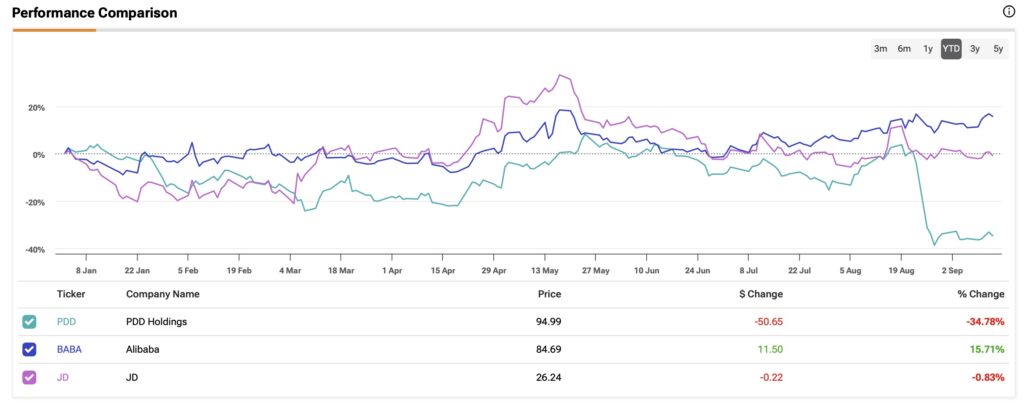

The Chinese e-commerce landscape is dominated by PDD Holdings (PDD), Alibaba (BABA), and JD.com (JD). Using the TipRanks Stock Comparison Tool, I’ll explain why I consider JD.com to be a Buy and a strong investment, while I also rate Alibaba a Buy but have a Hold rating on PDD. In the end, JD.com is the least risky investment and most favorable option for investors.

PDD Holdings (PDD)

Let’s begin with why I consider PDD stock to be a Hold. PDD Holdings operates the Pinduoduo e-commerce platform and the Temu online marketplace. I have a Hold rating on this stock mainly because it emerged during the COVID-19 pandemic, and its stock has struggled to keep pace with the broader market. So far this year, the company’s share price has declined 32%, and the stock currently trades at just under $100.

In terms of valuation, the stock is trading at a forward price-to-earnings (P/E) ratio of 10, which may seem cheap and attractive at first glance. However, when examining the company’s top-line performance, it becomes clear that the stock is trading at a high 2.8 times price-to-sales (P/S) ratio, which is three times the industry average. This discrepancy suggests that while PDD’s valuation reflects strong growth prospects, there are concerns about whether these prospects will materialize.

While it is true that Temu has been a top app in the U.S. since it launched in 2022, that success hasn’t helped the company’s financial results. PDD’s second-quarter revenue fell short of expectations. Despite this, analysts project substantial revenue growth of 65.5% for PDD Holdings this year, potentially reaching $56.93 billion. However, the company faces significant risks. U.S. politicians are urging President Joe Biden to address de minimis trade loopholes, which could negatively impact Temu’s sales. PDD has warned that its operations could be “materially and adversely affected” if current tariff exemptions are removed.

Is PDD a Buy, According to Wall Street Experts?

Despite my Hold position on PDD, the consensus view among 13 Wall Street analysts is that the stock is a Strong Buy. There are 11 Buy, two Hold, and no Sell ratings on the stock. The average price target on PDD stock of $159.91 suggests a potential 68.34% upside from where the shares presently trade.

Citigroup (C) analyst Alicia Yap, who has downgraded PDD to a Neutral rating, raises some concerns. She notes that PDD’s global business may be negatively impacted by “evolving external environment and non-business factors,” and she sees the potential trade risks as significant.

Read more analyst ratings on PDD stock

Alibaba (BABA)

My bullish view of Alibaba is based on the company’s diversified business, decent growth, and solid cash balance. As the undisputed leader in China’s e-commerce sector, Alibaba operates through Taobao and Tmall. Its ecosystem includes AliCloud, the logistics arm Cainiao, and Ant Financial.

Despite the company’s strong position in the marketplace, Alibaba’s most recent quarterly results fell short of expectations. In this year’s second quarter, Alibaba reported revenues of 243.24 billion yuan (about US$33.4 billion), a 4% annual increase, but below the expected 249.05 billion yuan. Fortunately, the company trades at a relatively low valuation of 9.7 times forward P/E and a P/S ratio of 1.6 times, which are better multiples than PDD stock.

Alibaba’s cash position is another reason to like the stock. With $55.8 billion in net cash, equivalent to 27% of its $204.32 billion market capitalization, Alibaba has authorized a $31.9 billion stock buyback program, which will reduce the company’s share count to the benefit of investors who own the stock.

Is BABA a Buy or Sell?

My bullish view of Alibaba is shared on Wall Street. Currently, BABA stock enjoys a Strong Buy rating among 16 analysts who track the company’s progress. 13 analysts rate the stock a Buy, three rate it a Hold, and there are no Sell ratings. The average price target of $109.53 indicates potential upside of 29.33% for Alibaba’s stock.

Jefferies (JEF) analyst Thomas Chong is particularly bullish on BABA stock. He says that he appreciates Alibaba’s clear strategy across different business segments and the completion of its dual primary listing in Hong Kong in August of this year.

Read more analyst ratings on BABA stock

Jd.com (JD)

Last but not least is JD.com, the stock I am most bullish on. As one of China’s largest e-commerce platforms, JD.com operates on a direct retail model—buying products from suppliers, holding inventory, and selling directly to consumers. JD.com is less diversified than Alibaba and has slower growth than PDD. Over the last three years, JD has seen its revenue grow 8.9% per year, far behind PDD’s 58.4% growth. Analysts expect only 6.2% sales growth at JD.com this year.

So why am I bullish on JD? Largely because JD.com has a strong balance sheet with $28.8 billion in cash and minimal debt. This cash represents over half of the company’s $42 billion market capitalization. Despite challenging macro conditions, it has consistently topped earnings per share (EPS) estimates for at least 20 consecutive quarters. This consistency, combined with its low valuation—just seven times P/E ratio and a P/S ratio of 0.27 times—makes JD stock significantly cheaper to buy than Alibaba and PDD.

Is JD a Buy According to Wall Street?

Wall Street analysts are also bullish on JD.com. Twelve professional analysts give the stock a consensus Strong Buy rating. Nine out of 12 analysts have a Buy rating, while the other three rate the stock a Hold. There are no Sell ratings on the stock currently. The average price target of $38.09 suggests potential upside of 45.16% with JD.com stock.

Barclays (BCS) analyst Jiong Shao is positive about JD.com, noting that despite a slowdown in net product revenue growth for the second quarter, the company saw an increase in general merchandise sales and significant improvements in gross and adjusted operating margins. Additionally, JD’s $2.1 billion share buyback in Q2 of this year reflects the company’s financial health.

Read more analyst ratings of JD stock

Conclusion – JD.com Stands Out

The strong balance sheet and discounted valuation make JD.com stand out as the preferred investment among this trio of Chinese tech titans. Alibaba, which I also rate a Buy, remains a solid long-term investment due to its diverse operations and robust financial position. While PDD Holdings offers the greatest growth potential, its stock trades at a much higher valuation compared to its peers and faces increased regulatory challenges that could impact its future growth. Therefore, I believe a neutral outlook is warranted for PDD Holdings.