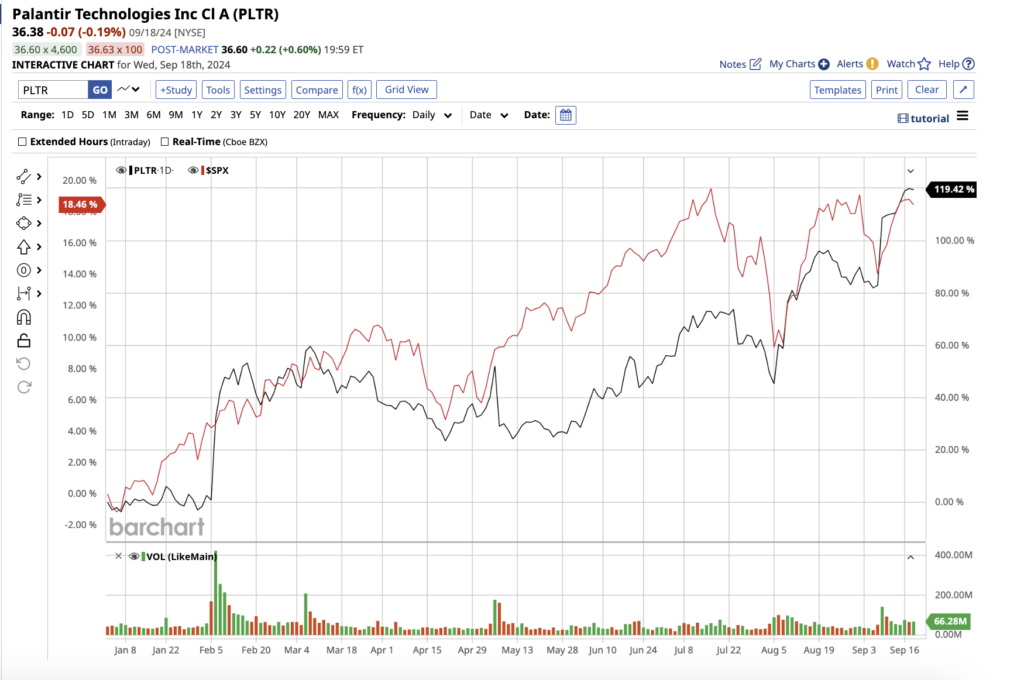

Amid the rise of artificial intelligence (AI), Nvidia has emerged as one of the premier stocks. Not only has it developed a technical lead in AI chips, but its chips support the functions of other AI companies, making it all the more essential.

Still, that focus may have induced investors to ignore other AI chip stocks, and one that may deserve more attention is Qualcomm (NASDAQ: QCOM). The leading designer of smartphone chipsets has brought AI innovation to the smartphone, as well as products such as IoT and automotive applications, and more recently, to the personal computer. Given such innovations, investors may want to give more attention to this stock before other prospective buyers take notice.

Qualcomm’s Strategic Focus on AI

As the leading smartphone chipset company in the high-end market, Qualcomm has wholeheartedly embraced AI. The Snapdragon 8 Gen 3 chipset has attracted strong demand, particularly in China. CFO Akash Palkhiwala mentioned on the fiscal Q2 2024 earnings call that its smartphone sales in China grew by over 40% yearly, likely due to these devices’ generative AI capabilities.

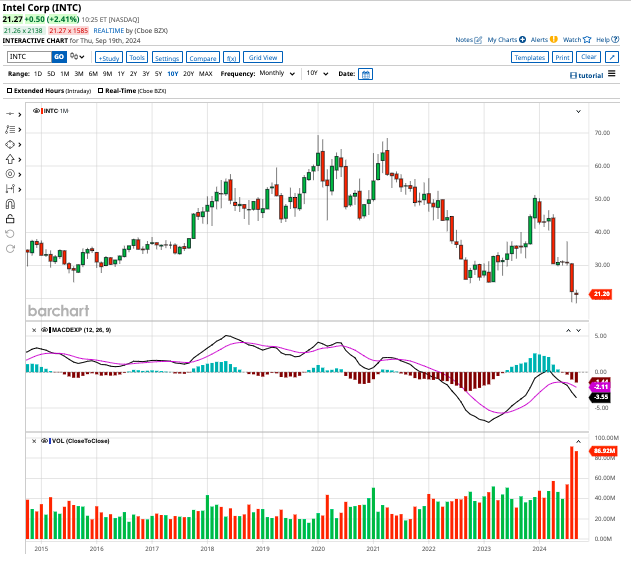

Qualcomm expanded beyond smartphone chipsets in recent years, with all applications incorporating AI. It has ventured into the CPU space, producing an AI-powered personal computer. Microsoft’s collaboration with Qualcomm to build an AI-powered PC could disrupt a segment long dominated by Intel and AMD.

Financial Performance and Growth Potential

However, despite its potential, Qualcomm’s financials seem to reflect the recent industry downturn more than an AI-driven future. In the first six months of fiscal 2024, its $19 billion in revenue only rose by 3% compared to the same period last year.

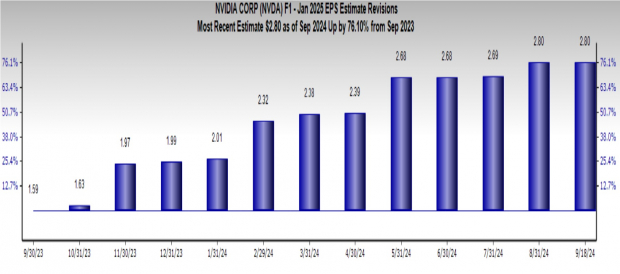

Although profitability significantly improved due to reduced operating expenses, it lags behind Nvidia’s triple-digit revenue growth. Nonetheless, investors have been optimistic, driving the stock to all-time highs with over an 85% increase in the past year.

Investment Opportunity in Qualcomm

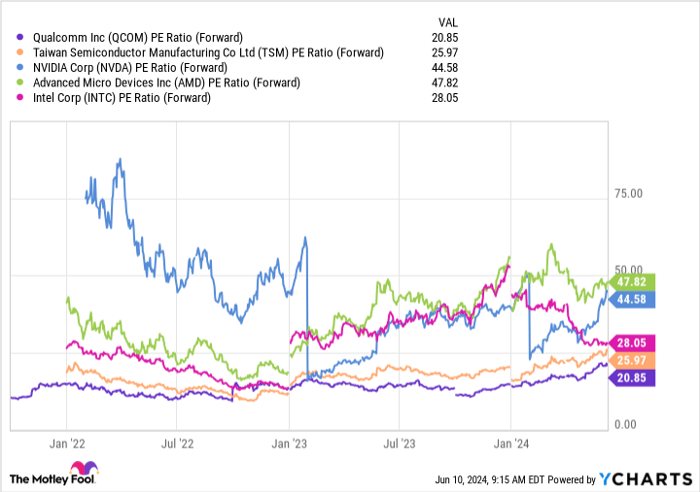

For shareholders eyeing the AI chip industry at a low valuation, Qualcomm stands out as a strong contender. With a reinforced technical lead in smartphone chipsets and AI integration across various industries, Qualcomm’s recent growth and relatively low valuation suggest further increases ahead.

Future Outlook for Qualcomm

Despite recent gains, Qualcomm’s favorable forward P/E ratio positioning it attractively for semiconductor stock investors looking for exposure to AI innovations.

Will Healy holds positions in Advanced Micro Devices, Intel, and Qualcomm. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft.