Engaging in day trading can often feel like a rollercoaster ride. The twists and turns of economic data can throw even the most seasoned traders off their game, leading to missed opportunities and unexpected losses. Such was the case for many traders recently – a day that seemed full of promise turned sour due to unforeseen volatility.

But for the patient investor, there’s always a silver lining. Despite the hurdles faced by the Russell 2000, the Nasdaq emerged as a beacon of hope, making up for any lackluster performances elsewhere. While trading volumes may not have been as robust as desired, the sturdy advances seen in the market suggest a promising trend that could potentially lure in fresh investments.

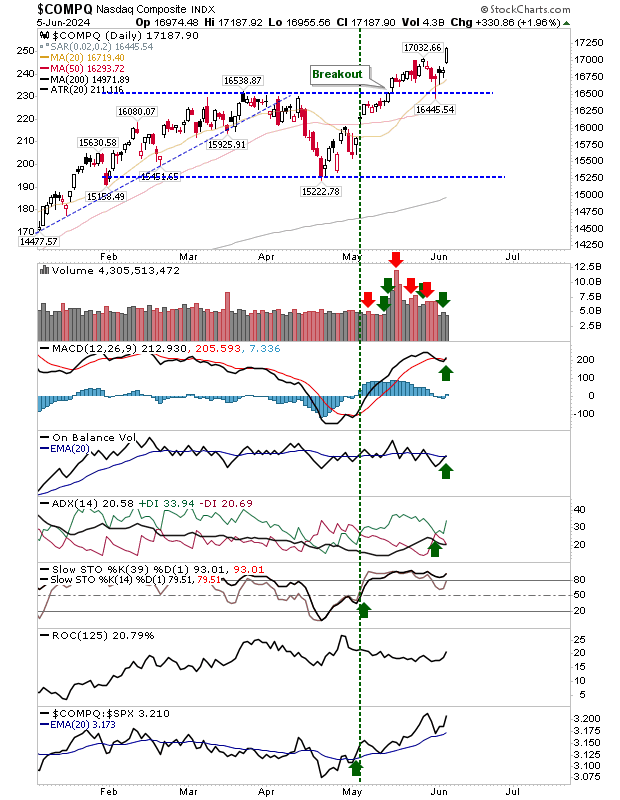

Should these positive movements continue, the Nasdaq is poised to continue shouldering the market’s heavy lifting, drawing in more investors with its impressive relative performance. Technical indicators are painting a rosy picture, with new ‘buy’ signals flashing in the MACD and On-Balance-Volume metrics, alongside a bullish +DI/-DI switch.

Meanwhile, the S&P 500 charted a more moderate trajectory, with technical indicators not as bullish as the Nasdaq. Although the MACD signal is yet to shift to a new ‘buy’ trigger, the On-Balance-Volume metric indicates strong accumulation. Despite losing some ground in relative performance against the Nasdaq, the S&P 500 remains a solid contender in the market.

Unlike its counterparts, the Russell 2000 opted for a more conservative approach, showcasing incremental gains without breaking out of its trading range. Until the ‘bull trap’ is surmounted, bulls might find themselves mumbling rather than roaring with excitement. Technical signals align closely with those of the S&P 500, as the MACD continues to cling to previous ‘sell’ trigger points.

Another index worth tracking is the . Following the Nasdaq’s lead, this index experienced a significant breakout, ushering in positive technical signals and painting a bullish outlook for the days ahead.

The recent market movements have infused a wave of bullish optimism among investors. Clear strides away from breakout support levels, coupled with improving technical indicators, hint at a favorable landscape where losses can be absorbed without jeopardizing the overarching bullish trend. With Friday’s weekly candlestick looming, all eyes are on the horizon, eagerly awaiting the next chapter of this compelling market narrative.