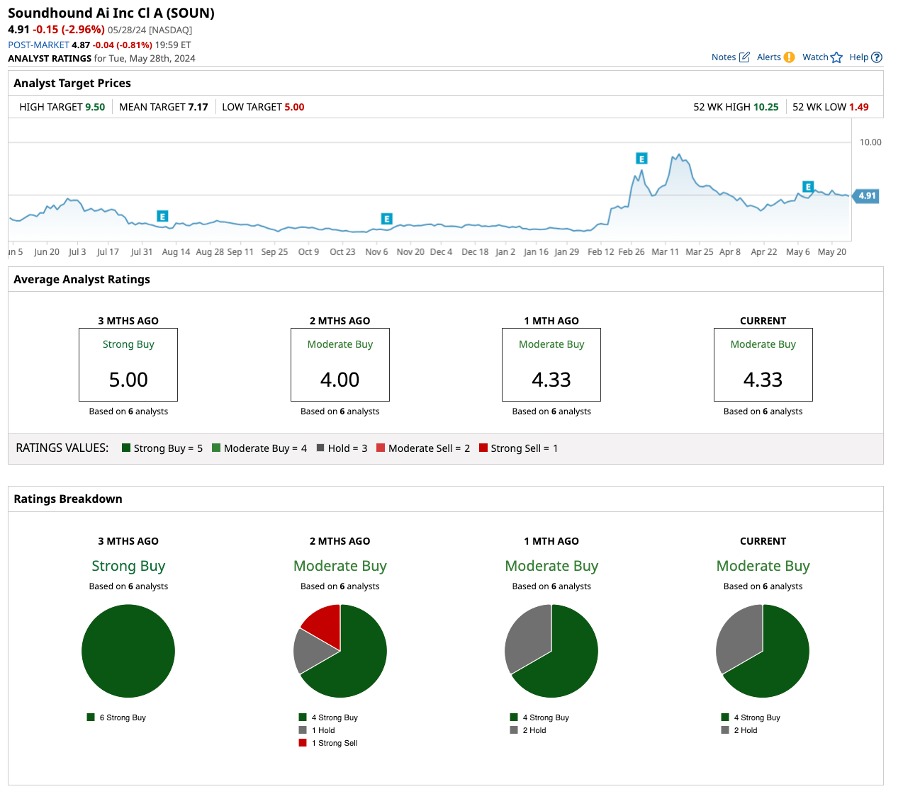

Trading at 23 times forward 2024 sales, SoundHound AI’s stock presents investors with a valuable opportunity given the long-term growth prospects of AI technology. Analyst sentiments reflect confidence in the company, with four out of six analysts rating it as a “strong buy” and a significant upside potential of 52.5% based on the average target price.