Netflix NFLX has surged 40.8% year to date, leaving the Zacks Consumer Discretionary sector’s 1.2% decline in the dust. This remarkable performance owes much to the triumph of its international content.

The streaming titan now reigns supreme as one of South Korea’s premier video streaming platforms.

The company, sporting a Zacks Rank #3 (Hold), recently unveiled a partnership with director Yeon Sang-ho and writer Choi Gyu-seok to bring to life another enthralling comic series, Revelations, following the success of their spine-chilling thriller Hellbound. This upcoming film will revolve around a pastor and a detective, each steadfast in their individual convictions.

Renowned for their poignant exploration of themes like life and death in Hellbound, Yeon and Choi plan to captivate audiences once again through Revelations, delving into the intersections of religion, humanity, belief, and determination. The movie is poised to deliver a narrative that provokes thought, with Ryu Jun-yeol featuring as Min-chan, a vengeful pastor, and Shin Hyun-been as Yeon-hee, an unyielding detective driven by her pursuit of justice amid personal struggles.

Esteemed director Alfonso Cuarón steps in as an executive producer, enriching the project with his expertise. Produced by WOW POINT, a global content powerhouse with active projects in Korea, the U.S., and Japan, Revelations is set to be a riveting, emotionally charged film that carries forward Yeon and Choi’s legacy of impactful storytelling.

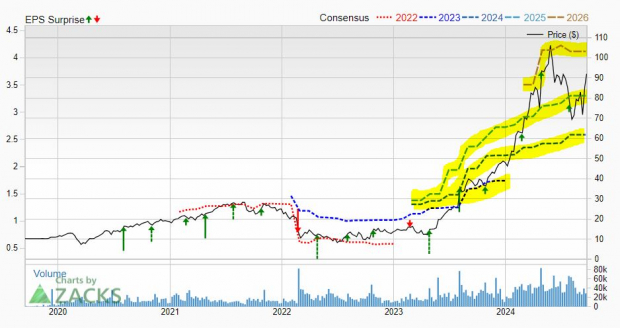

Netflix, Inc. Price and Consensus

Netflix, Inc. price-consensus-chart | Netflix, Inc. Quote

NFLX Faces Competition in South Korea’s Video-on-Demand Market

Despite Netflix’s dominant position in the market, it encounters escalating competition from other platforms. As the market burgeons, NFLX must innovate and broaden its content offerings to uphold its leading status and meet the changing preferences of South Korean viewers.

An Economic Times report reveals substantial growth in South Korea’s subscription video market, which garnered over 700,000 new subscribers in the last quarter, surpassing a total of 19 million subscribers. This surge underscores the rising popularity and demand for video-on-demand services in the nation.

Disney’s DIS Disney+ emerged as the fastest-growing platform during this period, amassing around two million subscribers. This rapid expansion underscores Disney+’s successful foray and growth in the fiercely competitive South Korean market, fueled by its vast array of popular content and strategic marketing endeavors.

Despite Disney+’s impressive growth, Netflix and Tving maintain their stronghold as leading platforms. Netflix, with its extensive library of international and local content, retains a robust presence and loyal subscriber base. Tving, a local service, also commands a significant market share by offering a diverse range of Korean dramas, movies, and shows tailored to local preferences.

Other prominent players in South Korea’s video-on-demand market include Fox’s FOXA Tubi, and Alphabet’s GOOGL YouTube.

Tubi, known for offering 200 free Korean titles spanning from the late ’90s to 2023 under its K-Drama Plus category, includes both subtitled and a few English-dubbed movies and TV series. To curate a personal watch list, users must create an account. Tubi is accessible across major streaming devices, including gaming consoles and smart TVs.

Alphabet’s YouTube Red, which evolved into YouTube Premium, provides an ad-free experience, background play, and download options across its vast video library.

Upcoming Korean content from NFLX like You Have Done Well, Hong Rang, and Agents of Mystery are anticipated to drive subscriber growth and bolster the company’s APAC revenues in the coming quarters.

The Zacks Consensus Estimate for NFLX’s 2024 APAC revenues stands at $4.23 billion, signaling a 12.7% year-over-year surge. Earnings are expected to hit $18.31 per share, reflecting a 52.2% year-over-year increase.