As the sun sets on April 18th, all eyes are on Netflix (NASD: NFLX) as it prepares to unveil its quarterly earnings. Projections suggest earnings of $4.50 per share on a robust $9.26 billion of revenue. For investors, the impending announcement marks a crucial juncture in Netflix’s financial saga.

Reflecting on past earnings, Netflix’s trajectory unveils a tale of triumphs and tribulations. Recent reports lay bare a narrative of growth and adaptation:

| Period | Earnings Date | Earnings |

|---|---|---|

| Q4 2023 | 1/23/2024 | 2.110 |

| Q3 2023 | 10/18/2023 | 3.730 |

| Q2 2023 | 7/19/2023 | 3.290 |

| Q1 2023 | 4/18/2023 | 2.880 |

| Q4 2022 | 1/19/2023 | 0.120 |

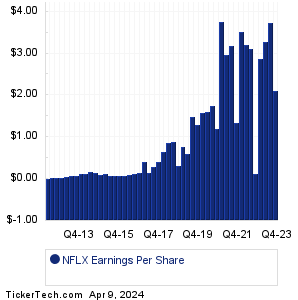

Riding on the waves of these earnings are impressive long-term charts, showcasing Netflix’s growth in both earnings per share and revenue. The visuals paint a picture of a company in its prime.

Yet, the impending earnings report harbors a double-edged sword. While it signifies a time for scrutiny and analysis, it also ushers in a wave of volatility for Netflix’s stock. Investors brace themselves for potential tremors in the market as they digest the financial intricacies. This volatility is a goldmine for stock options traders, who see it as an opportunity to capitalize on market movements, heading into the expiration date of April 19th.

For stock options enthusiasts eager to delve deeper into the realm of possibilities, exploring the NFLX options chain on Stock Options Channel can offer valuable insights. Whether it’s exploring the puts or calls, this platform serves as a treasure trove for discovering new strategies and opportunities.

Expand Your Horizons:

Explore Historical Stock Prices

Unveiling the History of Outstanding Shares

Insightful Videos on the Financial Landscape