Nvidia Corporation‘s (NASDAQ: NVDA) shares dipped 3.4% in response to its fiscal 2025 third-quarter results last week, but I see this modest move lower as an opportunity to add to my position. While analysts project the company’s revenue growth to slow from 111.9% in fiscal 2025 to 49.2% in fiscal 2026, I remain convinced of this technology giant’s fundamental story.

I’m particularly excited about the opportunity that lies ahead in artificial intelligence (AI). Major cloud providers plan to invest $267 billion in AI infrastructure next year alone, a 33.5% increase from current levels. This unprecedented buildout positions Nvidia, with its 80% market share in AI chips, at the center of what Amazon CEO Andy Jassy calls a “once-in-a-lifetime” opportunity.

Image Source: Getty Images.

Here’s a full breakdown of why I plan to continue to buy shares of this AI titan despite its slowing growth trajectory.

A leader in AI infrastructure

Nvidia’s latest results demonstrate its dominance in AI computing. The company reported record data center revenue of $30.8 billion for its fiscal 2025 third quarter, up 112% year-over-year. This staggering growth reflects insatiable demand from major cloud providers who are racing to build AI capabilities.

Microsoft is expected to spend $80 billion on total infrastructure in 2024, while Alphabet and Amazon have earmarked $51 billion and $75 billion respectively for their capital investments, with AI infrastructure being a major focus.

CEO Jensen Huang describes current AI demand as “insane,” with the total addressable market for AI accelerators projected to grow over 60% annually to reach $500 billion by 2028, according to Advanced Micro Devices (AMD) CEO Lisa Su. This rapid market expansion isn’t just about current applications; the entire industry is preparing for the next wave of AI breakthroughs.

Reasonable valuation amid the AI gold rush

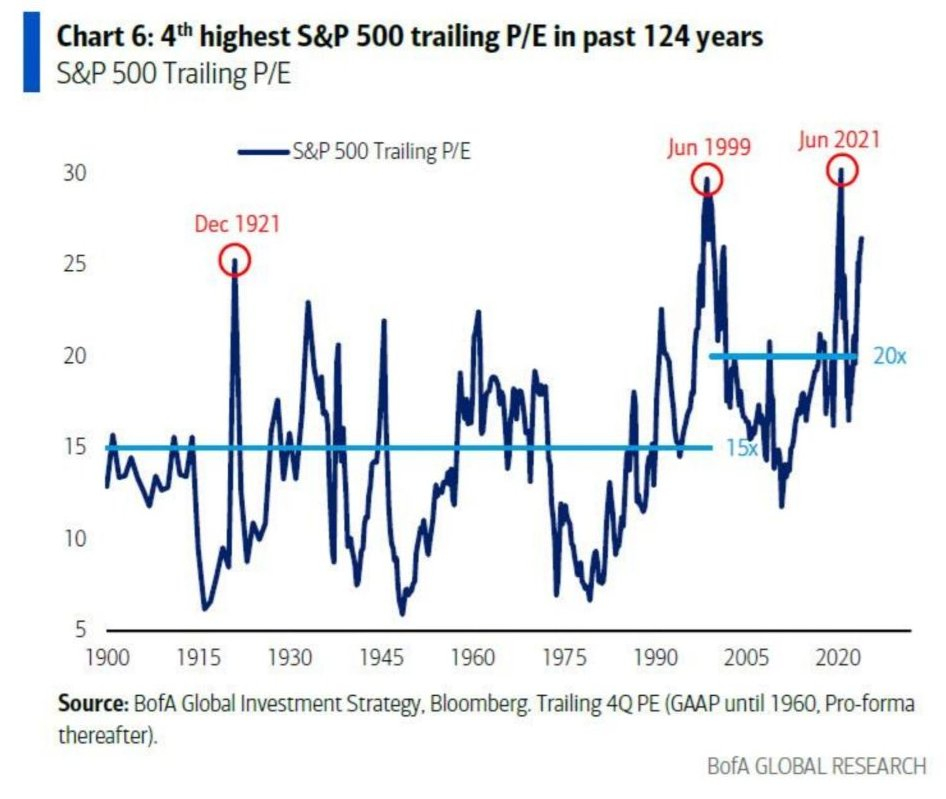

At 33.6 times forward earnings, Nvidia trades at a premium to the S&P 500‘s 23.8 multiple but remains reasonably valued given its growth trajectory. After all, a company growing revenue more than 100% year over year with industry-leading profitability deserves to trade at a premium multiple.

What’s more, the company’s pricing power tells a compelling story. Gross margins reached a sizzling 74.6% in the most recent quarter on a generally accepted accounting principles (GAAP) basis, demonstrating exceptional operational efficiency even as production scales to meet surging demand. This pricing power stems from continuous technological innovation.

Evidence of this innovation appears throughout Nvidia’s product line. The H200 chip, which delivers up to 2 times faster inference performance and up to 50% improved total cost of ownership according to management, has seen significant sales growth and is now being deployed by major cloud providers including AWS, CoreWeave, and Microsoft Azure. Meanwhile, its next-generation Blackwell platform has entered full production, promising even greater performance gains in the years ahead.

Time to buy?

While Nvidia’s growth rates may be cooling from their torrid pace, I remain convinced of the company’s long-term potential. After all, major cloud providers plan to accelerate AI investments in the years ahead, and enterprise adoption is just beginning. According to CEO Jensen Huang, “$1 trillion worth of computing systems and data centers around the world is now being modernized for machine learning.”

Moreover, the entire space is approaching a potential “Gutenberg moment” with the possible advent of artificial general intelligence (AGI) — AI systems capable of performing any intellectual task that humans can — within the next two to three years. Such a breakthrough would require massive computing power, likely driving even greater demand for Nvidia’s specialized chips.

A normalizing growth rate might spook some investors, but I see a much bigger picture emerging. With its dominant market position, expanding technological lead, and the massive AI infrastructure buildout still in the early stages, I’m using this latest dip to aggressively add to my position in this AI juggernaut.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $869,885!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 25, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. George Budwell has positions in Microsoft and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.