Earnings season kicks into high gear this week, with a bevy of major players in the financial and tech sectors slated to release their quarterly reports. Among the notable names set to report are Taiwan Semiconductor (TSM), Bank of America (BAC), United Airlines (UAL), Netflix (NFLX), Goldman Sachs (GS), Johnson & Johnson (JNJ), and Morgan Stanley (MS).

When a company is on the cusp of reporting earnings, the implied volatility tends to be heightened as the market grapples with uncertainty. Speculators and hedgers flock to the company’s options, driving up implied volatility and consequently, the options’ prices.

Following the earnings announcement, implied volatility typically subsides to more standard levels.

Estimating the anticipated range for these stocks involves examining the option chain and summing the prices of the at-the-money put and call options, using the first expiry date after the earnings release. While this method lacks precision, it provides a relatively accurate approximation.

Monday

GS – 3.8%

BLK – 3.3%

Tuesday

UNH – 4.7%

BAC – 3.9%

MS – 3.8%

SCHW – 5.1%

PNC – 4.4%

Wednesday

AMSL – 6.8%

JNJ – 2.7%

USB – 4.3%

KMI – 2.2%

LVS – 2.9%

UAL – 8.7%

Thursday

TSM – 7.5%

NFLX – 8.8%

ABT – 4.3%

ISRG – 5.4%

BX – 4.5%

DHI – 4.9%

DPZ – 5.5%

Friday

AXP – 4.8%

SLB – 4.0%

TRV – 4.0%

HAL – 3.5%

Market participants trading options can leverage these projected movements to structure their trades effectively. Bearish traders might consider selling bear call spreads beyond the anticipated range, while bullish traders could opt for selling bull put spreads or explore naked puts for those with a higher risk appetite.

Those adopting a neutral stance may find iron condors appealing. When employing iron condors during earnings season, it is advisable to position the short strikes outside the expected price range.

Prudent trading strategies when dealing with options during earnings entail adhering to risk-defined approaches and maintaining conservative position sizes. A swift, unexpected market move resulting in a full loss trade should ideally not exceed a 1-3% impact on one’s overall portfolio.

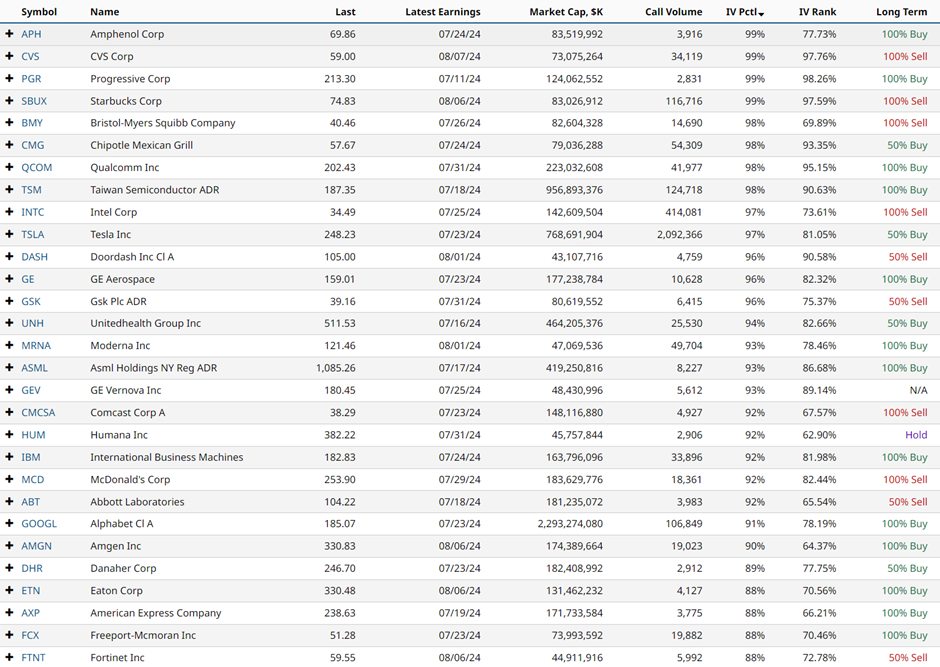

Stocks With High Implied Volatility

Utilizing Barchart’s Stock Screener can uncover additional stocks exhibiting elevated implied volatility. By applying filters such as Total call volume (>2,000), Market Cap (>40 billion), and IV Percentile (>70%), investors can identify stocks meeting these criteria.

For detailed insights into discovering option trades during earnings season, the provided article offers valuable guidance.

Last Week’s Earnings Moves

Last week witnessed actual moves compared to the expected ones:

- CAG -1.5% vs 4.5% expected

- DAL -4.0% vs 6.3% expected

- PEP +0.2% vs 2.6% expected

- C -1.8% vs 3.5% expected

- JPM -1.2% vs 3.2% expected

- WFC -6.0% vs 3.9% expected

Out of the 14 stocks analyzed, 8 remained within the anticipated range.

Unusual Options Activity

Stocks like RIVN, RKT, KMI, AA, PFE, and TSLA experienced unusual options activity last week. A glance at the unusual options activity for other stocks is provided below:

It’s important to note that options trading carries inherent risks, and investors should be prepared for the possibility of losing their entire investment. This article acts as an educational resource and not as a trading recommendation. Always conduct thorough due diligence and consult with a financial advisor before making any investment decisions.

More Stock Market News from Barchart