Nvidia’s High-Flying Act: Is The Bubble Bursting?

Nvidia, a stalwart in AI chips and GPU technology, has soared on the back of a fervent demand for AI and data center solutions. Despite this, concerns loom over its dizzying valuation, currently perched at a price-to-earnings multiple (P/E) of 55.13 – a substantial premium compared to industry peers – raising doubts about the sustainability of its ascent.

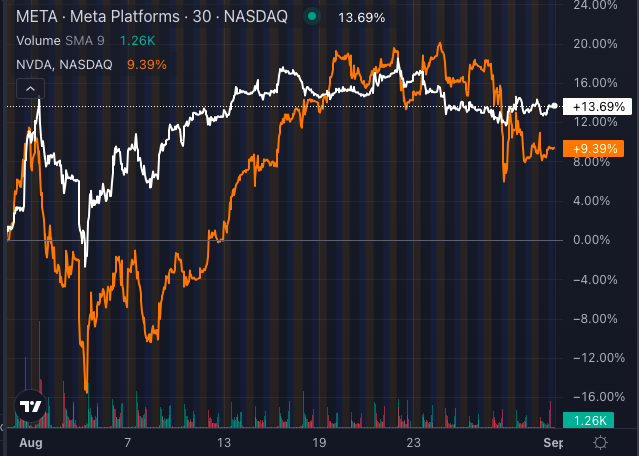

August’s tepid stock uptick hints at investor introspection into Nvidia’s lofty price label.

Meta’s AI Magic: New Kid On The Block Shines

Conversely, Meta is basking in the glow of its strategic pivot towards AI. Harnessing AI’s power to boost advertising efficacy and user engagement, Meta’s stock renaissance is well underway. The company’s AI investments are starting to pay dividends, offering a more diverse play in the tech sphere.

Valuation Showdown: Is Nvidia’s Crown Slipping?

The recent divergence in performance might signify a broader market sentiment shift, hinting at escalating investor caution surrounding overpriced tech equities. While Nvidia retains its AI innovation mantle, its ebbing stock momentum could signal a quest for more evenly balanced, less risky AI ventures.

The ongoing debate calls for investors to balance Nvidia’s immense growth potential against its valuation hazards. Meta, showcasing prowess in capitalizing on AI at a lesser premium (sporting a P/E of 26.51), places a quandary at hand: Is Nvidia weathering a transient cooldown, or is it marking the start of a lasting trend?

Only time will unveil whether Nvidia can reclaim its luster or if Meta’s assorted AI strategy will persist in outshining its tech adversary.