Nvidia (NASDAQ: NVDA) stock garnered significant attention as it became just the third U.S. public company to surpass the $3 trillion market cap milestone. In a history-making sequence, Apple achieved this feat in January 2022, followed by Microsoft in January 2024. A chorus of investors foresees Nvidia dethroning Microsoft as the market cap leader in the foreseeable future.

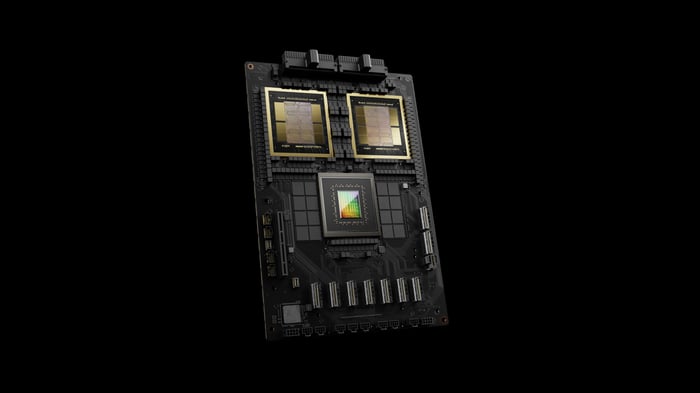

The Nvidia GB200 Grace Blackwell Superchip. Image source: Nvidia.

Nvidia’s Stellar Rise in the Chip Industry

Nvidia’s trajectory has been nothing short of spectacular, fueled by the widespread adoption of artificial intelligence (AI). However, it’s crucial to reflect on a not-so-distant past when sentiments had turned bleak for Nvidia. Between November 2021 and October 2022, the company’s stock plummeted over 66% due to macroeconomic challenges. Yet, with the advent of generative AI in early 2023, the tide shifted dramatically.

Generative AI revolutionized the tech landscape, showcasing unprecedented capabilities like creating original content ranging from music to digital art. Nvidia’s GPUs, renowned for their parallel processing prowess, proved instrumental in driving this AI renaissance, positioning the company at the vanguard of innovation.

Although these AI models necessitate substantial computational resources, Nvidia’s cutting-edge technology provides the essential firepower. The company’s adeptness in adapting to emerging trends placed it in prime position as generative AI gained prominence.

A Legacy of Triumphs

Nvidia owes its present stature to the visionary leadership of CEO Jensen Huang. In 2013, Huang astutely steered Nvidia towards AI, a bold move at the time when AI was not yet in the limelight. Leveraging parallel processing for AI applications, Nvidia laid the foundation for its current success story.

While Nvidia had a commendable track record preceding the AI boom, AI has been the primary growth driver in recent years. The company’s revenue has surged by 2,260% over the past decade, propelling a remarkable 11,530% increase in net income and a staggering 27,900% rise in stock price.

Nvidia’s impending 10-for-1 stock split marks another milestone in its journey, slated for implementation after the market close on Friday. An analysis by Bank of America indicates that post-split, companies tend to witness a 25% average increase in stock price in the ensuing year compared to a 12% gain for the S&P 500, underscoring Nvidia’s operational excellence.

The latest fiscal report for the first quarter of fiscal 2025 showcases Nvidia’s remarkable growth, with a 262% year-over-year revenue surge to $26 billion and a monumental 629% rise in earnings per share to $5.98. Boasting a flourishing data center segment, which includes AI processors, Nvidia has witnessed a 427% revenue upswing to $22.6 billion, fueled by escalating demand for AI chips.

Implications for Nvidia’s Trajectory

Recent deliberations by investors on AI’s sustainability echo caution, with some opting for a prudent “wait and see” stance. However, underestimating AI’s potential could prove costly. Conservative estimates project a generative AI market size of $1.3 trillion by 2032, while more optimistic forecasts by figures like Ark Invest CEO Cathie Wood envision a $13 trillion total addressable market by 2030.

Nvidia faces competition as tech giants endeavor to develop AI solutions rivaling its GPU supremacy, yet Nvidia remains at the innovation forefront. The company continues its robust investment in research and development, allocating nearly $8.7 billion in the last year, equivalent to 14% of its revenue.

Unleashing Nvidia’s Dominance in the Tech Industry

In the fast-paced arena of technology, Nvidia stands tall like a Goliath, its revenues dwarfing competitors and its stronghold on the market unyielding. The company’s investments in Research and Development have bestowed upon it a decade-long head start, a golden advantage that seems insurmountable for its challengers.

The Impending Competition

As the industry witnesses a surge in competitors eyeing Nvidia’s throne, it is clear that the battlefield is about to get intense. However, the sheer magnitude of the playing field hints at the possibility of multiple victors emerging victorious.

Valuation Insights

An interesting aspect to consider is Nvidia’s valuation. The stock’s soaring price has left many investors uneasy, trading at 72 times earnings and 38 times sales. While these figures may seem exorbitant, they fail to account for Nvidia’s staggering triple-digit growth over successive quarters, a trend anticipated to persist. Delving deeper, Nvidia’s price/earnings-to-growth (PEG) ratio, a metric reflecting growth potential, indicates that the stock remains undervalued, standing at less than 1.

Opposing factions may argue that lurking competition, lofty stock prices, and the uncertain future of Artificial Intelligence (AI) pose significant risks. However, Nvidia represents the most certain path to partake in the impending AI bonanza. In the grand scheme of things, it’s a no-brainer – an investment in Nvidia screams opportunity, a chance to ride the wave of AI’s meteoric rise.

Looking Beyond the Numbers

Numbers aside, historical perspective provides valuable insight. When Nvidia found a spot on the prestigious list back on April 15, 2005, a mere investment of $1,000 back then would have ballooned into a gargantuan $713,416 by today’s standards. This success story is a testament to Nvidia’s potential as a market leader, a trailblazer for savvy investors willing to take the plunge.

A glance at the market performance of the Motley Fool’s Stock Advisor service further cements Nvidia’s allure, outperforming the S&P 500 by a staggering margin since 2002. This track record highlights Nvidia as a beacon of investment brilliance in an ever-evolving tech landscape.