Nike Inc, the athletic apparel and footwear behemoth, is gearing up to unveil its fiscal Q4 ’24 earnings report next Thursday, following a significant tumble of about 50% from its peak in late November 2021.

Trading within the high $80’s to low $90’s range since mid-April, market analysts are eyeing expectations of $0.84 earnings per share, $1.54 billion in operating income, and $12.85 billion in revenue. This forecast translates to a year-over-year growth of 27%, 26%, and 0% in revenue.

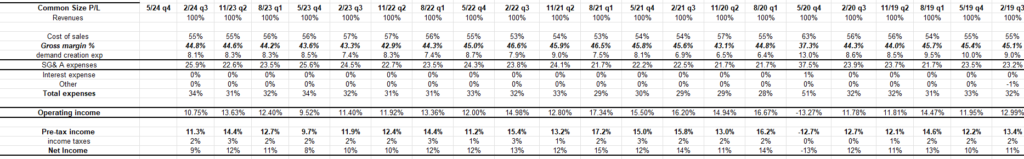

However, it’s essential to note that this anticipated 26% growth in operating income is a rarity for Nike, occurring only the second time in the past 11 quarters, shedding light on the brand’s struggle post-Covid.

Examining Nike’s financial performance post-November ’21 summit reveals meager growth figures: 5% in revenue, -8% in operating income, and -1% in earnings per share, suggesting a challenging period for the iconic sportswear giant.

An in-depth analysis of Nike’s financial situation exposes a slight uptick in SG&A expenses juxtaposed with a gradual erosion of operating income since late 2019, pointing to potential stagnation within the brand’s offerings.

Market Analysis and Stock Evaluation:

Delving into Nike’s technical stock data, piercing through the $100 mark could pave the way for a smooth sail towards the 50-month moving average, potentially reaching $120 – $121 per share. Despite recent overselling trends, concerns loom over the brand’s vitality and its ability to break free from stagnation.

As for valuation, trading at $95 per share, Nike’s current standing at 24x expected EPS amid a mere 1% revenue growth outlook for both fiscal ’24 and ’25 fails to excite potential investors, reflecting a somewhat lethargic market sentiment.

Future Projections and Strategical Insights:

The imminent fiscal ‘25 guidance call carries significant weight, with analysts eyeing $3.88 EPS on $52.1 billion in revenue. Considering Nike’s historical performance, stagnation with two consecutive years of 1% revenue growth might pose critical challenges for the brand.

Despite recent efforts to curb inventory glut and performing well against revenue growth, Nike’s heavy reliance on the Chinese market indicates a strategic vulnerability subject to evolving economic dynamics.

Interestingly, while Morningstar presents a $129 fair value estimate for Nike, representing a 25% – 26% discount to current trading levels, the stock’s immediate trajectory remains uncertain amidst prevailing market sentiments.

Concluding Remarks:

With the looming fiscal year showing signs of potential stagnation for Nike, investors are advised to tread cautiously and observe the forthcoming earnings call keenly for strategic cues. Amidst uncertainties in revenue growth and market dynamics, astute monitoring continues to be crucial amidst a backdrop of perceived brand fatigue and market challenges.