Ollie’s Bargain Outlet Holdings, Inc. OLLI is poised to spread its wings in the retail landscape, with the recent procurement of seven erstwhile Big Lots stores. This endeavor follows Big Lots’ organizational overhaul, which involved shuttering 143 outlets.

The Intricacies of Ollie’s Acquisition of 7 Big Lots’ Stores

Out of the seven establishments, Ollie’s Bargain has obtained the final green light and endorsement for six stores from the United States Bankruptcy Court for the District of Delaware. The seventh outlet is poised to secure the requisite approvals imminently.

Noteworthy about these acquisitions is that these properties boast suitable dimensions, occupy prime commercial territories, and resonate with OLLI’s pledge to cater to budget-conscious shoppers. Furthermore, these stores are strategically positioned in the Midwest, a locale where OLLI envisions substantial expansion prospects, having recently unveiled a new distribution center.

Similar to its acquisition strategy involving 99 Cent Only stores, OLLI’s primary focus revolves around launching the newly procured Big Lots outlets while recalibrating the roadmap for other planned store inaugurations to enhance productivity and curtail pre-opening expenditures. For the fiscal year 2024, Ollie’s Bargain forecasts the unveiling of 50 fresh stores and the shuttering of two existing ones.

Ollie’s Bargain’s absorption of former Big Lots stores exemplifies a strategic growth leap amidst the cut-throat retail domain. Currently, OLLI runs a network of 541 stores sprawled across 31 states. The company’s grand scheme involves managing 1300 stores nationwide in the long haul.

Critical Insights for Investors Interested in OLLI

Ollie’s Bargain operates on a business model entailing “buying cheap and selling cheap,” augmented by stringent cost-control measures, a laser focus on store efficiency, and the expansion of its customer rewards scheme, Ollie’s Army. The latter remains a pivotal sales catalyst in the second quarter of fiscal 2024, with membership on the uptrend. The period concluded with 14.5 million active Ollie’s Army members, accounting for over 80% of the company’s sales. Collectively, these endeavors position OLLI for enduring growth.

OLLIs furnished a robust performance in the second quarter by prioritizing value-driven merchandise arrays, enabling the firm to seize market windows and fulfill consumer requisites with precision. Comparable store sales surged by 5.8% in the quarter, buoyed by upticks in transactions and basket sizes. Ollie’s Bargain has now secured nine consecutive quarters of augmented comparable store sales.

The enhanced business acumen spurred management to elevate its fiscal 2024 projections. OLLI now anticipates net sales to range between $2.276-$2.291 billion compared to the prior bracket of $2.257-$2.277 billion. Ollie’s Bargain projects a rise in comparable store sales spanning 2.7-3.2%, contrasting the previous forecast of 1.5-2.3%. The company has revised its adjusted EPS forecasts to $3.22-$3.30 from the previous guided range of $3.18-$3.28.

How is OLLI Faring According to Zacks Consensus Estimate?

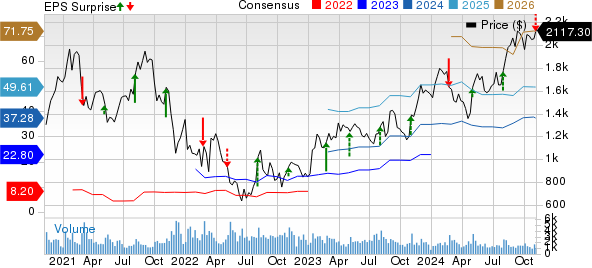

Reflecting the favorable sentiment surrounding OLLI, the Zacks Consensus Estimate for EPS has undergone upward revisions. Over the past 60 days, analysts have boosted their estimates for the ongoing and forthcoming fiscal years by 0.3% to $3.28 and 1.1% to $3.72 per share, respectively. These figures indicate an envisaged year-over-year growth of 12.7% and 13.4% correspondingly.

Assessment of OLLI Stock Attractiveness

Over the previous six months, OLLI’s shares have soared by 38.5%, outmaneuvering the industry and the S&P 500’s growth rates of 6.8% and 9.9%, severally.

OLLI’s stocks have demonstrated robust performance, yet its valuation remains a topic of deliberation. Presently, the stock commands a premium relative to the industry, as indicated by its price-to-earnings ratio, hinting that its growth potential might already be factored into the price.

OLLIs forward 12-month price-to-earnings ratio stands at 26.7X, surpassing the industry’s ratio of 18.6X. This signifies that investors are paying a premium in comparison to the company’s projected earnings growth. OLLI bears a Value Score of D.

An Outlook on Playing OLLI Stock

Ollie’s Bargain stands well-positioned to amplify its market presence, steer sales, and deliver value to its clientele, thereby enhancing its financial performance in forthcoming quarters. Investors with a protracted investment horizon may consider retaining positions in this Zacks Rank #3 (Hold) stock, albeit prospective investors are advised to scout for a more opportune entry point, given its lofty valuation.

Favorable Stock Options for Consideration

In the sphere of better-ranked stock alternatives, we underscore three picks, namely Sprouts Farmers Market, Inc. SFM, Burlington Stores, Inc. BURL, and Chewy, Inc. CHWY, each bearing a Zacks Rank # 2 (Buy).

Sprouts Farmers engages in the retailing of fresh, natural, and organic food products under the Sprouts brand in the United States. SFM boasts a trailing four-quarter earnings surprise averaging nearly 12%.

The Zacks Consensus Estimate for Sprouts Farmers’ ongoing fiscal year sales and earnings signals growth rates of 9.6% and 18.7%, respectively, compared to the corresponding figures from the previous year.

Burlington Stores functions as a retailer of branded goods in the United States. BURL maintains a trailing four-quarter earnings surprise averaging 18.4%.

The Zacks Consensus Estimate for Burlington Stores’ ongoing financial year sales and earnings projects upticks of 10.1% and 30.5%, respectively, relative to the figures reported in the preceding year.

Chewy specializes in the pure-play e-commerce domain in the United States. CHWY boasts a trailing four-quarter earnings surprise of 50.9%.

The Zacks Consensus Estimate for Chewy’s ongoing financial year sales and earnings reflects increments of 5.7% and 65.2%, respectively, compared to the corresponding figures from the previous year.