The Current State of NFLX

Netflix (NFLX) undeniably reigns as the undefeated champion in the volatile realm of streaming services. With its stellar Q2 earnings, the company not only surged its subscriber base but also boasted an addition of 8 million net users during the period. Furthermore, Netflix is successfully expanding its operating margins, with a forecasted rise to 26% in 2024, surpassing the initial estimate of 25%.

Outperforming Expectations in Q2

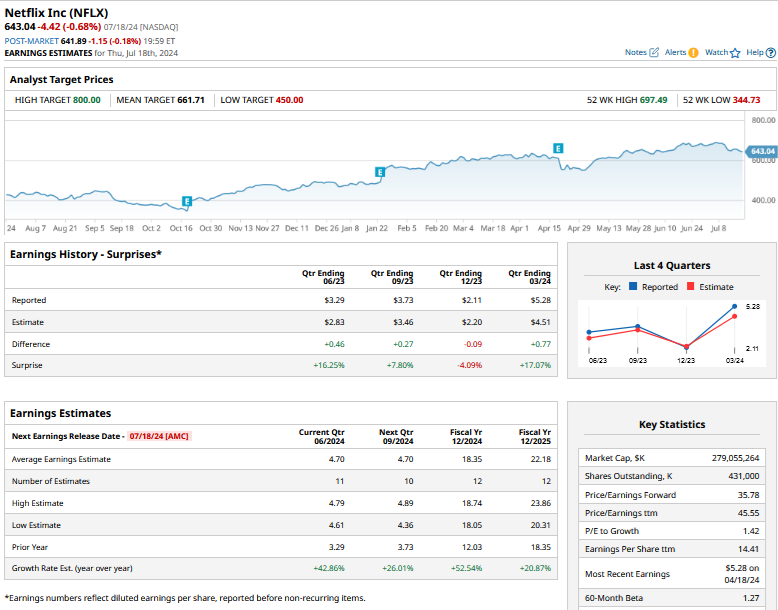

In the impressive realm of Netflix’s financials, Q2 revealed a nearly 17% year-over-year increase in revenues, reaching $9.6 billion, slightly exceeding analysts’ $9.53 billion projection. The company’s earnings per share (EPS) stood at $4.88, a robust 48% YoY jump, outperforming Wall Street’s model of $4.74.

With a subscriber base of 277.6 million, Netflix effortlessly surpassed the predicted 274.4 million, further solidifying its market dominance.

Defying Doubts and Skepticism

Contrary to the expectations of skeptics, Netflix continues to impress both on its top and bottom lines, diverging from rivals such as Disney (DIS) who are striving for streaming profitability at the cost of growth. Adding 30 million net subscribers in the previous year and another 17.5 million in the first half of 2024, Netflix’s strategic moves, including an ad-supported plan and a crackdown on password-sharing, have proven to be remarkably successful, resonating with consumers.

The burgeoning success of the ad-supported tiers, attracting over 45% of new subscribers in available markets, coupled with a 34% sequential rise in the ad-supported member base in Q2, underscores Netflix’s evolutionary strategy.

Anticipating the Future of NFLX Stock in 2025

While Netflix has witnessed remarkable growth in recent years, the company holds a repertoire of growth strategies poised for 2025 and beyond:

- Enhanced monetization of users on the ad-supported plan, aiming to transform ad revenues into a significant revenue stream by 2026.

- Exploration of live streaming, including sporting events, as a potential growth avenue.

- Entry into the gaming market, recognizing a $150 billion global opportunity, which could exponentially augment Netflix’s revenue streams.

- Strategic price adjustments and margin expansion to elevate average revenue per user and overall profitability.

Contemplating Valuations and Future Growth

Despite presenting a compelling value proposition compared to competitors, Netflix’s valuations have become a point of contention. Currently trading at a next 12-month (NTM) price-to-earnings (PE) multiple of 33.4x, akin to tech giants like Apple (AAPL) and Microsoft (MSFT), Netflix’s forward trajectory hinges on substantial earnings growth and sustainable profitability.